Brazil GDP Review: No Contraction is Good News

Brazil's GDP pleasantly surprised, growing by 0.1% (q/q) in Q3, defying expectations of a -0.2% contraction. This resulted in a 2.4% YoY growth. Agriculture contracted by -3.3%, reflecting the end of strong Q1 harvests. Industries and Services sectors each grew by 0.6%, with noticeable sectoral variations. Family Consumption strengthened by 1.1%, supported by a robust labor market. Despite overall deceleration, the economy remains resilient, with forecasts expecting 3.2% growth in 2023 and 1.4% in 2024.

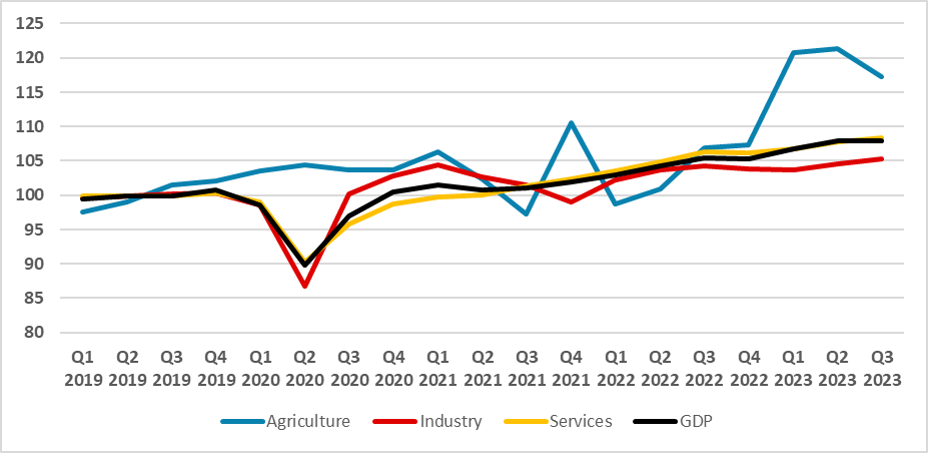

Figure 1: Brazil GDP by Sector (Seasonally adjusted, 2019 = 100)

Source: IBGE

The Brazilian National Institute of Statistics (IBGE) has released GDP data for the third quarter. The figures surprised on the upside as the GDP grew by 0.1% (q/q) during the quarter, while the market was expecting a -0.2% contraction according to the Bloomberg survey. Therefore, GDP has grown by 2.4% compared with the same quarter last year.

Agriculture contracted by -3.3% during the quarter as the effects of the strong harvest in the first quarter faded. Both the Industry and Services sectors grew by 0.6% during the quarter. Industry growth was propelled by Utilities, which grew by 3.6% (q/q), while Construction contracted by 3.3% (q/q). Manufacturing and Extractive Industry were more or less stable in the quarter, as both grew by 0.1% (q/q). Looking at the Services sector, Transports contracted by 0.9% (q/q), while Financing Activities and Communications both grew by 1.3%.

Turning to demand, what surprised most was the strength of Family Consumption, which grew by 1.1% in the month. Most of this growth was likely sustained by the strength of the labor market and mass salaries, aided by falling inflation numbers. Government Consumption grew by 0.5%. The bad news came from the Investment figures, which contracted by 6.6% in the quarter; the ratio of Investment over GDP reached 16.6% in the quarter. Exports grew by 10%, while Imports retracted by 6.6%.

The Brazilian economy has finally decelerated, but it is worth remembering that this deceleration came mostly from a contraction in the Agricultural sector, which could be a reflection that most of the harvests have ended. The Industrial and Services sectors have shown relative strength, while the strong numbers in Consumption point to a brighter picture. Whether the strength of the labor market will continue to sustain those levels of growth is yet to be seen. We believe job creation will decelerate in the upcoming quarter, consequently slowing down consumption growth.

IBGE has also reviewed past GDP numbers, which increased the growth seen during this year. We continue to see the Brazilian economy returning to its pre-pandemic trend in the next quarters. Lagged effects of monetary policy will still be felt. We forecast the Brazilian economy to have grown by 3.2% (y/y) in 2023 and 1.4% in 2024.