LatAm Outlook: Diverging Paths in 2024

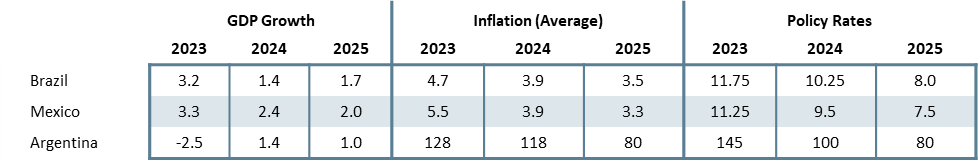

· We foresee Brazilian GDP growth decelerating in 2024, while we see Mexico continuing strong growth as a consequence of higher demand from U.S. and nearshoring. Argentina will see some growth in 2024 due to a lower basis of comparison and a better harvest in the agricultural sector.

· Both Brazil and Mexico were able to significantly reduce their inflation rate. We see the fall of inflation to slow down in 2024 as result of inertia and core prices stickiness. We see inflation converging to their central Bank target sonly in 2025,although there will be some reduction in 2024. For Argentina, the triple digits’ inflation will continue in 2024 and only slowing down to 90% in 2025.

· In terms of interest rates, we see Brazil and Mexico slowing cutting their interest rate in the beginning of 2024 and then applying some pause in the middle of the year to then, resuming the cuttings and the end of 2024. This tactic is to ensure that inflation comes back to target. In 2025, both countries will move their policy rates towards their neutral levels. Argentina will gradually low their policy rate while inflation falls.

· Forecast changes: From our September outlook, we have lowered marginally our inflation forecast for Brazil and Mexico while we have significantly raised it for Argentina. We have also reviewed our policy rate forecast for 2024 raising the end of the year policy rate for Brazil, as we see Brazil have a mid-year pause in rate cuts.

Our Forecasts

Risks to Our Views

Source: Continuum Economics

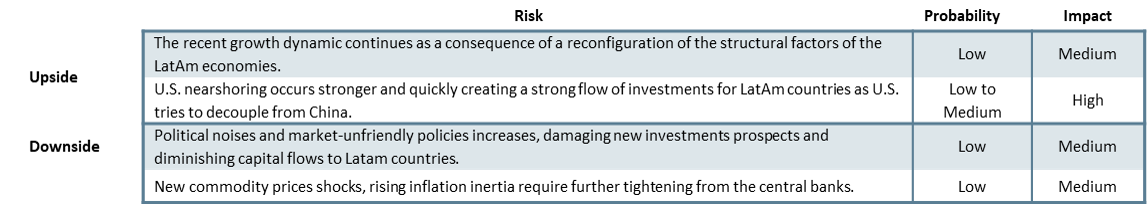

Brazil: Switching Back to Slow Growth?

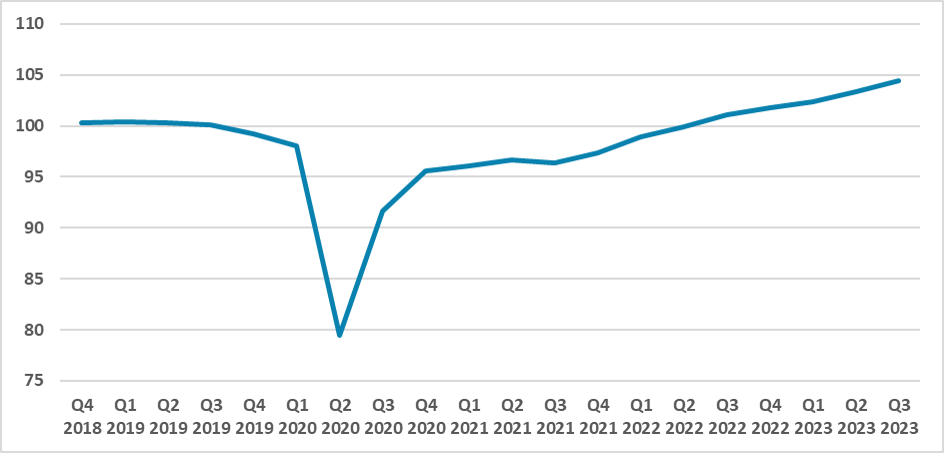

Brazil growth has finally begun to decelerate (here), as the growth in the third quarter dropped to 0.1% (q/q). However, growth for 2023 is expected to stand at 3.2% (Yr/Yr) which is quite a bit higher than most were expecting. What surprised was the strong growth of the agriculture sector (+15%), this growth is responsible for around 70% of year growth, although industry and services will also register both positive growth. However, we are not expecting the agricultural growth to register a similar growth next year. El niño will impact the agricultural production and we are expecting this sector to be stagnate next year.

Figure 1: Brazil GDP by Sector (Seasonally adjusted, 2019 = 100)

Source: IBGE

Additionally, Brazil will suffer headwinds from China growth. China is the biggest trading partner of Brazil and main destination of the Brazilian exports. Whether Brazil will continue to grow their agricultural exports by finding another trading partners remains to be seen. Additionally, monetary policy will continue to be tight, which is likely to drag growth down. Employment is also likely to decelerate, although we expect some growth from internal demand. Although, there have been some structural reforms in the past five years, we believe Brazil is poised to return to its pre-pandemic growth trend. We see the Brazilian economy growing 1.4% in 2024 and 1.7% in 2025.

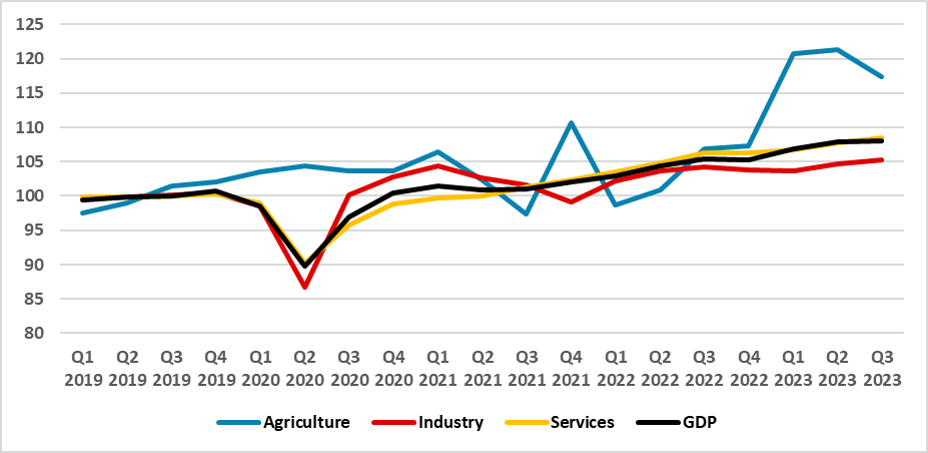

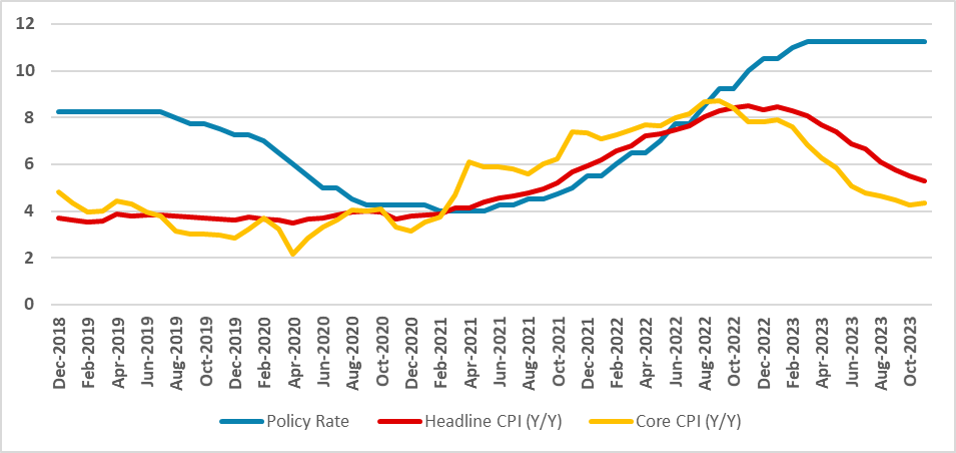

Looking at inflation, it is difficult not to see some success on the aggressive hiking strategy of the Brazilian Central Bank (BCB), as inflation is now at 4.7% (Yr/Yr) which is inside the BCB bands but still a bit far from the 3.25% target for 2024 and even farther from the 3.0% target for 2025. Additionally, there have been some risks, growth has been strong and fiscal policy is looser (here), inertia will also be an important factor during the disinflation process. We believe the CPI inflation will fall more slowly in 2024 and to show a certain degree of persistence. We believe inflation will slow down to 4.0% in 2024. And then will fall to 3.5% in 2025, this conditioned no further inflationary shocks happen.

Moving to interest rate, after the fall of inflation the Brazilian Central Bank has been able to start cutting the key interest rate in the sense of only diminishing the scale of monetary tightening. At 11.75%, there still some room for the interest rate to fall. However, the BCB is signaling caution. Inflation expectations are not aligned yet with the BCB target. The prospect of a looser fiscal policy will also make the task of disinflation tougher.

Figure 2: Brazil Policy Rate and CPI (%)

Source IBGE and BCB

The path of interest rates for Brazil will mostly be data-dependent. We think that the BCB wants to avoid bringing the policy rate back to neutral levels too quickly, therefore we don’t think they will increase the pace of cuts. We believe the BCB is likely to continue to apply 50bps cuts until May/June and then will pause the cutting cycle, to only then resume cutting in the end of the year. This would mean that the policy rate will end 2024 at 10.25%. However, another possibility is that the BCB does not make any pause but rather only diminish the cutting pace to 25bps, meaning the policy rate would end 2024 at 9.25%, in this case. This would only happen if inflation falls below the 4.0% mark and expectations fall closer to the 3.0% target. In 2025, as inflation converges towards the target the BCB will move the interest rate closer to its neutral rates at 8.0%.

Also it is important to note that President Lula will finally announce its candidate for BCB President. Due to BCB independency bill, BCB Presidents have a 4-years mandate meaning the BCB President appointed by the former President stays in charge for 2 years of the mandate of the next President. Markets will be looking to whether Lula appoint a person that could be complacent with inflation in order to promote more growth, meaning lower interest rates and higher inflation. Our take is that Lula will appoint a qualified President who will be adamant to put inflation back to its target, likely not moving inflation expectations up.

Mexico: Continued Growth Through Nearshoring

Similar to Brazil, Mexico has also seen high growth in the latest quarters but for different reasons. Although internal demand has been strong, with vigorous growth in investment and consumption, the locomotive of growth for Mexico has been external demand, especially from the U.S., fueling an anticipated 3.3% growth in 2023. Employment has also been strong in Mexico, with unemployment rates hitting 2.5%, and formal employment reaching a record in Mexico. The so-called nearshoring phenomenon, commonly known as the decoupling of U.S. value chains from China, is taking place not as the installation of fresh industry and value chains but rather the favoring of the current products already produced in Mexico from U.S. companies.

Figure 3: Mexico GDP (2019 = 100, Seasonally Adjusted)

Source: INEGI

We believe we will not see a strong movement of new companies coming to Mexico; only TESLA has announced the installation of a plant so far. Although there is a desire for Mexico to enter the microchips industry, we remain skeptical as it would have thelabor specialization. Mexico also already has all its formal labor occupied, and there is little room to absorb additional labor – a major jump in female participation is unlikely (here). However, the stronger demand for Mexican products from the U.S. will continue to play an important factor in the upcoming years, making growth higher than it was pre-pandemic. We believe external demand will compensate for the tight monetary policy. We see the Mexican economy growing by 2.4% in 2024 and 2.0% in 2025.

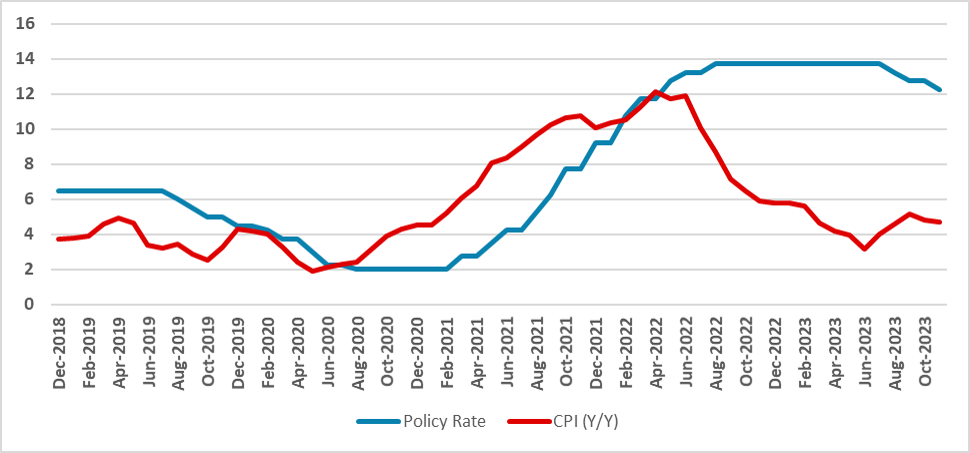

Looking at inflation, Mexico has made some progress in lowering post-pandemic inflation. The CPI is expected to grow by 5.5% in 2023. The fall in inflation rates has been first concentrated on non-core CPI, fueled by food and energy prices, while core CPI is showing more stickiness. However, it is important to note that there are some risks to the inflationary outlook. First, the labor market has been strong, and wage inflation is at double digits. Second, fiscal policy will be significantly looser in 2024 (here) with potential inflationary effects. Third, inertia from 2023 will also move inflation up in the next year. However, we believe that these risks will only be marginally felt, and the effects of the tighter monetary policy will outweigh them. Therefore, we expect CPI to fall to 3.9% (Yr/Yr average), and in 2025, it will converge to 3.3% (Yr/Yr average).

In terms of monetary policy, it is difficult not to see the success of Banxico's strategy. Raising the policy rate to 11.25% is paying its dividends in terms of lower inflation. Banxico was keeping the rhetoric of the inflationary risks and that the policy rate will stay at that level for a prolonged period of time. However, this rhetoric has changed, moving to "a certain period of time," meaning the cuts are closer. Indeed, the lowering of inflation has made real rates higher, meaning there is some room to cut rates while keeping the general level of tightening. As expectations have not yet converged, and there are several inflationary risks, Banxico will need to keep rates contractionary.

Figure 4: Mexico Policy Rate and CPI (%)

Source: Banxico and INEGI

We believe Banxico will apply the first cut in February, and it is likely to be at 50 bps, which will be followed by additional two cuts and then a pause. At the end of the year, when expectations are aligned and most of the impact of wage inflation and the fiscal package pass, Banxico will resume the cutting. We forecast the policy rate to end 2024 at 9.5%. However, if inflation falls stronger than we expect, it is possible Banxico won't pause at all, which would make the policy rate end 2024 100 bps lower. In 2025, Banxico is likely to move the policy rate towards its neutral levels of 7.0%.

One big theme for 2024 in Mexico is the general elections. Incumbent President Lopez-Obrador will not participate as re-election is vetoed, but he is poised to elect his successor. The chosen name from Lopez-Obrador's Party is Mexico City mayor Claudia Sheinbaum. She is likely to face Xotchil Galvez, who will represent the unified front of PAN and PRI. Sheinbaum is projected to win due to high Lopez-Obrador popularity, but the Congress is likely to remain divided, meaning there will be no major change of policies.

Argentina: Hoping for Brighter Times

After experiencing triple-digit inflation at the beginning of the year, prices in Argentina continued to skyrocket. Severe droughts significantly impacted the country by curtailing agricultural production, the primary source of exports and, consequently, the largest source of US dollars. As a result, Argentina's FX reserves have diminished. The government's decision to restrict access to these reserves has caused economic damage. Our forecast for 2023 anticipates a contraction of -2.5% in GDP growth, with year-on-year CPI projected to reach 124%.

However, the most significant news at the moment is the election of the far-right candidate Javie Milei (here). He defeated the center-left coalition candidate Sergio Massa and will lead the country for the next four years. It's crucial to note that Milei will need to form an alliance with other center-right members from Juntos por el Cambio to govern, as his party hasn't secured significant representation in the Congress. His newly appointed Minister of Economy will be Luis Caputo, the former Central Bank President during the government of Mauricio Macri.

The task of restoring Argentina to stability will be immense. Fiscal adjustment and restricting monetary emissions from the Central Bank of Argentina are imperative. Dollarization and the closure of the Central Bank have been ruled out by Milei's economic team. Renegotiating with the IMF will also be on the agenda, with conditions for the new deal expected to be more stringent, possibly involving a less gradual approach.

In terms of growth, we anticipate that 2024 will be an improvement over 2023. The likelihood of a repeat of the droughts in rural areas is low, and exports are expected to increase, supporting the Central Bank in its quest for US dollars. Additionally, the lower basis of comparison will contribute to our forecast of 1.4% growth in 2024, followed by 1.0% growth in 2025. Achieving a reduction in inflation will be challenging. We anticipate that the BCAR will maintain rates slightly positive, but inertia may prevent a significant decrease. Our inflation forecast is for CPI to end 2024 at 118% and then decrease to 90% in 2025.