U.S. Treasuries and the Trump Effect

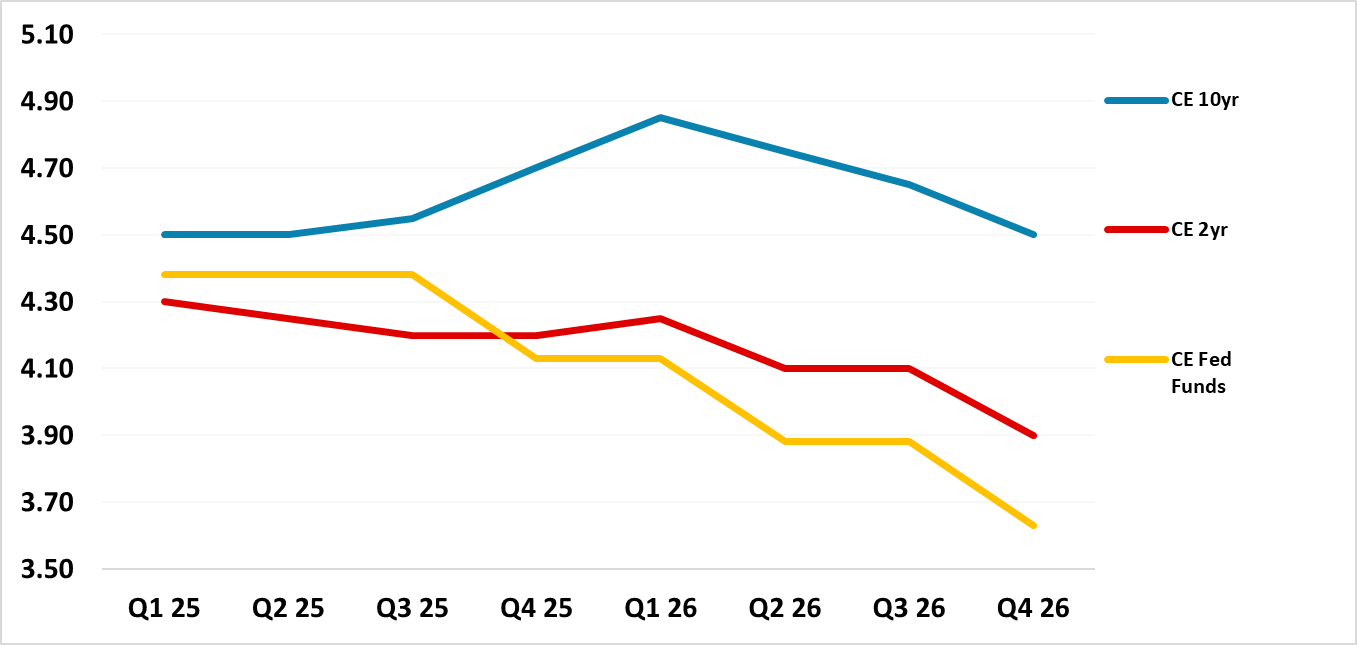

If the Fed convince the market that it is leaving the door open to easing and sees Fed Funds reduction multi-year, then 2yr could hold onto a small discount in the next two quarters and then swing to a small premium of 2yr to Fed Funds (Figure 1). 10yr yields will likely maintain a small to modest premium to 2yr. Heavy funding will keep 10yr elevated unless a slowdown in the economy is evident, but the 10yr budget bill now looks like it will produce a 6.5-7.0% budget deficit in 2026-27 rather than anything higher.

We have changed our Fed Funds forecast to one 25bps cut in Dec 2025 and two 25bps cuts in May and Nov 2026. What does this mean for 2yr and 10yr U.S. Treasury yield forecasts?

· Figure 1: Fed Funds and 2 and 10yr U.S. Treasury Yield Forecast (%)

Source: Bloomberg/Continuum Economics

The current resilience of the U.S. economy and difficulty in getting core PCE inflation down to target are the main motivation for our revised forecast of only one 25bps cut from the Fed in December 2025 (here). We see this still being a move to ease policy, both as current restrictive monetary policy continued to feedthrough as a headwind for the U.S. economy and as Trump administration policies are not now projected to significantly boost the U.S. economy.

Fiscal policy stimulus now looks likely to be modest rather than our previous view of aggressive. The House budget committee last week adopted a resolution (here) that clarifies the order of magnitude for the 10yr budget bill. Republican budget hawks have a victory with maximum tax cuts of USD4.5trn and maximum budget deficit increase of USD3.3trn over the 10yr period. Since renewing lapsing 2017 tax cuts are estimated at USD4.7trn, this leaves no room for social security or overtime tax cuts and the net impact of tax cuts could be small to modest on the U.S. economy. The expenditure cuts target may not be reached, given internal division in the GOP over reducing Medicaid but a USD3.3trn budget deficit increase could end meaning a 6.5-7.0% budget deficit in 2026 and 2027. Unless President Trump intervenes to push for more tax cuts and a higher budget deficit, the overheating risks around the budget deficit have become less for the U.S. economy and inflation.

Secondly, Trump trade war is a 2025 reality rather than a 2026 prospect. The economic and inflation damage however will likely be less than a congress-controlled system of universal tariffs. The combination of steel and aluminium (here) and reciprocal tariffs (here) will likely be partially diluted by President Trump love of a deal – which is likely with a number of countries over the next 12 months including China. Provided that 25% across the board tariffs are not introduced against Canada and Mexico, the effect on U.S. inflation will likely be to slow progress of core PCE inflation moving towards target rather than providing a fresh boost to U.S. inflation.

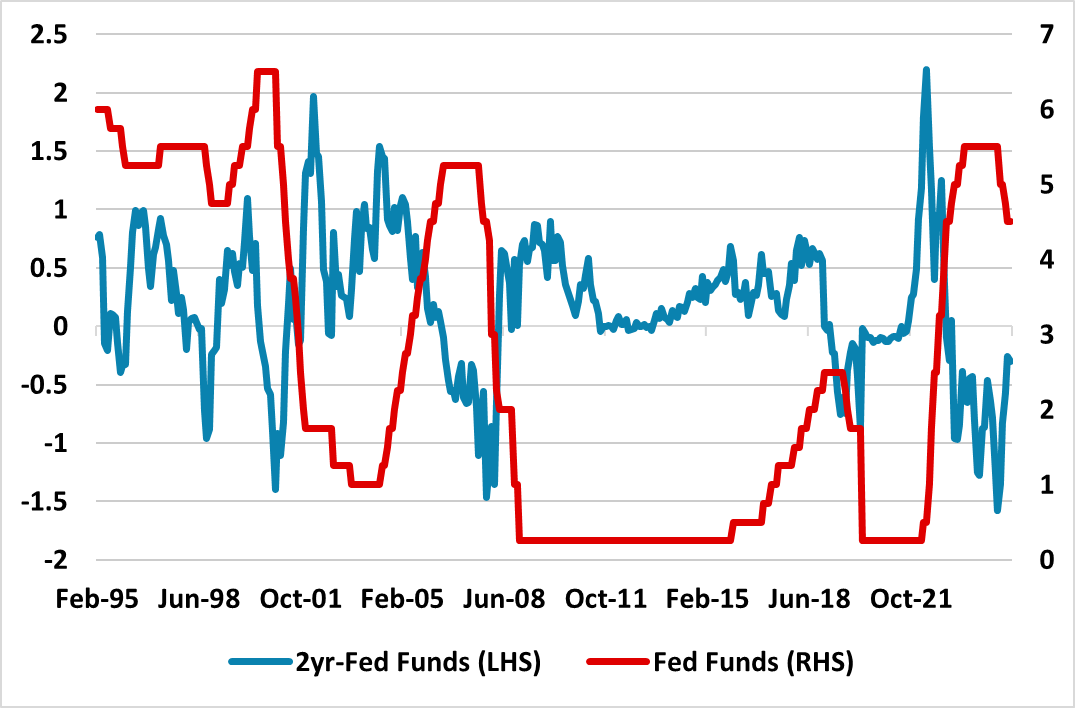

For 2yr U.S. Treasuries much will depend on Fed communications. If the Fed convince the market that it is leaving the door open to easing and sees Fed Funds reduction multi-year, then 2yr could hold onto a small discount in the next two quarters and then swing to a small premium of 2yr to Fed Funds – this is our baseline forecast (Figure 1). However, if the market believes that a high risk exists of even a modest tightening cycle, then 2yr yields will likely move to a 50-75bps premium versus the Fed Funds rate. This happened often in the 1990’s (Figure 2). With only modest fiscal policy easing and more limited spill over from tariffs, the Fed would have to be really worried about core inflation for a high risk of tightening to occur.

Figure 2: 2yr-Fed Funds and 2yr Yield (%)

Source: Datastream/Continuum Economics

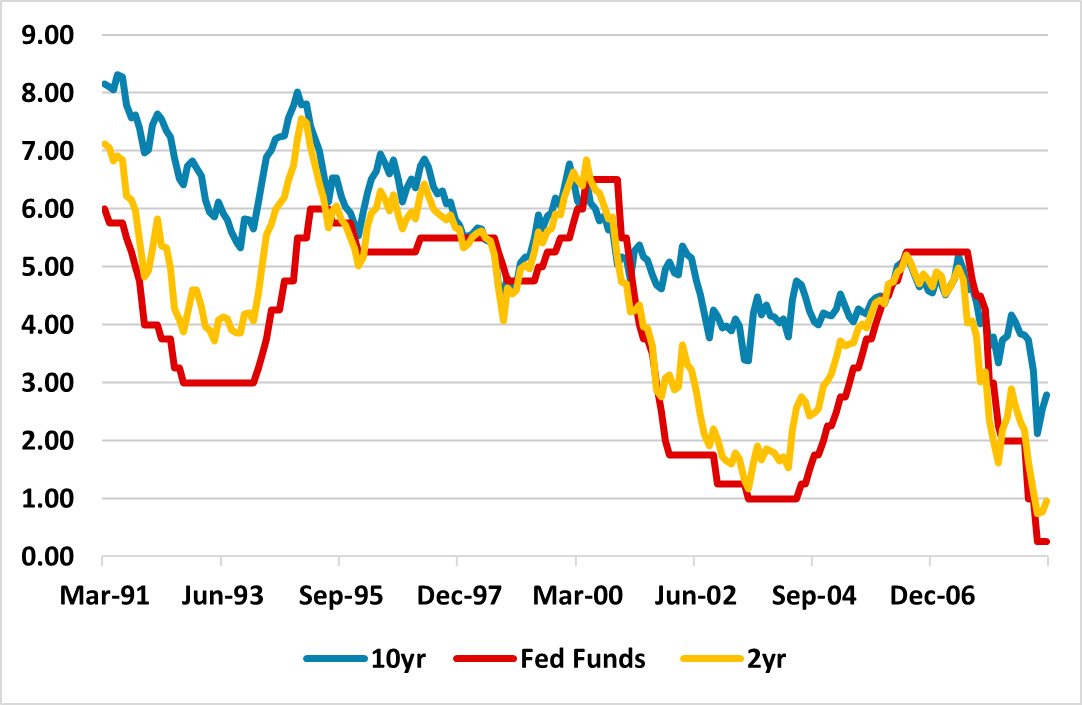

In terms of 10yr U.S. Treasury yields, current real yields are relatively high by the experience of the last 25 years and this helps in terms of funding the heavy issuance from a 6% plus budget deficit. If the House/Senate end up with a 6.5-7.0% budget deficit it will still be a heavy funding picture into early 2026 and this is one of the reasons we look for 10yr yield close to 5% in this period (Figure 1). Much also depends on whether U.S. Treasury secretary Bessant aims for a lower proportion of funding from the long-end, which could restrain the long end but keep shortening the average maturity of U.S. debt. Even so, a premium of 10yr to 2yr was the norm in the 1991-2008 period (Figure 3). The main cap to U.S. Treasury yields not going through 5% would be the lack of significant Fed tightening risk and only modest budget stimulus. The main floor to 10yr U.S. Treasury yields not going below 4% is the need for a healthy real yield to fund the budget deficit and the lack of a slowdown in the U.S. economy. A hard landing would see 10yr yields fall below 4%, but this is a low to modest alternative scenario for 2025-26.

Figure 3: Fed Funds and 2 and 10yr U.S. Treasury Yield 1991-2008 (%)

Source: Datastream/Continuum Economics