FX Weekly Strategy: August 18th-22nd

PMIs a focus but EUR/USD looking rangebound

DXY continues to follow Trump 1.0

JPY upside scope still looks to depend on equity turn

GBP has some downside risks on CPI

Strategy for the week ahead

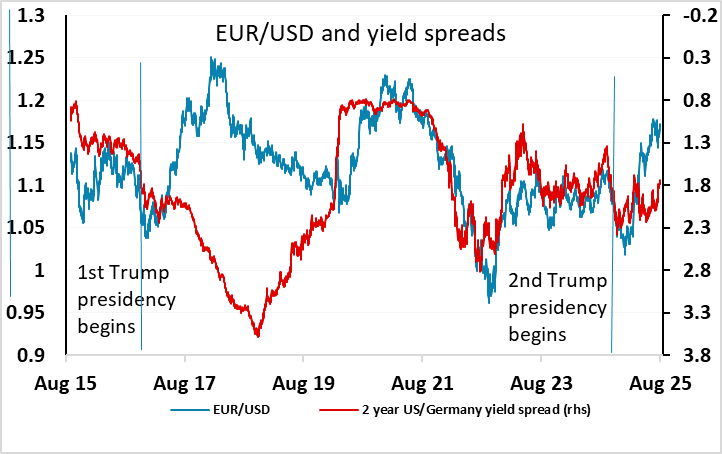

A relatively quiet week for data sees preliminary August PMI indices from around the world, but it would be surprising if these were to show significant changes in the broadly steady trends seen in recent months. The European indices are usually the most closely watched, and the Eurozone numbers may include some response o the EU/US trade deal, in which case the risks may be slightly on the downside. As it stands, we already think that the market has priced in just about as much Fed easing as it can in the absence of clear weakness in US labor market data, and with EUR/USD already trading well above the levels suggested by yield spread correlations, it’s hard to make the case for a test of the recent highs above 1.18, despite the firm tone to EUR/USD at the end of last week.

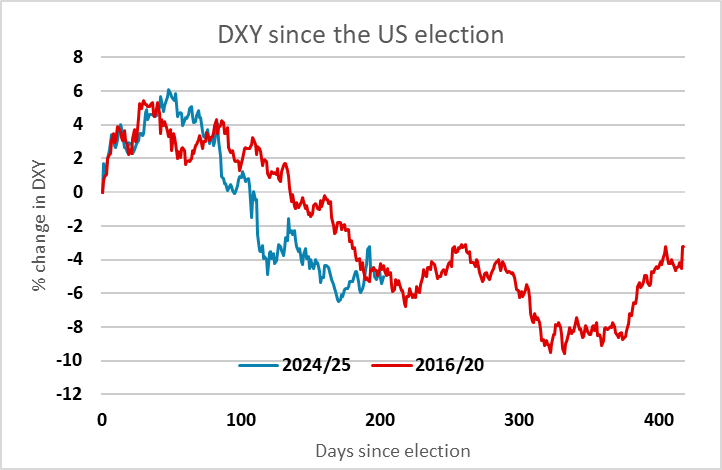

The risks may therefore be slightly on the EUR/USD downside, but EUR/USD remains a hard pair to call now that it has disengaged form the trend in yield spreads. Much the same was true during the first Trump presidency, and the trend in the USD continues to broadly follow Trump 1.0. At this point in the first Trump administration we saw DXY stabilize for the next 100 days or so after seeing a 6% decline in the first 200 days as we have this time around. While we wouldn’t necessarily expect the USD’s behaviour to completely mirror that seen in 2016/7, in the absence of significant news we might see a period of stability in DXY and EUR/USD (which makes up the majority of the DXY index).

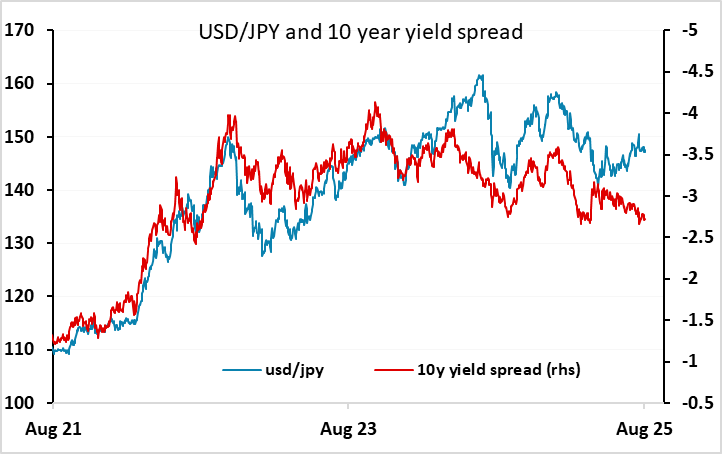

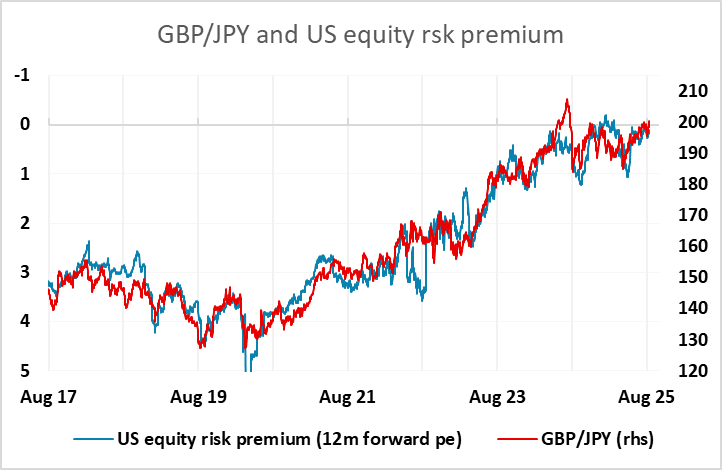

Bigger picture, it remains hard to see major FX moves without some disturbance to the resilience of the equity market. While USD/JPY appears to have downside scope based on yield spread correlations, the JPY continues to correlate strongly with equity risk premia on the crosses. Unless we see some rise in risk premia, it will therefore be hard to see a major decline in EUR/JPY or GBP/JPY, even though these continue to look very expensive on fundamental measures (as does USD/JPY). The most likely trigger for a turn lower in equities and a rise in equity risk premia, would be evidence of real weakness in the US labour market. While the last few employment reports do show a slowdown in job growth, it may take something negative to shake market confidence. We have the claims data that relate to the August employment report this week, so these may garner more attention than usual, but if initial claims continue steady, a fairly rangy market looks likely.

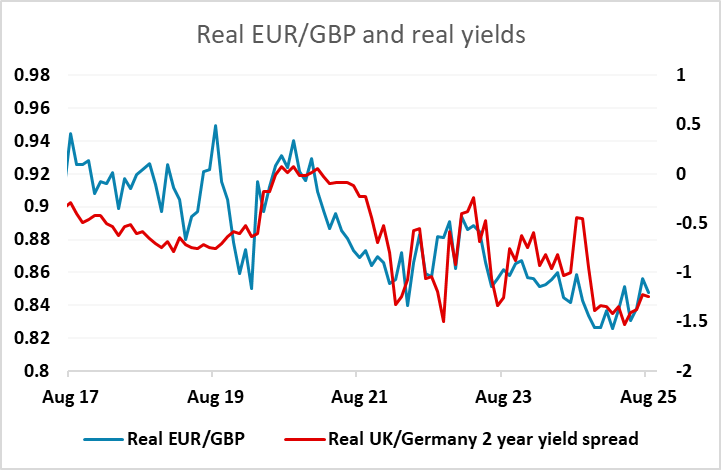

This week does see CPI data in Canada, the UK and Japan, with the UK data looking to have the most potential for market impact. While we expect the headline data in Canada to soften, we see no change in the BoC’s core measures and no impact on BoC policy expectations. However, we do see some downside risks to UK CPI, and given the very meagre 50bp easing priced into the UK curve by the end of 2026, we see some risks of lower UK yields and a decline in GBP. EUR/GBP put pressure on support at 0.86 last week after the stronger than expected UK Q2 GDP data, but in real terms we still expect UK yields to converge with Eurozone yields going forward, and this would imply upside risks for EUR/GBP.

Data and events for the week ahead

USA

It is a quiet week for US data. August’s NAHB homebuilders’ survey is due on Monday. On Tuesday we expect July housing starts to fall by 4.6% to 1260k while permits fall by 3.1% to 1350k.

On Wednesday, Fed’s Waller, who dissented for easing in July, will speak, as will Bostic. Minutes from the July FOMC meeting are also due, and are likely to show a majority backing a cautious stance towards easing, but this meeting took place before weak recent employment data was seen.

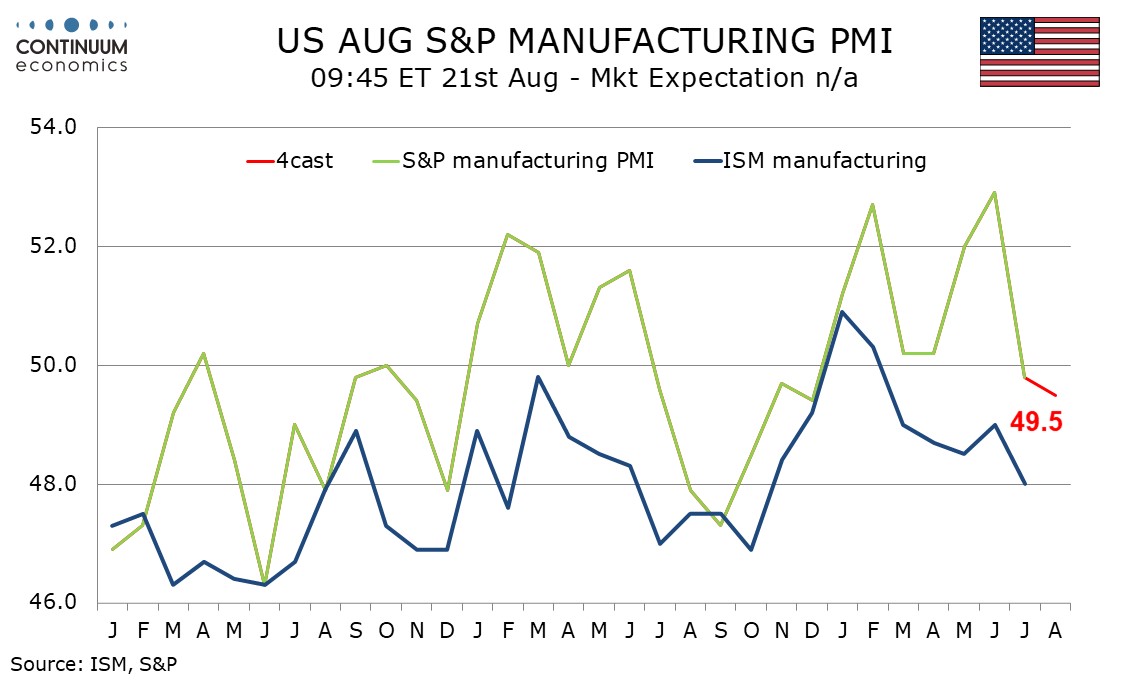

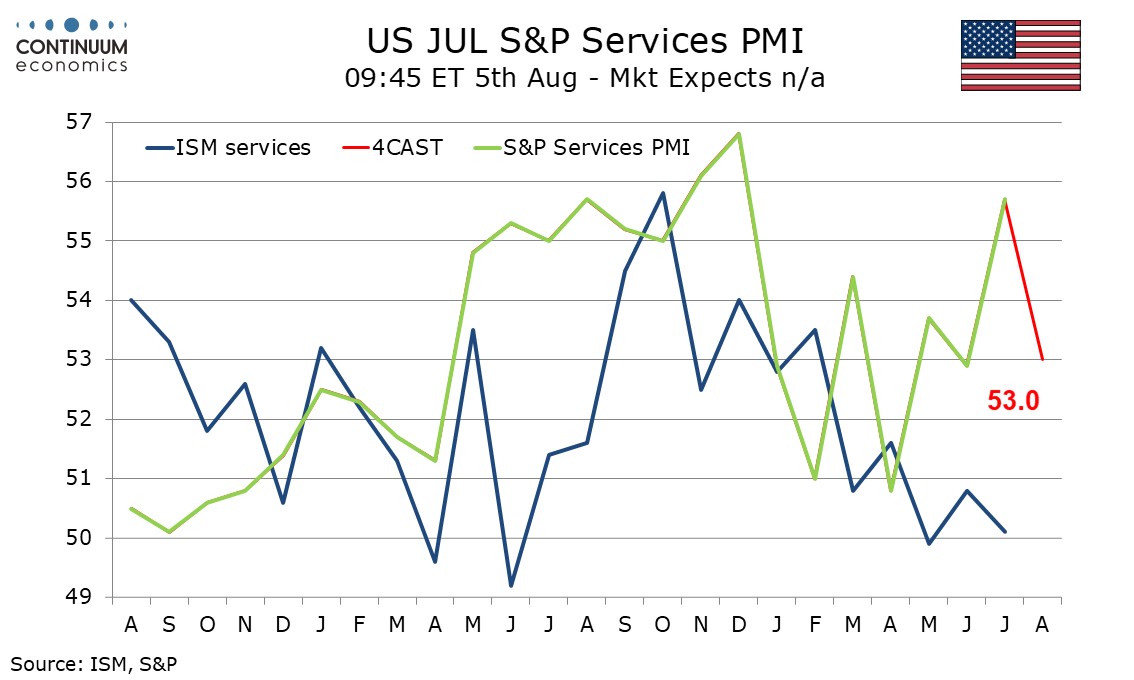

Thursday’s initial claims will cover the survey week for August’s non-farm payroll, and will be released alongside August’s Philly Fed manufacturing survey. Later we expect August S and P PMIs to show slippage in manufacturing to 49.5 from 49.8, and services to 53.0 from July’s surprisingly strong 55.7. July existing home sales follow, and we expect a 0.8% decline to 3.90m. July’s leading indicator is also due.

Canada

Canada releases August housing starts on Monday. July CPI is due on Tuesday where we expect slippage to 1.6%% yr/yr from 1.9% but with no change in the Bank of Canada’s core rates, which will remain above target. Thursday sees July’s IPPI and RMPI and Friday sees June retail sales. A preliminary estimate for a 1.6% increase was made with May’s retail sales data, which fell by 1.1%.

UK

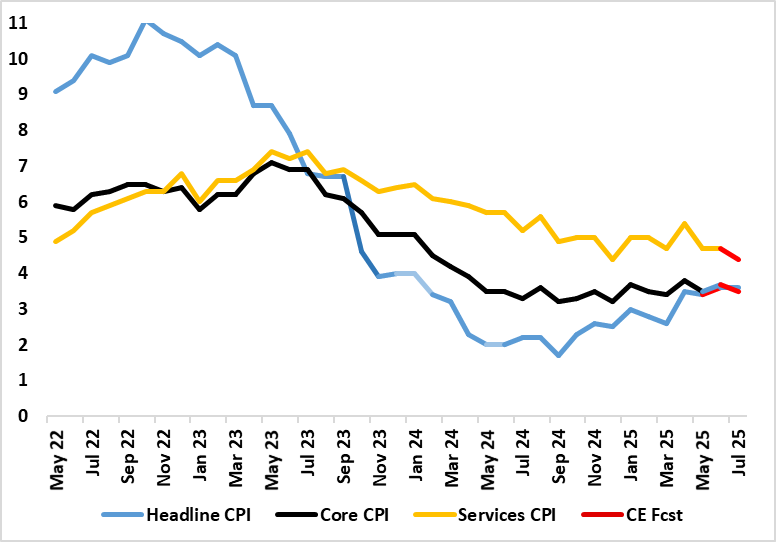

Despite many preferring beaches, the UK has several important economic updates looming in the coming week. Most high profile, After the upside (and broad) June CPI surprise, we see Wednesday’s CPI inflation steady at 3.6% in July, 0.2 ppt below BoE thinking. Our relatively lower estimate factors in lower services inflation and a fall back in that for food, the former allowing the core rate to unwind the increase to 3.7% see last time around. Thursday sees public borrowing n umbers which may still point to an overshoot of fiscal plans although estimates for borrowing in the first three months of 2025-26 were some £7.5 billion above the same period last year, which is exactly in line with OBR projections. The same day sees flash August PMI numbers which we see being broadly unchanged. At 51.5 in July, Composite Output Index eased from June's nine-month high of 52.0. But the inflation messages were lower too as average cost burdens were the least marked so far this year.

July Inflation to See Softer Core and Services?

Source: ONS, Continuum Economics

Friday sees July retail sales data where a m/m correction is seen with it unclear how a very warm month may have affected spending. Finally, BoE Governor Bailey speaks on a panel at the Jackson Hole conference and may discuss the symposium’s subject matter this year, namely labor markets.

Eurozone

More ECB updates arrive but purely data on Q2 negotiated wages on Friday. Otherwise, the week sees consumer confidence numbers (Wed) and Thursday’s flash PMI for August. In July, the Composite PMI rose to 50.9 from 50.6 in June. We see little change in what may be the first broad insight into how companies have actually reacted to the EU-U.S. trade ‘deal’ – the German ZEW update was weak though. Final German GDP (Fri) will offer little new as may final EZ HICP data (Wed), although Monday’s EZ trade figures and Thursday’s construction data may be interesting reading.

Rest of Western Europe

There are no key events in Sweden over and beyond the Riksbank verdict (Wed) and what may be weak but volatile labor market data (Fri). We see the Riksbank delivering a further 25 bp rate cut, taking the policy rate to new cycle low of 1.75%. This would chime with the hints after the last meeting and cut in July of a further move is possible. And with both real activity and CPI data having delivered downside news and surprises, the rationale as well as scope is there for what we think will be flagged as a final move. Norway sees Q2 GDP figures where we see a 0.2% q/q rise for the mainland figure, a notch below Norges Bank thinking

Japan

The critical National CPI will be released on Friday. We forecast all items to remain above 3% but showing further signs of moderation. It will be a hawkish surprise that inflationary pressure resurfaces stronger. Else, trade balance will be on Wednesday and could provide cues on export impact from tariff.

Australia

Rather clear calendar for Australia next week as we only have consumer inflation expectation on Thursday and PMIs on Wednesday. Neither are going to be market moving.

NZ

Kickstarting the week with Business PMI on Monday but the all important RBNZ decision will be on Wednesday. It is widely expected there will be one more 25bps cut from the RBNZ and we do not see any reason for them to not cut as inflationary figure aligns with forecast. With OCR forecast seeing no more cut, if the forward guidance suggest more cut to come, it may also cut the legs of the Kiwi. Trade balance will be release on Thursday while PPI on Tuesday, yet neither would carry more weight than RBNZ’s decision.