Published: 2025-08-15T15:27:16.000Z

Preview: Due August 29 - U.S. July Advance Goods Trade Balance - Deficit to rise as imports from China rebound

-

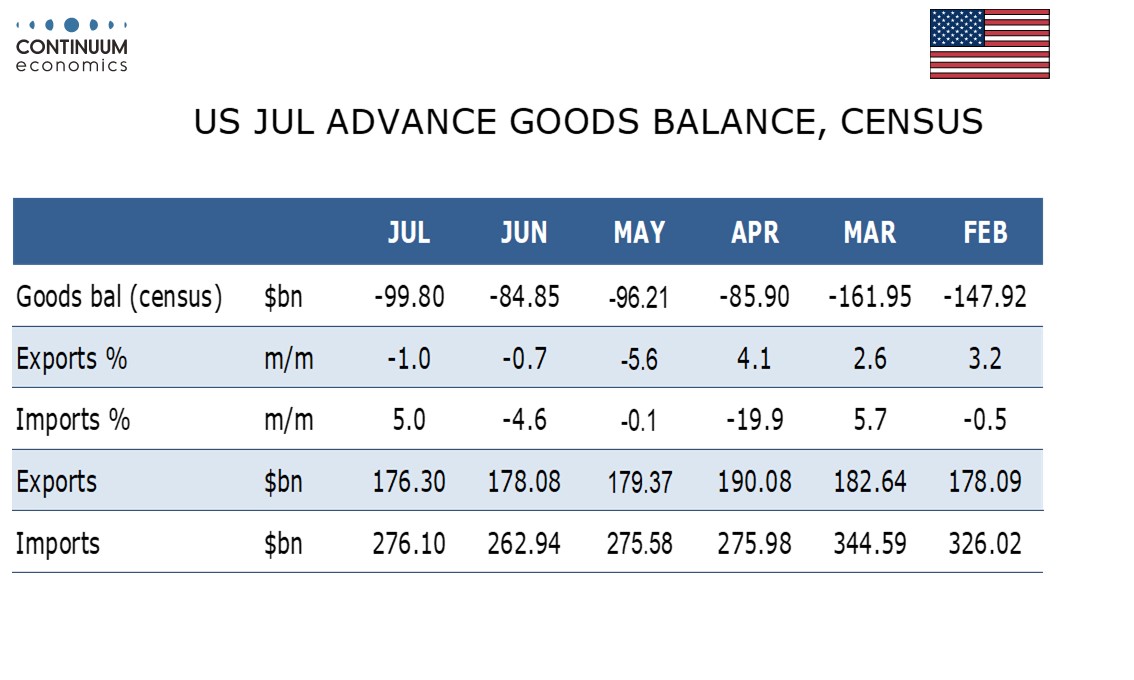

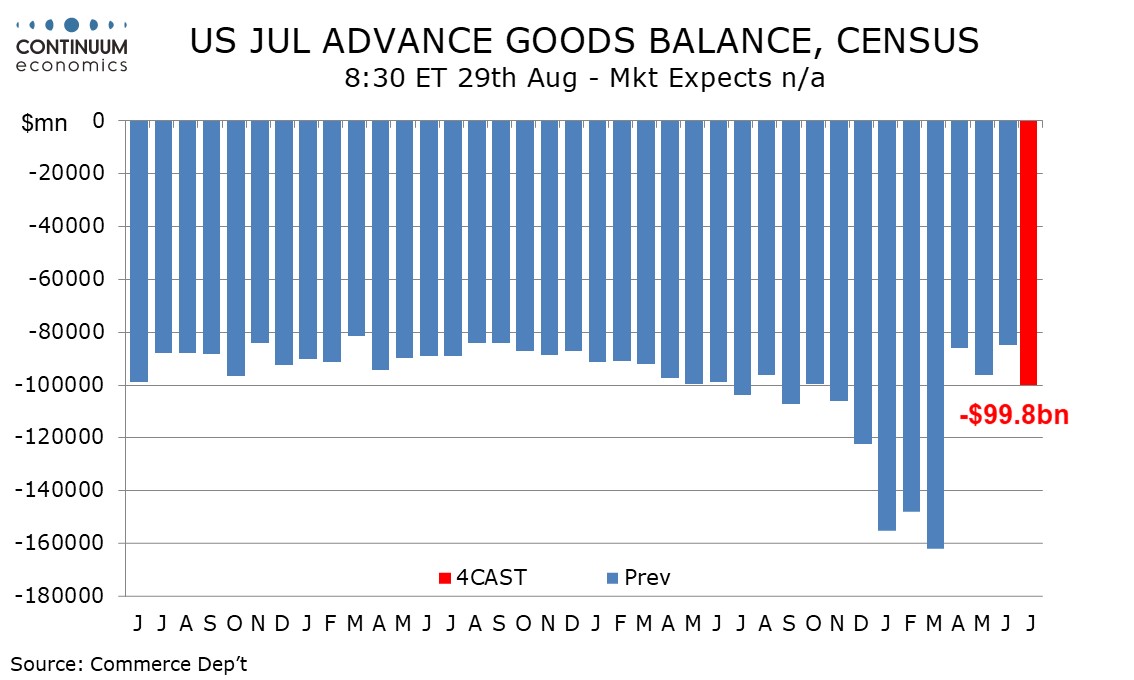

We expect an advance July goods trade deficit of $99.8bn, up from $84.9bn in June but still closer to the Q2 average of $89.0bn than the Q1 average of $155.0bn when imports surged ahead of tariffs.

We expect imports to rise by 5.0% after a 4.6% decline with the rise likely to be led by imports from China following an easing of trade tensions. Data from the Southern California ports suggest an increase in imports.

Exports are likely to remain subdued with a 1.0% decline, extending on a 0.7% decline in June. Advance July retail and wholesale inventory data are also due, and could offset any GDP implications from a wider trade deficit.