Eurozone: More Sobering Economic News

The February composite PMI data may have not fallen (stable at 50.2) and the weaker-than-expected outcome was dominated by sharp addition weakness in France, but the data will be uncomfortable reading for the ECB. The data very much suggest that the better news regarding EZ consumer spending seen of late has failed to bolster either output or business sentiment and where instead global economy uncertainty is causing continued falls even ahead of what may be a marked blow should tariffs actually be introduced as is being threatened. The data imply flat growth at best (Figure 1 which includes even weaker construction PMI numbers) as well as worrying hints that hitherto solid services output is buckling (Figure 2), this adding to signs of fresh consumer fragility. We still see a very sub-consensus 0.7% GDP picture thus year although note that the consensus is dropping towards our view!

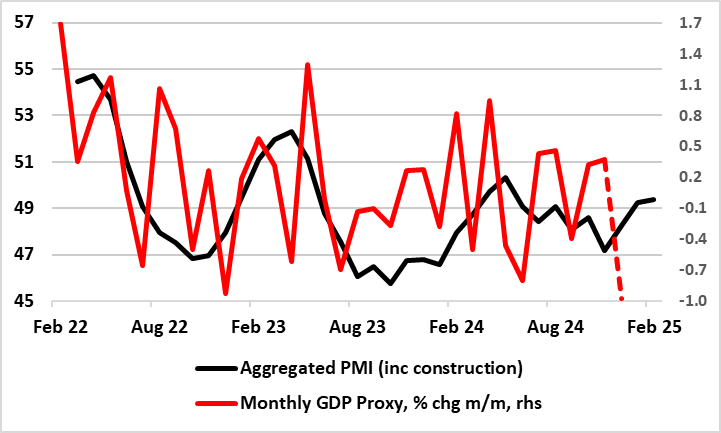

Figure 1: PMI Weakness May Actually Overstate Momentum

Source: Eurostat, European Commission; dashes are CE projection

Wages Driving Job Losses?

And while the PMI suggest that price pressures are not easing any further, they remain historically limited according to the survey. Any rise in costs probably may reflect the impact of recent rises in energy prices. Regardless what is noteworthy is if alleged reports in the survey of elevated wage pressures are accurate (they are in fact in conflict with what other sources suggest), it may be making firms reconsider the labor market – hence the further and faster drop in jobs reported as attempts are made to limit labor costs.

Momentum Lost?

While the ECB may draw some comfort from signs of a seemingly Q4 further recovery in consumer spending, possibly a hint that disinflation has persuaded households to run down what seem to be elevated savings, there seems to be a general and continued loss of momentum nonetheless, led by continued weakness which may now be spilling over more discernibly into weak exports. Indeed, this may mean that the recovery the continued consumer recovery the ECB sees through the coming year may falter as the declines in household savings it is partly based upon may already have occurred. In addition, the increasing weakness in the labor market that the PMIs point to is also hardly as positive from a demand perspective, especially is ECB wage indicators are right in suggesting much slower pay rises and where ay energy related cost pick-up is only going to accentuate demand weakness. Moreover, the risks are that the whole of the EZ is weakening given the possibly gloomier messages from business survey data into the current quarter with it likely that the anaemic Q4 GDP rise actually reflected fresh GDP declines as the quarter finished. Indeed, our GDP proxy* (Figure 1) suggests that December saw the economy weaken markedly, more than the PMIs suggest (even if the very fragile construction sector is included), this possibly a reflection of fiscal retrenchment and services weakening.

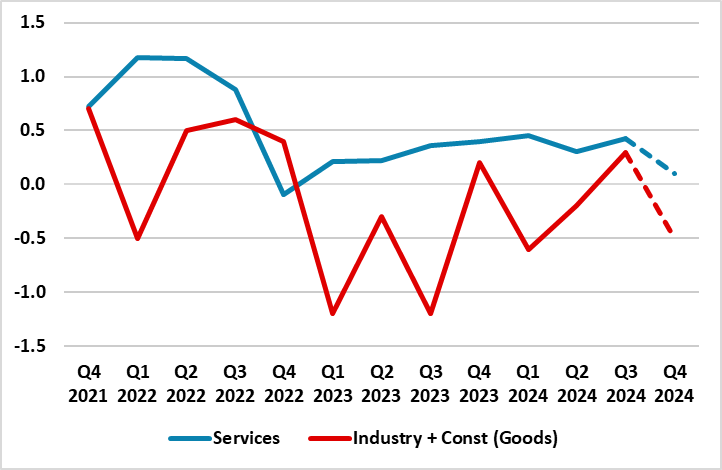

Figure 2: Services Succumbing?

Source: Eurostat, dashes are CE Q4 projection

The latter is important and is very much the main perturbing message from the PMIs. As we have noted before, the limp EZ recovery over recent quarters has come in spite of protracted manufacturing weakness with services instead having offered support. This may be changing albeit with the factor sector still in reverse while services flatten out (Figure 2). Indeed, it could very well be that actual services output fell sharply at the end of 2024, possibly setting an adverse precedent for at least H1 this year, and where the evolution of how global risks develop deciding what happens thereafter – we are not reassured.

*Eurostat does not produce monthly GDP data but we have compiled a proxy based on construction industrial and private services monthly numbers