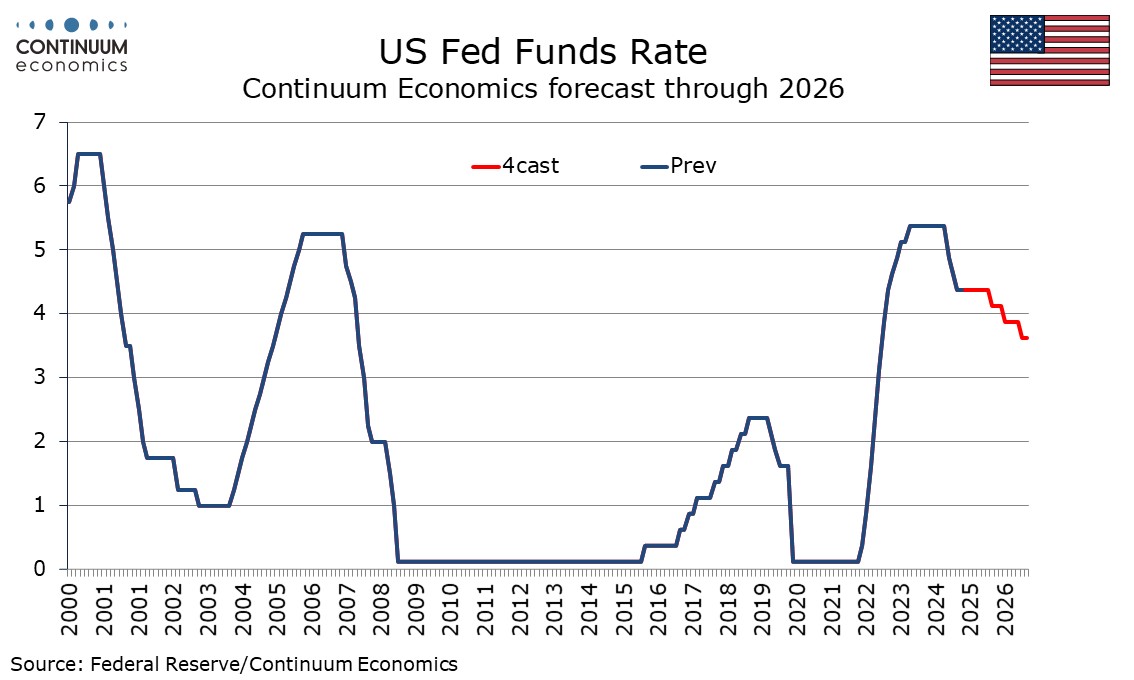

Revised FOMC view: One 25 bps easing in late 2025, two 25bps easings in 2026

Strength in January CPI does in part reflect residual seasonality, but continued stalling of progress in yr/yr growth is of concern. This revives concerns that the economy may need to slow to return inflation to the 2.0% target, something tariffs are likely to make more difficult. Uncertainty is exceptionally high, but we now expect only one 25bps easing in 2025, which is likely to come late if at all. We expect the Fed to remain cautious through 2026, though now expect two 25bps easings in that year.

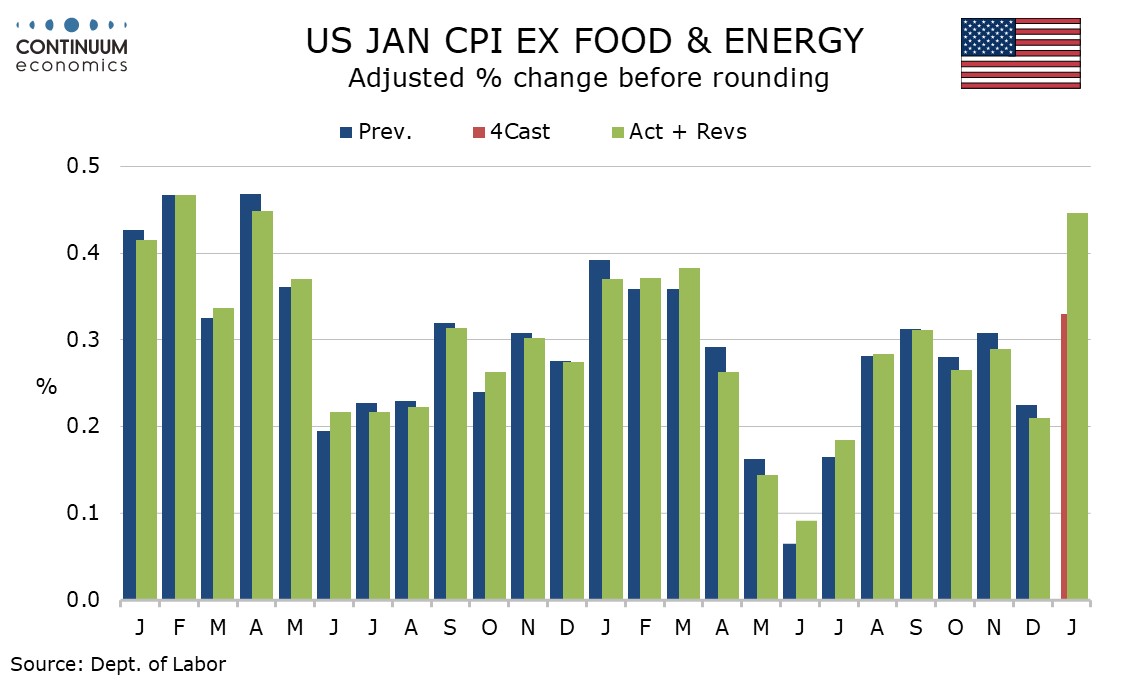

Celebrations on achieving a soft landing now look premature. January’s 0.446% core CPI increase before rounding exceeds those of January in both 2023 and 2024, lifting yr/yr growth to 3.3% from 3.2%. Yr/yr growth has been either 3.2% or 3.3% for eight straight months, showing a stalling in progress. While the strength of the CPI could encourage greater caution on tariffs, some increase on tariffs looks very likely (here) and would make renewed progress on inflation harder. Substantial tariffs could see inflation regaining momentum.

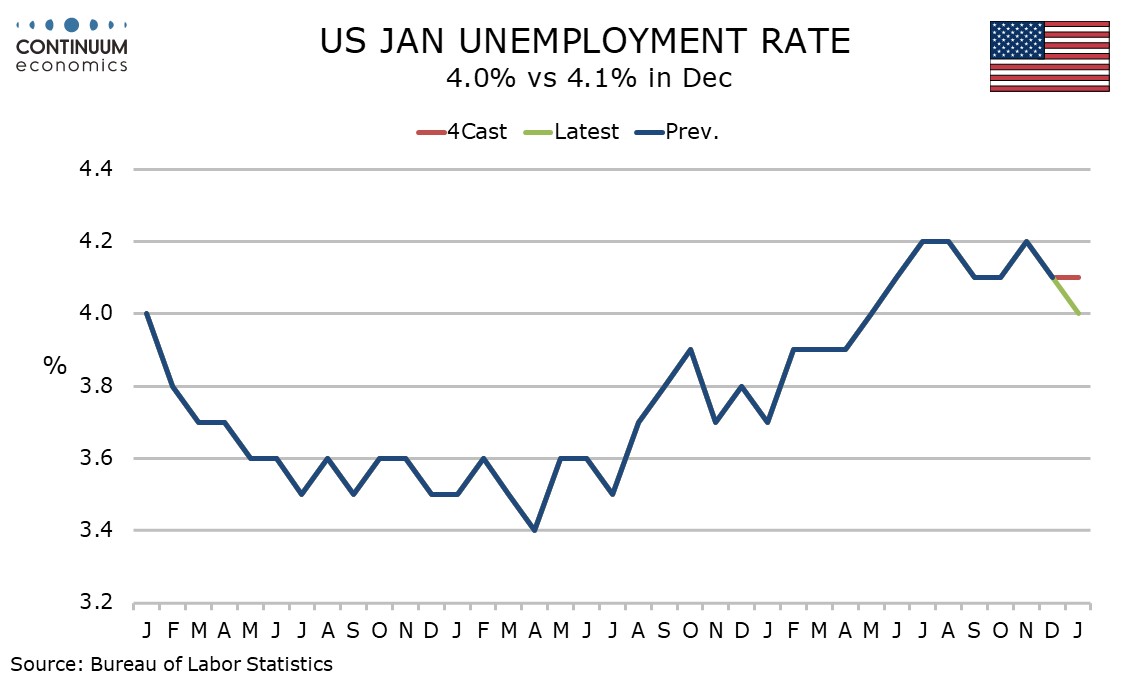

When the labor market started showing signs of losing momentum in mid-2024 the Fed acted quite decisively, with 100bps of easing between September and December. This appears to have stabilized the labor market, but has also contributed to a stabilization in inflation. Achieving the final mile on inflation may still require a more sustained rise in unemployment. Tariffs will add to downside risks on growth, marginally if tariffs are tightly targeted, but potentially significantly if they are broad based (here). Prospects of a significant fiscal stimulus are fading with Republicans divided over whether to prioritize tax cuts or fiscal discipline, and their small House majority making legislation hard to pass (here).

A Fed easing in March now looks out of the question, with a move in Q2 unlikely. In his recent testimony Fed Chairman Powell suggested rates could be kept on hold if the economy remains strong and inflation does not move towards 2%, but could ease if the labor market unexpectedly weakens or inflation falls more quickly than expected. As we move into the second half of 2025, we could be faced with a situation of stubborn inflation and a weakening labor market. The Fed would probably be more cautious in responding to hints of labor market weakness than they were in 2024, but if inflation was stable, with core PCE prices, currently 2.8% yr/yr, holding steady below 3%, we feel a modest 25bps ease is more likely then not in late 2025, most likely in December. Should inflation accelerate however, easing would be unlikely and tightening a significant risk.

We had previously expected tightening in 2026 on a view that easing would be seen in 2025 and inflationary tariffs would be more of a story for 2026 than 2025, as Trump sought to finance his tax cuts. It now looks likely that tariffs will be largely a story for 2025 and the boost to inflation will start to drop out in 2026, though both the timing and magnitude of tariffs remains highly uncertain. We have adjusted our 2026 Fed view to two 25bps easings, with timing penciled in for May and October. This would leave the end 2026 Fed Funds rate at 3.5-3.75%, still above current neutral estimates of 3.0%.