USD Reserve Status: Slow Slippage

Latest IMF COFER data shows that the USD reserve status is not slipping away quickly, but only slowly. Two themes to watch in 2024 is the pace of China’s ongoing switch from U.S. Treasuries to other assets including gold and also G7 ideas of confiscating Russian FX reserves.

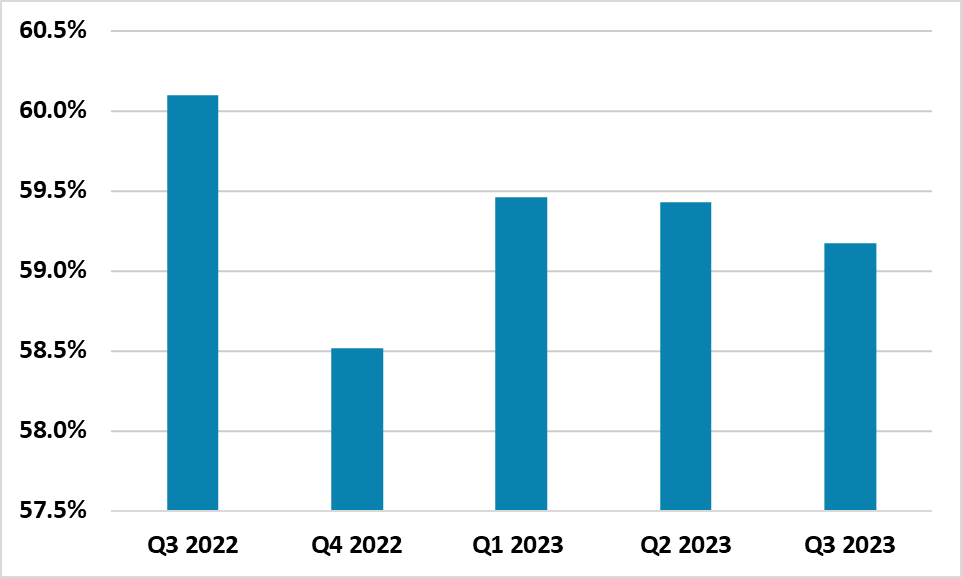

Figure 1: Pct of USD in Allocated FX Reserves

Source: IMF COFER/Continuum Economics

The latest IMF COFER data (here) shows that the USD still remain the dominant currency among central banks, with the Euro in 2nd place at 19.6% followed by the Japanese Yen and British Pound. The Chinese Yuan is a mere 2.6% and the absolute holdings of Yuan have fallen by USD20bln to USD260bln over the last 12 months. While this is partially the small depreciation of the Yuan versus the USD, global reserve managers are not substantively switch into Yuan or away from USD’s.

Is fear of the USD reserve currency demise overdone? Yes in the timescale of months, but on a multi-year basis a drift away from the USD can be evident. The freezing of Russia FX reserves after the Ukraine war has prompted some central banks to diversify reserves away from USD. However, most FX alternatives are Western currencies and the Chinese Yuan is not internationalized or trust enough by other governments. Instead, gold has been a beneficiary, with persistent central bank buying through 2023 led by the PBOC. China is well aware that any invasion of Taiwan would likely led to a similar freezing of China FX reserves.

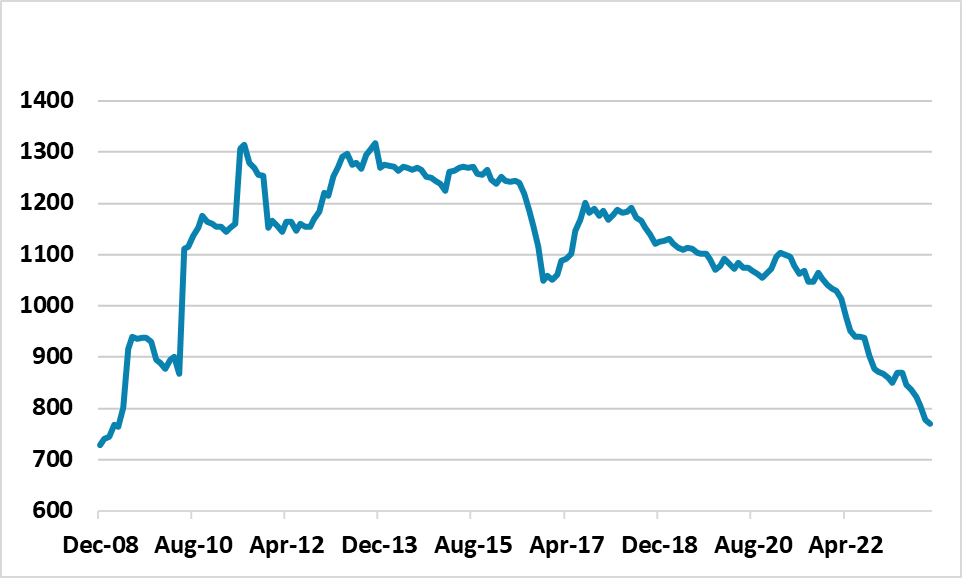

This has come alongside a USD97.5bln decline in China holdings of U.S. Treasuries from U.S. Treasury data (Figure 2). However, the pace of USD selling and gold buying by China is slow and persistent, rather than rapid and aggressive. This could be that China authorities themselves do not see a serious prospect of an invasion in the coming years.

Figure 2: China Holdings of U.S. Treasuries (USD blns)

Source: Datastream/Continuum Economics

While this is all at a slow pace, one issue for 2024 is the idea of confiscating part of the $300bln of Russian FX reserves for Ukraine reconstruction. If the G7 decide to act in this direction, it would likely cause some EM central banks to accelerate diversification away from the USD. Additionally, it could also led to more financial and political fragmentation from the West, as confiscating assets is one step further than freezing assets.