FX Daily Strategy: N America, August 14th

AUD bounced on solid Australian employment data

GBP risks on the downside on GDP data

NOK at attractive levels ahead of Norges Bank decision

USD more likely to gain than fall on PPI

Underlying positive risks tone hard to justify longer term

AUD bounced on solid Australian employment data

GBP risks on the downside on GDP data

NOK at attractive levels ahead of Norges Bank decision

USD more likely to gain than fall on PPI

Underlying positive risks tone hard to justify longer term

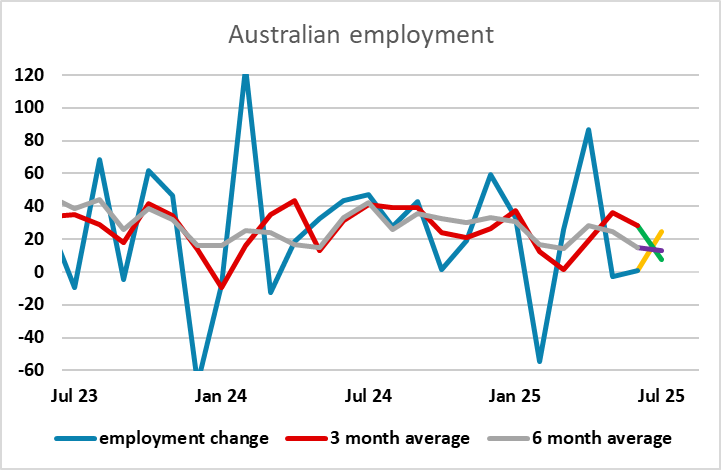

Thursday kicks off with Australian July employment data. The modest 2k rise in June was a disappointment after the 1k decline in May, and suggests we may be seeing a deterioration in the underlying trend. However, the data can be choppy from month to month, and the last two months may be a reaction to the big 85k rise in April. The 25k consensus increase in July maintains a mildly positive trend, but suggests the trend is weakening and supports expectations of further RBA easing later in the year. But with the unemployment rate lowered to 4.2% from 4.3% y/y, the headline employment change at 24.5k is overshadowed by strong full time employment gain of 60.5k. The Aussie got a knee jerk jump but the gains did not last on inevitable more cuts from the RBA.

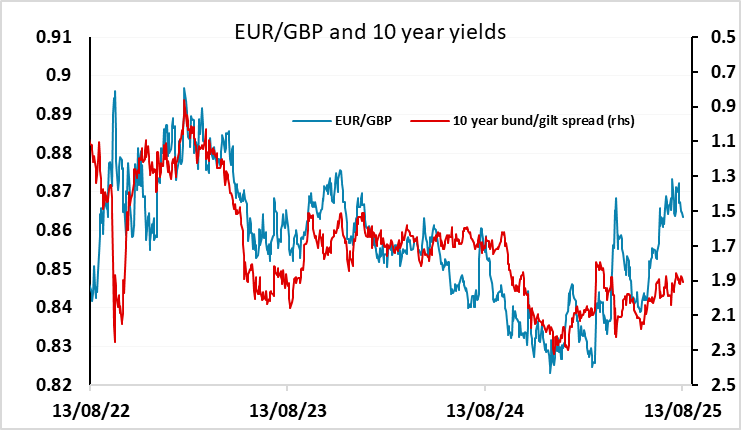

UK June and Q2 GDP have come in much stronger than expected at 0.4% m/m and 0.3% q/q respectively, driven by gains in services and construction. This follows a 0.7% gain in Q1 and negative GDP growth in April and May, both of which likely reflect activity being brought forward into February and March ahead of stamp duty and US tariff changes. The data is certainly GBP supportive, reducing the urgency for rate cuts, even though per capita GDP growth is less strong at 0.2%. EUR/GBP is slipping towards support at 0.86, and may manage a serious test of this level in response to what is significantly stronger than expected data.

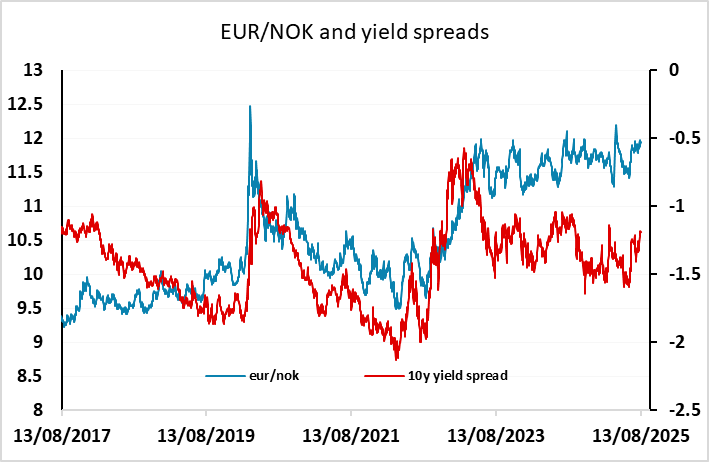

We also had the Norges Bank rate decision. Norges Bank left rates unchanged as expected, and indicated that they still expect to cut rates again this year, with their outlook still in line with the assessment they presented in June, which suggested one more 25bp cut by year end. The market is currently pricing some more dovish risks to this view, with 43bps of easing priced by year end. The NOK is marginally higher after the Norges Bank decision, perhaps reflecting the lack of any more dovish twist to the statement. EUR/NOK near 12 remains a good long term selling area.

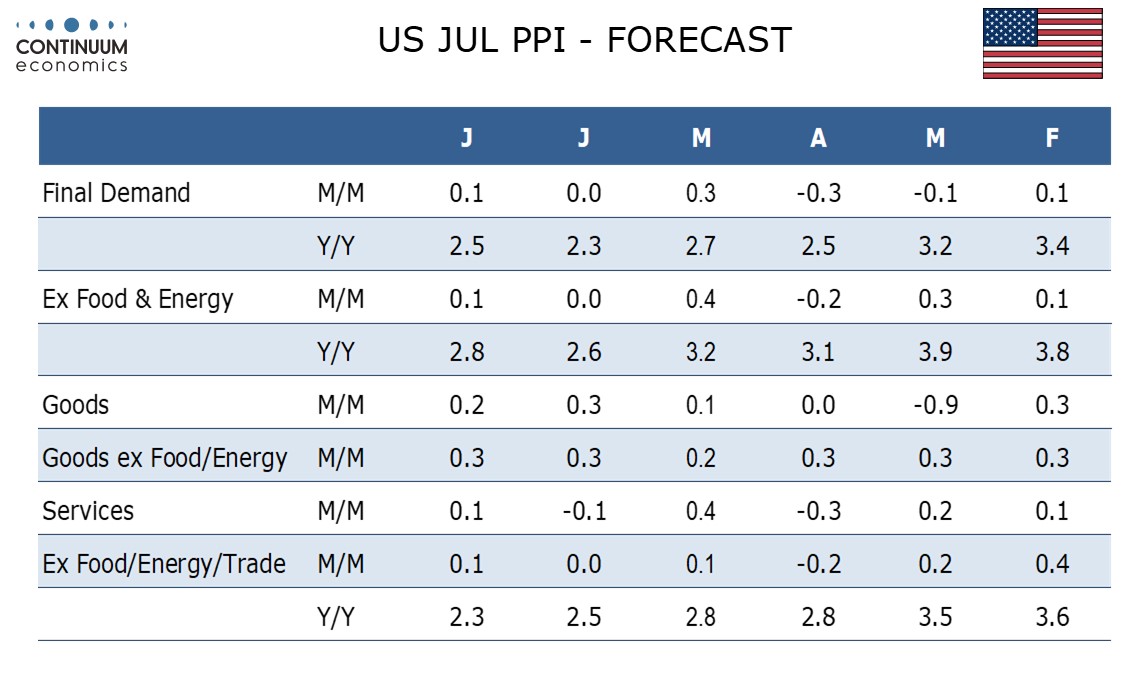

PPI in the US seems unlikely to have a major impact, but given tariff concerns may get more attention than usual, as tariffs may show up in the PPI data before we see them in CPI. We expect July PPI to rise by a modest 0.1% overall and in each of the core rates, ex food and energy and ex food, energy and trade. This would follow unchanged outcomes in all three indices in June, but risk is that those indices will be revised higher, offsetting weakness in July. In the first six months of 2025, PPI ex food and energy has seen an average downside surprise relative to consensus of 0.28%. However the average upward revision for the first five months of the year (June revisions will come this month) is 0.26%, almost fully offsetting the downside surprises. Cuts in Labor Department staff may be impacting data quality, which raises concerns over CPI which is only revised one a year. With the market already fully pricing in a Fed rate cut in September, the risks look to be to the USD upside on stronger than expected data.

We continued to see new highs in the S&P500 on Wednesday, and the strength of the US equity market in particular and global equity markets in general remains a key aspect of the markets. One concern is that this strength is due in large part to the expectations of 125bps of Fed easing over the next year, which would take the funds rate down to 3%. This would no longer be restrictive, and only seems likely to happen if either growth or inflation fall significantly. It’s hard to see much weaker inflation given tariff increases, so suggests a weaker growth outlook, which is hard to square with the extremely high equity market valuation. Nevertheless, until we see unemployment rising, the equity market is likely to remain resilient, but this may not be as far away as all that. When it comes, JPY strength is the most likely FX response.