Published: 2025-08-15T14:15:39.000Z

U.S. August Preliminary Michigan CSI - Suggests worries about jobs and prices

2

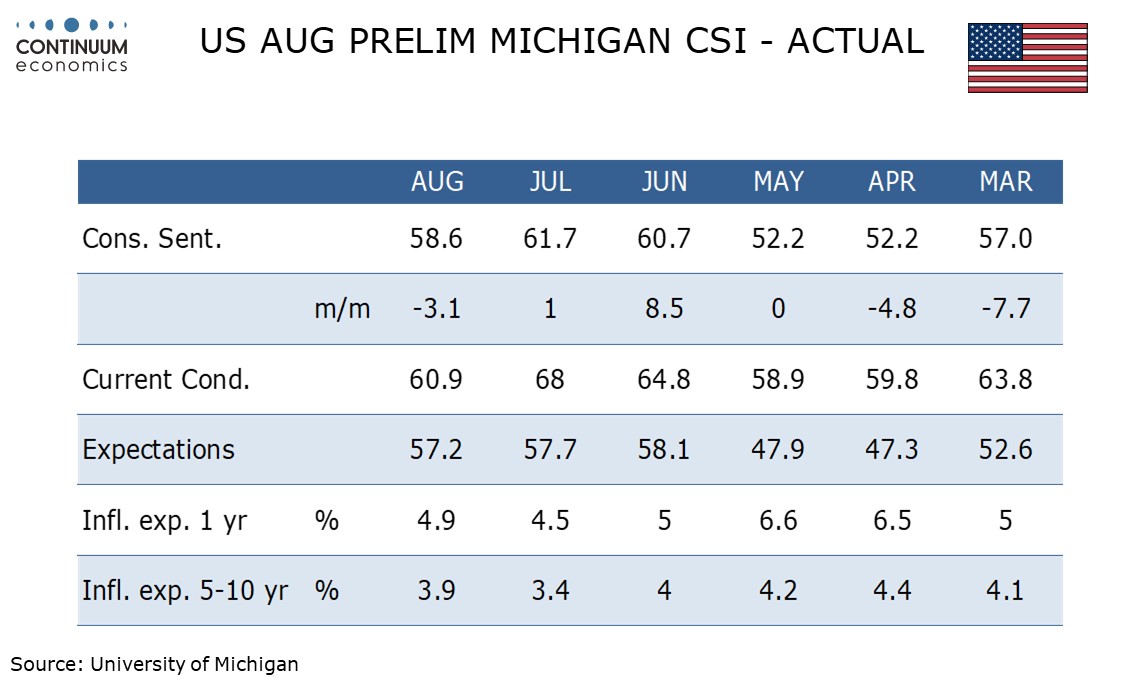

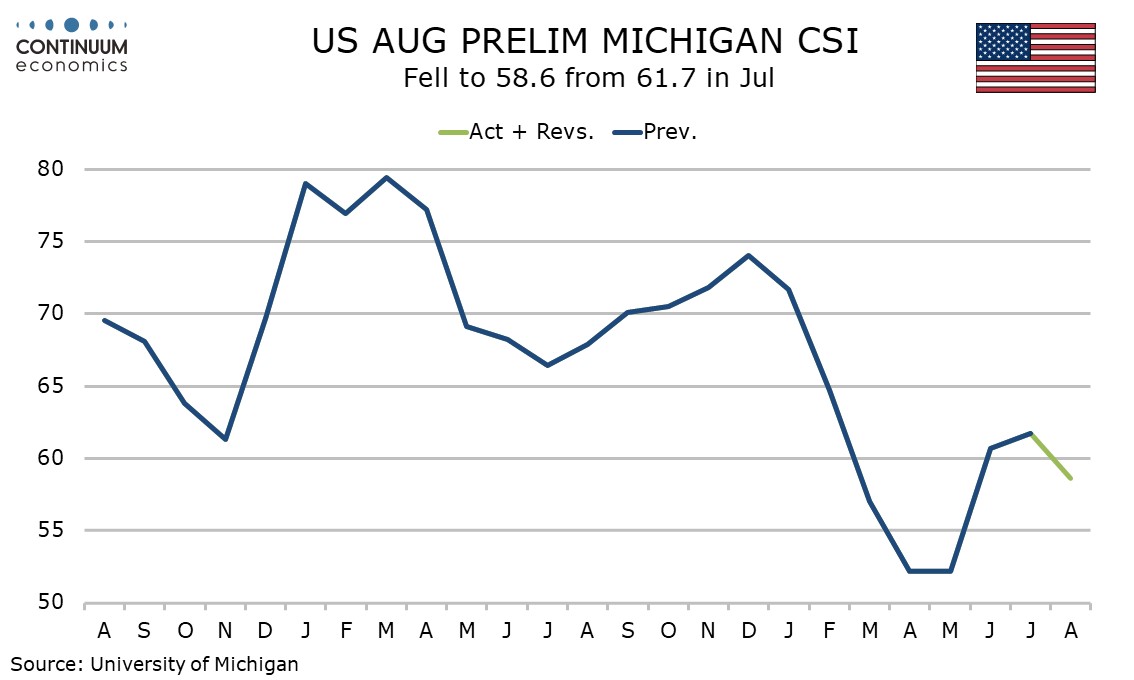

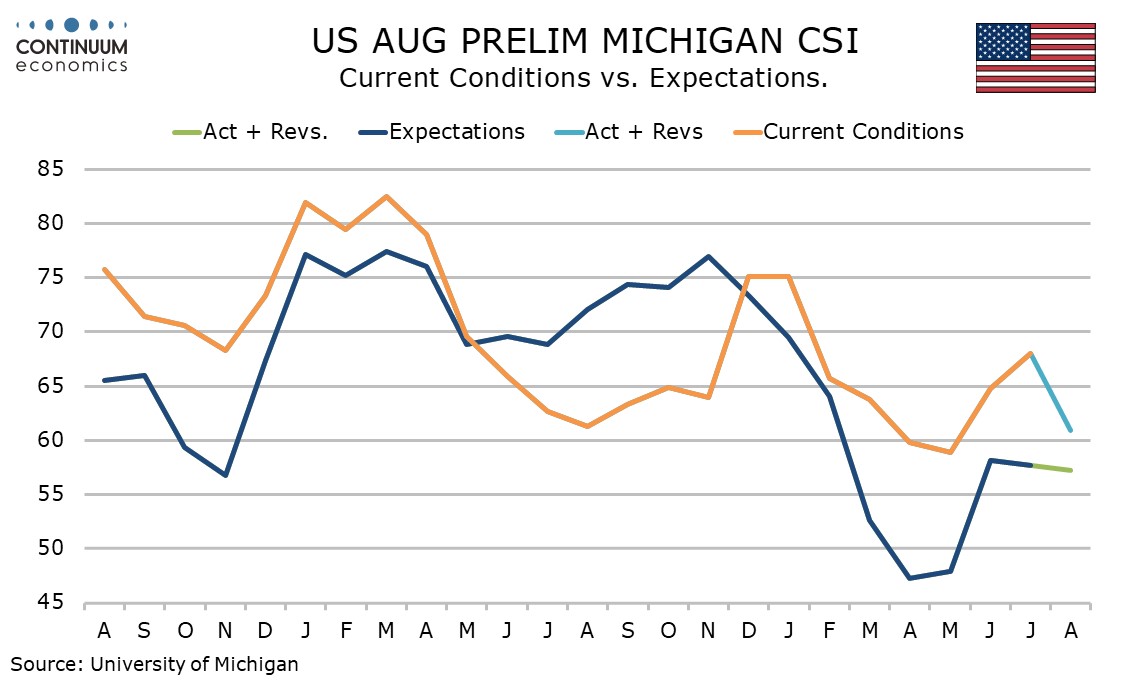

August’s preliminary Michigan CSI is a disappointment, falling to 58.6 from 61.7 in July and 60.7 in June, while remaining above the 52.2 seen in April and May. The fall was led by current conditions while inflation expectations saw a disappointing bounce.

Current conditions fell to 60.9 from 68.0 while expectations were only marginally lower at 57.2 from 57.7.

The most obvious explanation for the dip in current conditions is employment. It is uncertain whether consumers are responding to their own experiences of the labor market or simply the reporting of weak data.

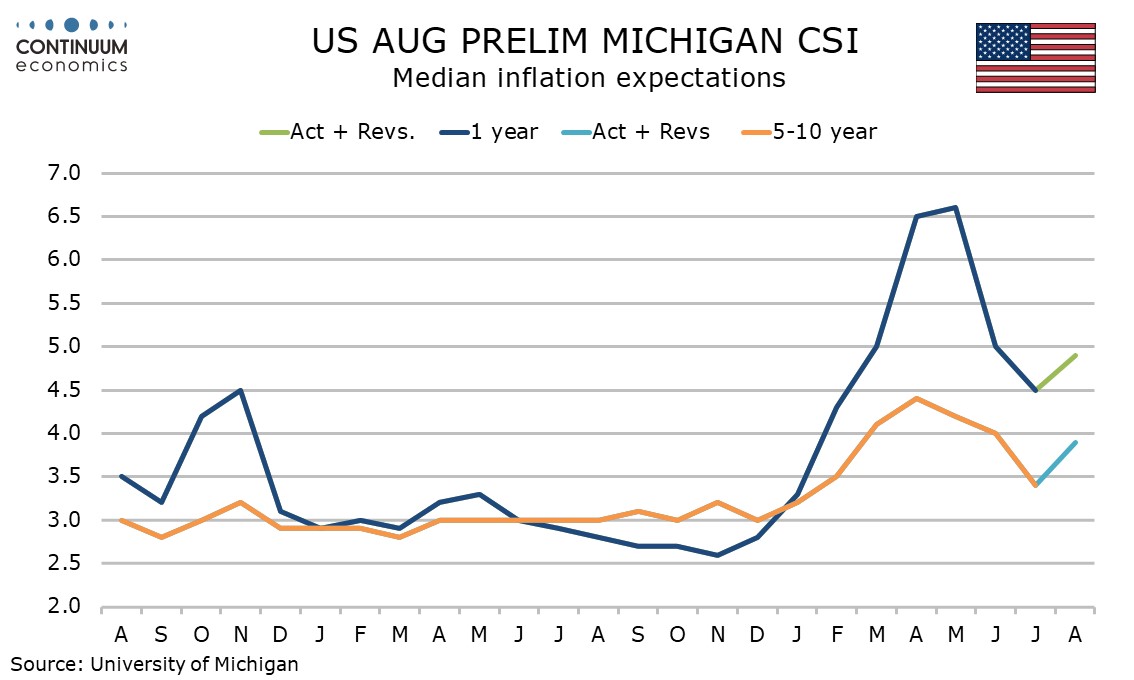

Inflation expectations also saw an unwelcome bounce, the one year view to 3.9% from 3.4% and the 5-10 year view to 4.9% from 4.5%. These rates remain marginally below June’s but suggest tariff concerns are heating up again after having eased in June and July.