U.S. July PPI - Shocking rise after a string of subdued months

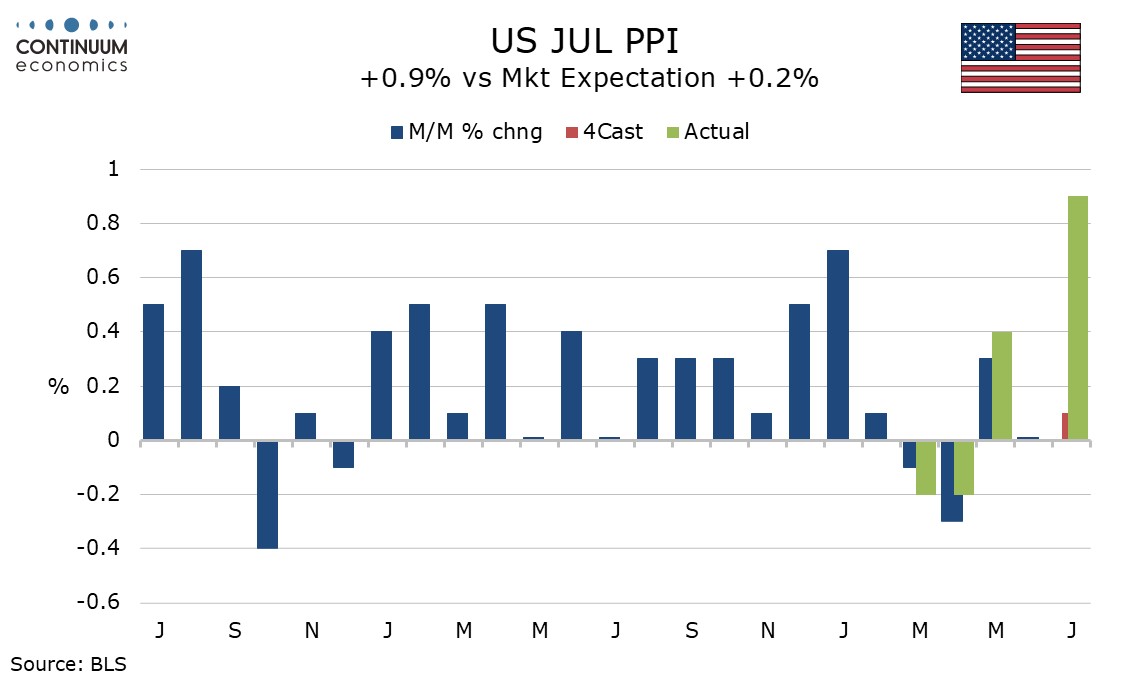

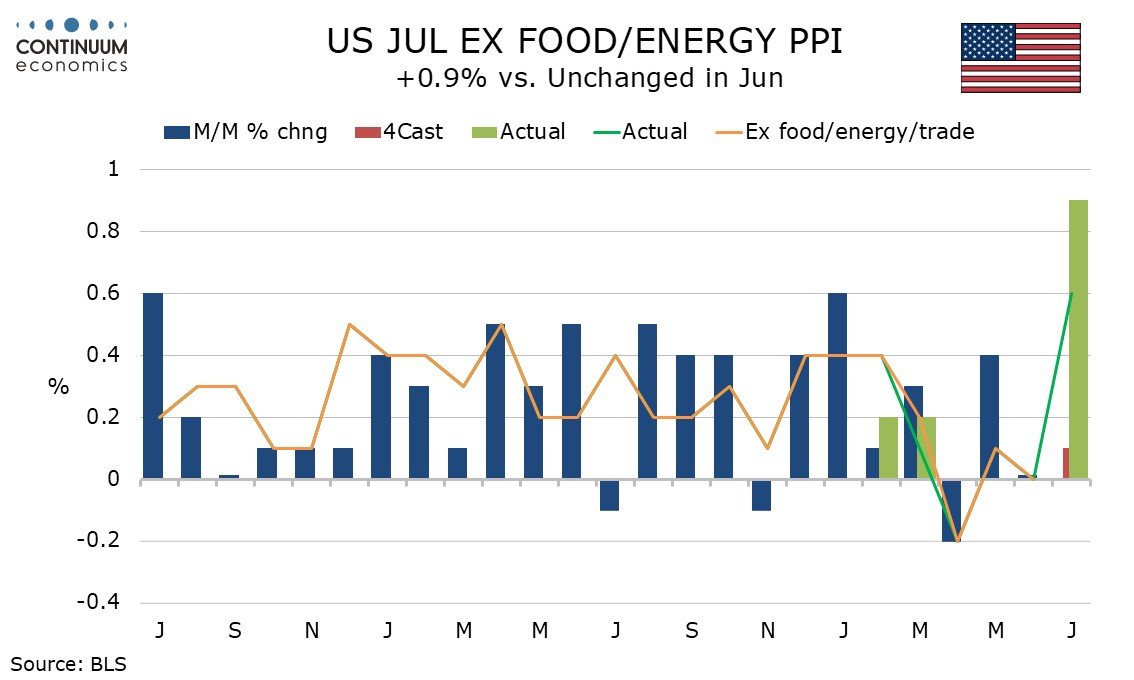

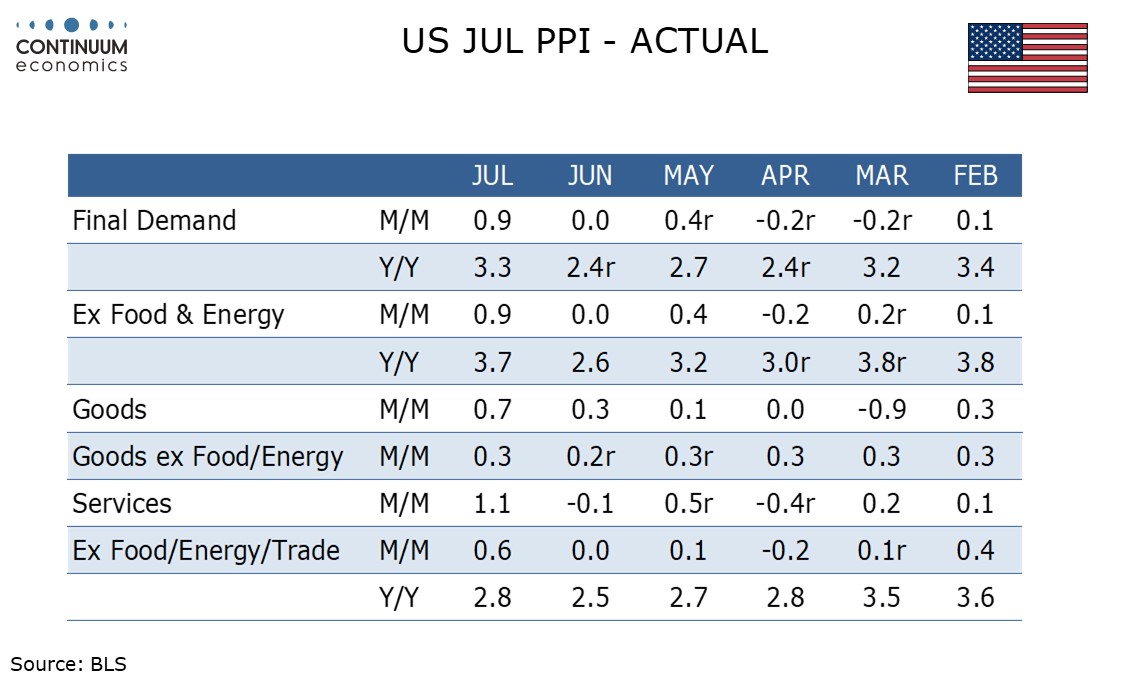

July PPI has risen a shocking 0.9% overall and ex food and energy, with a 0.6% increase ex food, energy and trade. The surprise was led by a 1.1% surge in services which had been showing an increasingly subdued trend into June, though goods were also firm at 0.7%, 0.4% ex food and energy.

The services rise still looks strong even when seen alongside a 0.1% decline in June, with trade up 2.0% after a 0.3% drop, transport and warehousing up 1.0% after a 0.8% drop, and ither services up by 0.7% after a 0.1% increase. Why services have seen such a sharp bounce is unclear, with services less impacted by tariffs than goods.

Food and energy both saw gains, the former strong at 1.4% and the latter moderate at 0.9%. Goods less food and energy rose by 0.4% after a 0.2% June increase that followed four straight gains of 0.3%. This is a pick up from trend in the second half of 2024, when gains were all 0.1% or 0.2%.

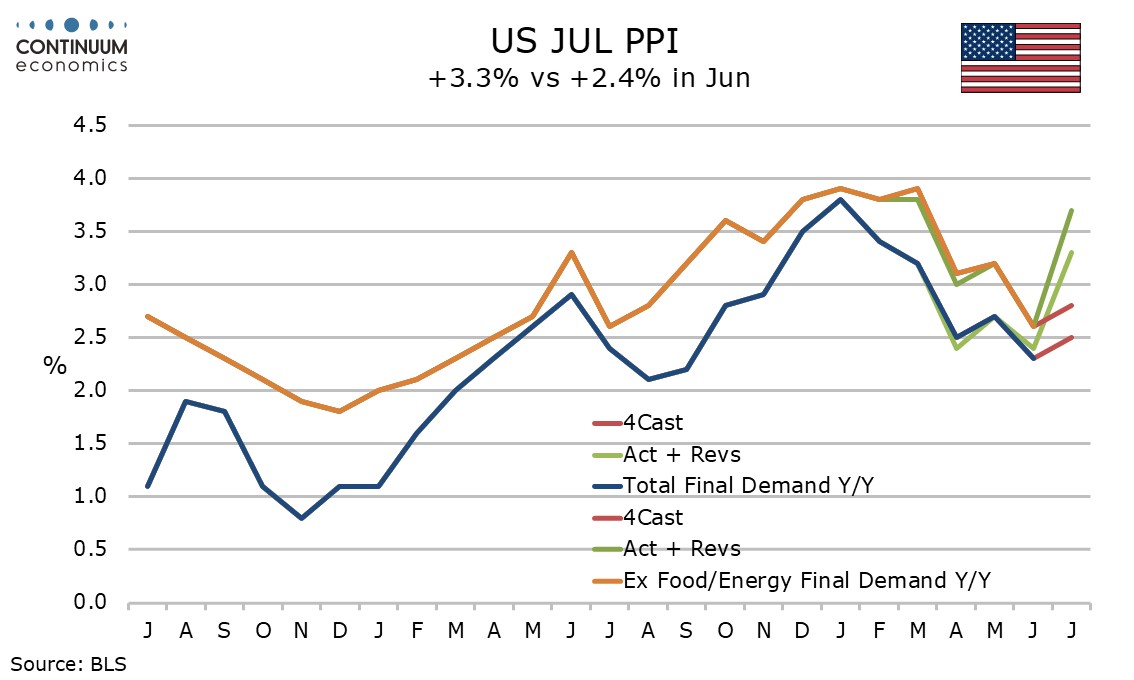

Yr/yr growth accelerated to 3.3% from 2.3% overall, though was higher as recently as February. Ex food and energy at 3.7% from 2.6% was higher as recently as March, while ex food, energy and trade at 2.8% from 2.5% simply returns to April’s pace. The July strength can be seen as corrective from a strong of fairly soft months, that lasted from February through June.

Intermediate data also shows acceleration, services up by 0.9% after averaging 0.1% in the first six months of the year. Processed intermediate goods rose by 0.8% and 0.5% ex food and energy, while unprocessed goods rise by 1.8% and 2.0% ex food and energy.

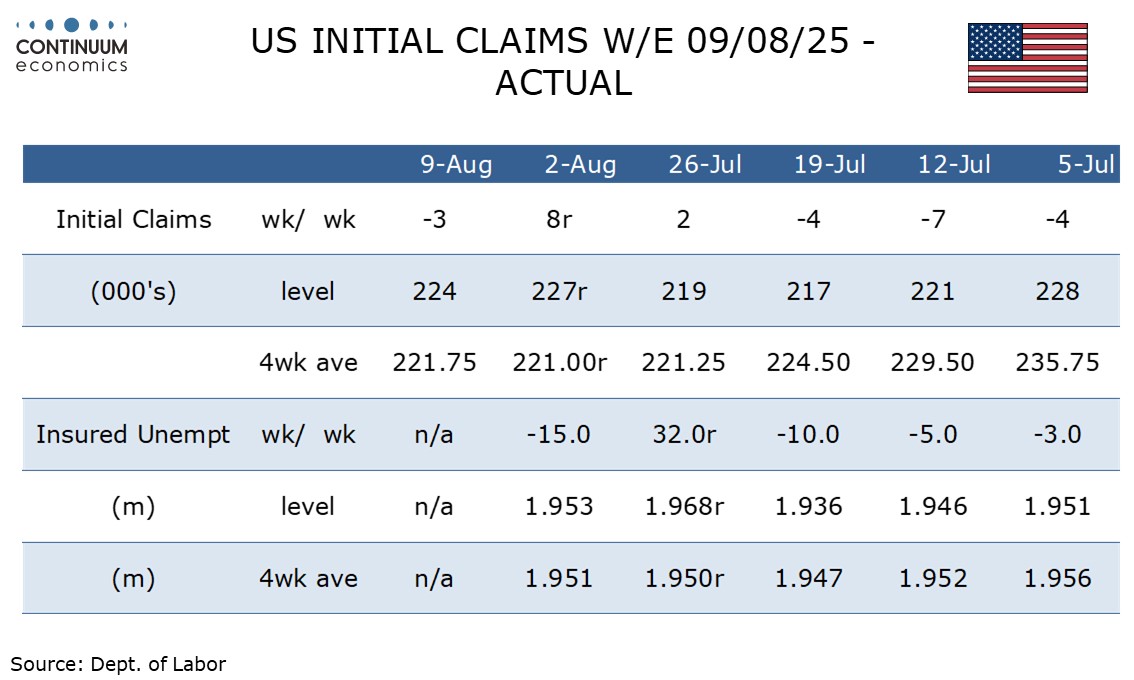

Initial claims were down 3k to 224k while continued claims fell by 15k to 1.953m. Neither fully reversed preceding gains of 8k and 32k respectively but the levels remain low, consistent with a steady labor market.