FX Daily Strategy: APAC, August 14th

AUD vulnerable if Australian employment data is weak

GBP risks on the downside on GDP data

NOK at attractive levels ahead of Norges Bank decision

USD more likely to gain than fall on PPI

Underlying positive risks tone hard to justify longer term

AUD vulnerable if Australian employment data is weak

GBP risks on the downside on GDP data

NOK at attractive levels ahead of Norges Bank decision

USD more likely to gain than fall on PPI

Underlying positive risks tone hard to justify longer term

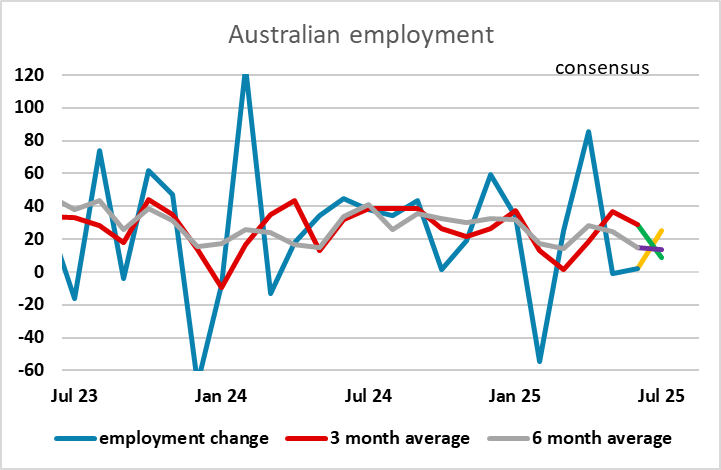

Thursday kicks off with Australian July employment data. The modest 2k rise in June was a disappointment after the 1k decline in May, and suggests we may be seeing a deterioration in the underlying trend. However, the data can be choppy from month to month, and the last two months may be a reaction to the big 85k rise in April. The 25k consensus increase in July would maintain a mildly positive trend, but would suggest the trend is weakening and support expectations of further RBA easing later in the year. The risk may be to the high side of the consensus, as it would take a very much larger increase to suggest anything more than a modest uptrend after the last two weak months. The AUD should therefore be more vulnerable to weak than strong data, especially after the AUD rally on Wednesday.

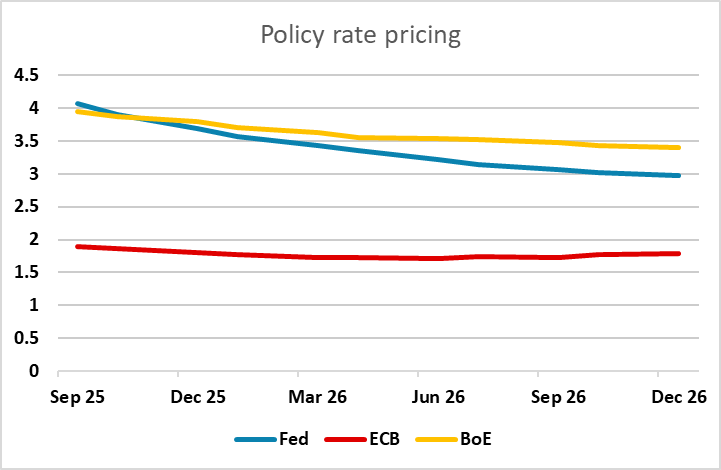

The UK Q2 GDP data kicks the day off in Europe. The consensus 0.1% increase in June would also likely mean a 0.1% increase in Q2, but the underlying trend looks weak after two consecutive negative months in April and May. EUR/GBP has been showing a soft tone since the last BoE rate cut was only passed by a 5-4 vote, and momentum is clearly to the downside. Anything above 0.1% for Q2 would likely be enough to break EUR/GBP below the 0.86 level, but this is quite an unlikely scenario without significant upward revisions, so we favour the EUR/GBP upside slightly. While Q2 may well turn out slightly positive due to base effects, there is a significant risk of a negative Q3 and with a tight October budget also likely, upside for GBP from here looks quite limited with scope for significantly more rate cuts than the two cuts by the end of 2026 that the market is pricing in.

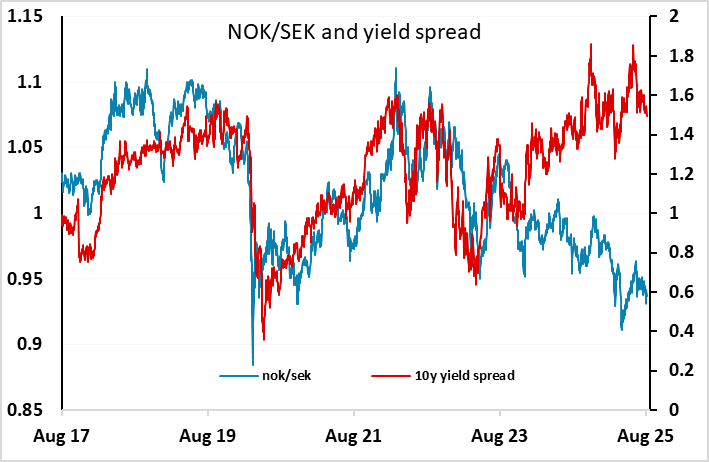

We also have the Norges Bank rate decision in Europe, but no change is expected after the surprise cut last time around, especially since this triggered another bout of NOK weakness. EUR/NOK managed to hold below 12, and NOK/SEK has bounced from 0.93, and we would still see these as good areas for long term NOK buyers, even though it is hard to identify a likely trigger for a significant NOK recovery. Today’s meeting seems likely to confirm that further rate cuts are on the cards, but if there are hunts that a cut may not come in September, the NOK may get a boost, as this is more than 90% priced in.

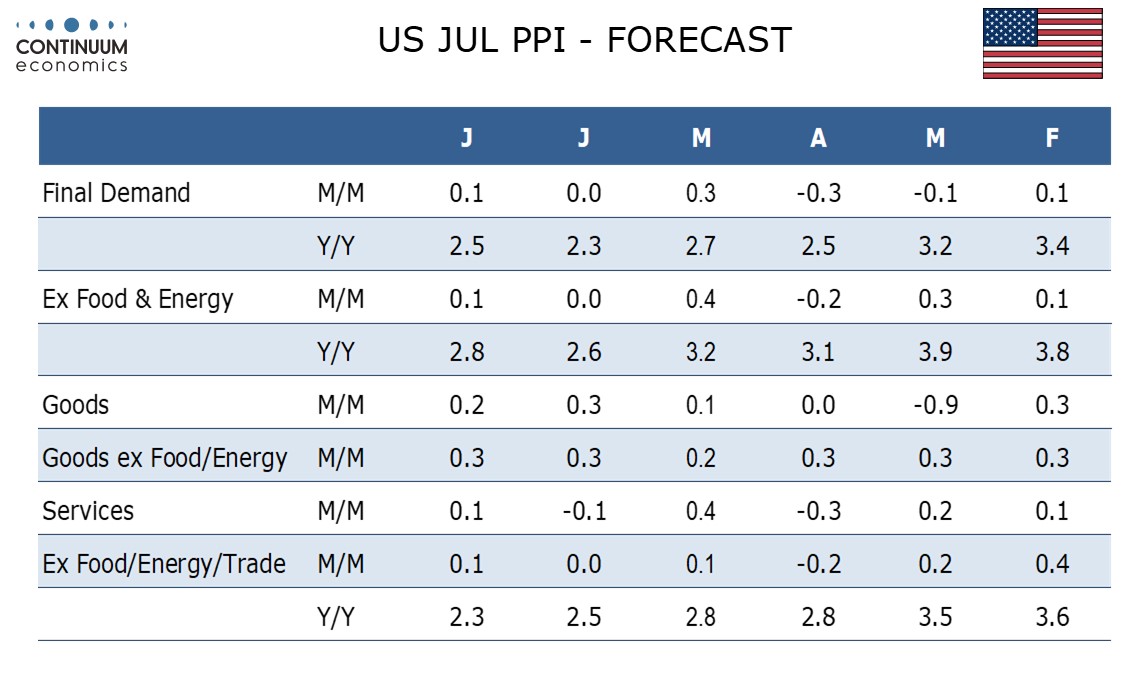

PPI in the US seems unlikely to have a major impact, but given tariff concerns may get more attention than usual, as tariffs may show up in the PPI data before we see them in CPI. We expect July PPI to rise by a modest 0.1% overall and in each of the core rates, ex food and energy and ex food, energy and trade. This would follow unchanged outcomes in all three indices in June, but risk is that those indices will be revised higher, offsetting weakness in July. In the first six months of 2025, PPI ex food and energy has seen an average downside surprise relative to consensus of 0.28%. However the average upward revision for the first five months of the year (June revisions will come this month) is 0.26%, almost fully offsetting the downside surprises. Cuts in Labor Department staff may be impacting data quality, which raises concerns over CPI which is only revised one a year. With the market already fully pricing in a Fed rate cut in September, the risks look to be to the USD upside on stronger than expected data.

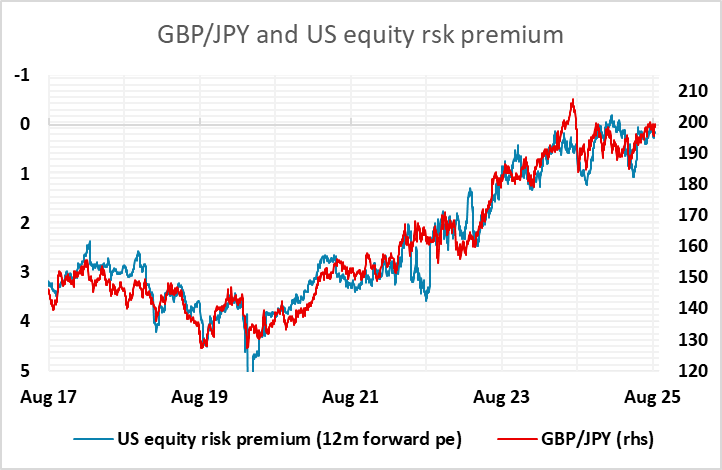

We continued to see new highs in the S&P500 on Wednesday, and the strength of the US equity market in particular and global equity markets in general remains a key aspect of the markets. One concern is that this strength is due in large part to the expectations of 125bps of Fed easing over the next year, which would take the funds rate down to 3%. This would no longer be restrictive, and only seems likely to happen if either growth or inflation fall significantly. It’s hard to see much weaker inflation given tariff increases, so suggests a weaker growth outlook, which is hard to square with the extremely high equity market valuation. Nevertheless, until we see unemployment rising, the equity market is likely to remain resilient, but this may not be as far away as all that. When it comes, JPY strength is the most likely FX response.