DM FX Outlook: Politics rears its head

· Bottom Line: The USD strength in Q2 on the back of a less dovish view of the Fed is unlikely to extend over the rest of the year. The JPY remains exceptionally cheap and has potential to recover sharply if risk appetite weakens. A slower JPY recovery is likely if lower inflation leads to lower interest rates in the US and Europe and equity markets remain well supported as a result.

· Concerns about European, and particularly French politics have emerged at the end of Q1, undermining the EUR in conjunction with the usual market skepticism about public finances in the Eurozone, following the S&P downgrade of French debt. But political uncertainty may not be USD positive in H2 as the US election approaches.

· Forecast changes: We have lowered our end 2024 EUR/USD forecast to 1.12 from 1.15 and raised our USD/JPY forecast for end 2024 to 140 from 135 to reflect the less dovish Fed stance.

Risks to our views: Political uncertainties relating to the French, UK and particularly the US election could have a bigger impact than expected, in either direction. Impact from such risks seems likely to be supportive for the safe haven currencies, particularly the JPY given the huge undervaluation. Sticky inflation could delay monetary easing longer than expected, maintaining short-term strength in higher yielders, but also potentially undermining risk sentiment, which could undermine risk sensitive currencies.

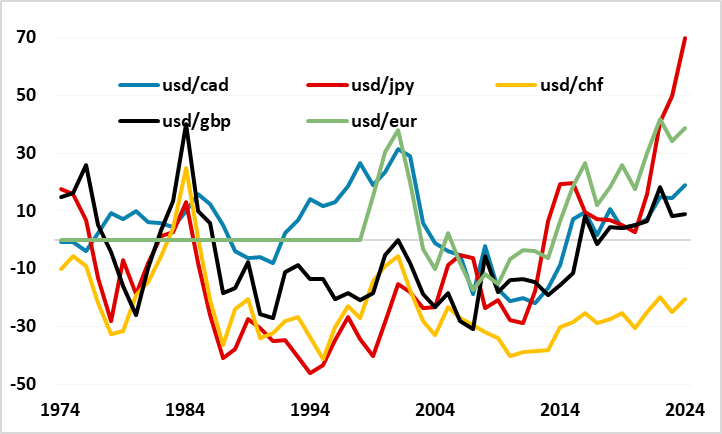

Figure 1: Percentage differences from PPP

Source: OECD

JPY weakness is at record extremes

While the USD has managed some general gains in the last quarter, and USD strength continues to be a theme, it is the general weakness of the JPY that remains the most notable feature of the FX market. As Figure 1 shows, the JPY is not only the weakest it has ever been relative to PPP, it is weaker than any of the major currencies have ever been, with USD/JPY trading nearly 70% above PPP. This is even more remarkable given the usual tendency of current account surplus currencies to trade at a premium to PPP. Indeed, this tendency is still being shown by the CHF, which is the only one of the major currencies currently trading above PPP against the USD.

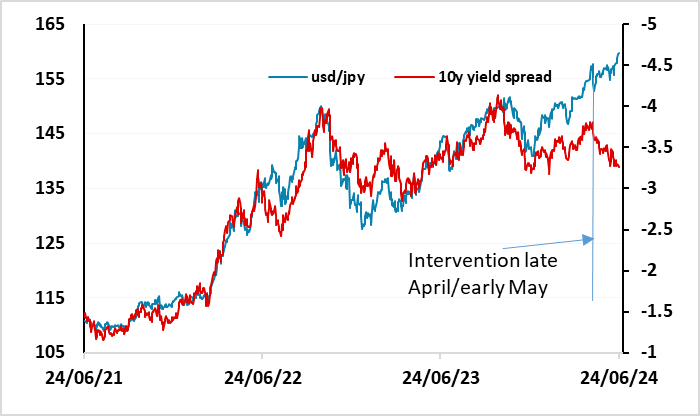

For most of the recent period of JPY weakness, the decline in the JPY was justified by the rise in yields being seen in the US and Europe. Until the end of 2023, the rise in USD/JPY was highly correlated with the rise in nominal yield spreads in favour of the USD. But this relationship has broken down this year, with yield spreads little changed but USD/JPY up around 15 figures from the start of the year. Until the BoJ intervention in late April/early May, there was at least still a positive correlation between yield spreads and USD/JPY, although USD/JPY was rising more sharply for any given rise in the spread. However, since the intervention, yield spreads have moved in the JPY’s favour but USD/JPY has resumed its rise – the correlation between yield spreads and USD/JPY has actually turned negative (see Figure2).

Figure 2: USD/JPY no longer tracking yield spreads

Source: Continuum Economics/Datastream

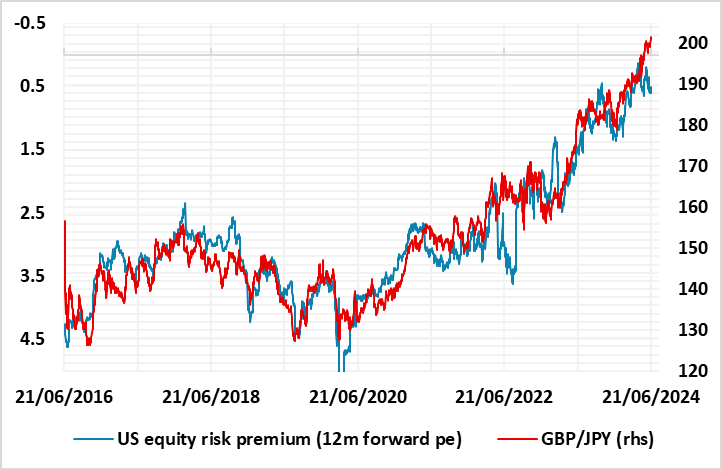

It’s hard to find a rationale for why this might be the case. There was certainly some disappointment that the BoJ left policy unchanged in June that helped trigger JPY weakness, but the BoJ had tightened in March without any significantly positive impact on the JPY. Even without BoJ tightening, yield spreads have narrowed, and the BoJ are suggesting there will be tightening in July. Until mid-May, there was still a strong negative correlation between JPY crosses (particularly EUR/JPY and GBP/JPY) and equity risk premia, and the continuing decline in equity risk premia had supported the new highs being made in JPY crosses. But risk premia have edged higher in recent weeks and JPY crosses have still continued to make new highs, with GBP/JPY and particularly CHF/JPY standing out. CHF/JPY gains to new all time highs are particularly hard to justify as there is no significant yield spread difference between the CHF and JPY, and both the CHF and JPY have historically shared safe haven characteristics, and yet CHF/JPY is more than 56% higher over the past 4 years. We can only conclude that JPY weakness is a bubble, and is currently being sustained by momentum trading and some carry trading rather than by any reference to fundamentals. Bubbles can expand for some time if they are left unchecked, but the BoJ are unlikely to allow further expansion. However, they may also be concerned at the prospect of rapid deflation of the bubble, as this could also cause deflation in Japan. So they are being cautious in their use of intervention. They want to stop JPY depreciation but don’t want too fast a JPY appreciation either. In practice, this is difficult road to tread. USD/JPY tends to go up the stairs and down the lift shaft, but as long as the global economy continues to show modest growth and global equities are consequently reasonably stable, a JPY recovery should be relatively slow.

Figure 3: GBP/JPY moving with equity risk premia

Source: Continuum Economics/Datastream

Politics rears its head

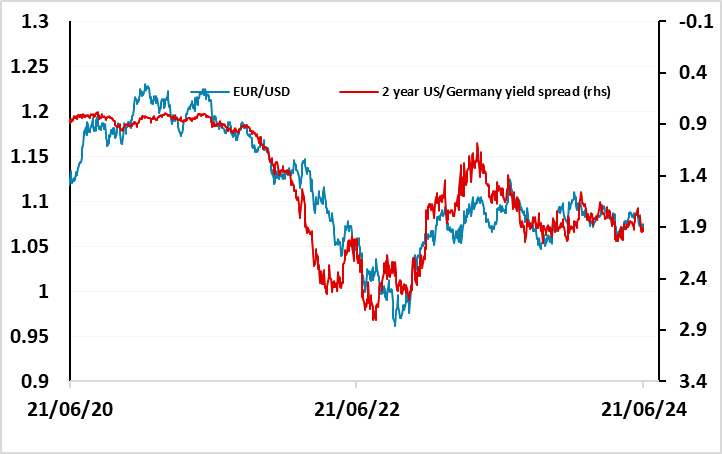

Outside USD/JPY things have been a lot calmer, with EUR/USD moving closely with 2 year yield spreads, but this may change in the second half of 2024 and into 2025. We have seen some EUR weakness emerge in response to the unexpected announcement of the French parliamentary election. The impact of this was greater due to the recent downgrading of France and concerns about the French fiscal position. Such concerns would increase if the left or right gain control of parliament, as both seem likely to want to increase spending rather than rein back the recent deficit expansion. The market has traditional concerns about the fiscal arrangements in the Eurozone due to the devolved nature of fiscal policy and the centralized control of monetary policy, and we may be set for a new bout of such jitters.

Figure 4: EUR/USD still tracking short term yield spreads

Source: Continuum Economics/Datastream

Even so, we still see some upside for the EUR over the rest of the year, as we suspect the European political concerns will be short-lived. The populists are unlikely to be able to gain effective control of parliament in France, and we see some scope for US yields to fall more at the short end than yields in the Eurozone. At the same time, the US election will start to impinge on the market’s thoughts, and this could lead to some questioning of the current strength of the USD, especially if the economy is starting to show signs of slowdown as seems likely. While we don’t anticipate major changes in fiscal policy whoever wins the US election, the election should be a reminder that the US fiscal position is not particularly healthy. While we don’t expect any fiscal tightening, there is also little scope for further easing if the economy turns lower. Neither presidential option seems likely to boost confidence in the USD, especially since the problem of the debt limit can be expected to return and remain intractable with a divided government. A reversion to more historically normal USD values is possible if we see some convergence between US growth and growth in Europe.

GBP may benefit modestly from the UK election

GBP has edged up against the EUR in recent weeks as concerns around the French political situation have growth and the ECB have cut rates, while the BoE have remained on hold. We expect GBP will fall back in the next couple of months as the concerns around French politics fade and the market starts to price in more BoE easing. As it stands, the market is pricing a less than 50% chance of BoE easing in August, and just two cuts this year, while we see scope for three. But EUR/GBP is already trading softer than might be expected given current yield spreads and rate expectations, so the French political situation is probably going to be the bigger issue in the near term.

Further out, we do see some better prospects for GBP if, as seems highly likely, Labour win a comfortable majority in the July 4 general election. While a Labour government is not traditionally seen as positive for GBP, the markets currently favour a Labour victory, largely because it offers a better prospect of a closer relationship with the EU. On top of this, and connected to it, there is some prospect of improved UK investment in response to Labour’s promised reforms, notably to housing regulation. GBP/USD has appeared to be incorporating a risk premium through the latter years of the Conservative administration, and there is some possibility of this being reduced under Labour. However, we would expect any such improvement in GBP/USD to be largely matched in EUR/USD, so the risks for EUR/GBP should remain mainly on the upside.

Figure 5 : Some risk premium in GBP/USD?

Source: Continuum Economics/Datastream

Limited upside for EUR/CHF

The CHF weakened for the first 5 months of the year but has recovered in June on the back if the ECB easing, the deterioration in sentiment around French and European politics, and the S&P downgrade of France. The resultant widening of France/Germany spreads is typically correlated with a lower EUR/CHF. However, EUR/CHF has found some support below 0.95 helped by a rate cut from the SNB and comments at the latest press conference making it clear that the SNB remain prepared to intervene in the FX market to prevent further CHF strength.

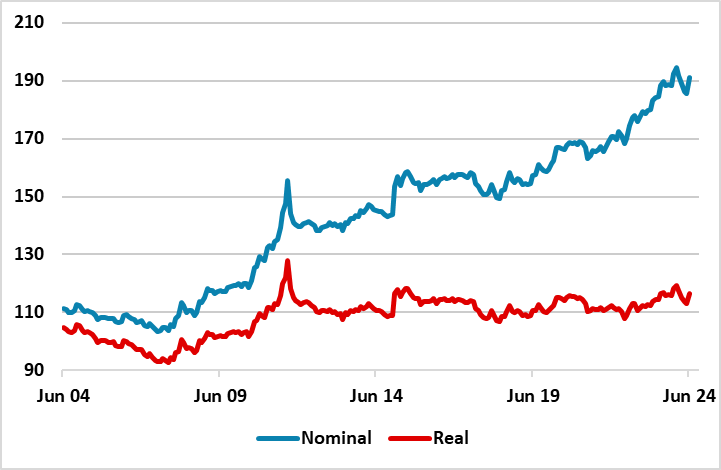

Over the next year or two we would expect to see a moderate recovery in the Eurozone and major concerns about French debt and wider intra-Eurozone spreads to fade[M1] , and this should allow a mild upside bias in EUR/CHF. But while EUR/CHF looks low in nominal terms, trading close to all time lows (ex the 2015 spike), it is still in the range seen over the last 10 years in real terms. There is also likely to be more ECB easing over the next couple of years than easing from the SNB, limiting the upside pressure. So while there is scope for a test back to parity in a more positive economic environment, gains beyond there are likely to be hard to sustain.

Figure 6: CHF effective exchange rates

Source: Continuum Economics/Datastream