EZ HICP Review (Mar 3): Headline Edges Lower With Friendlier Services Messages?

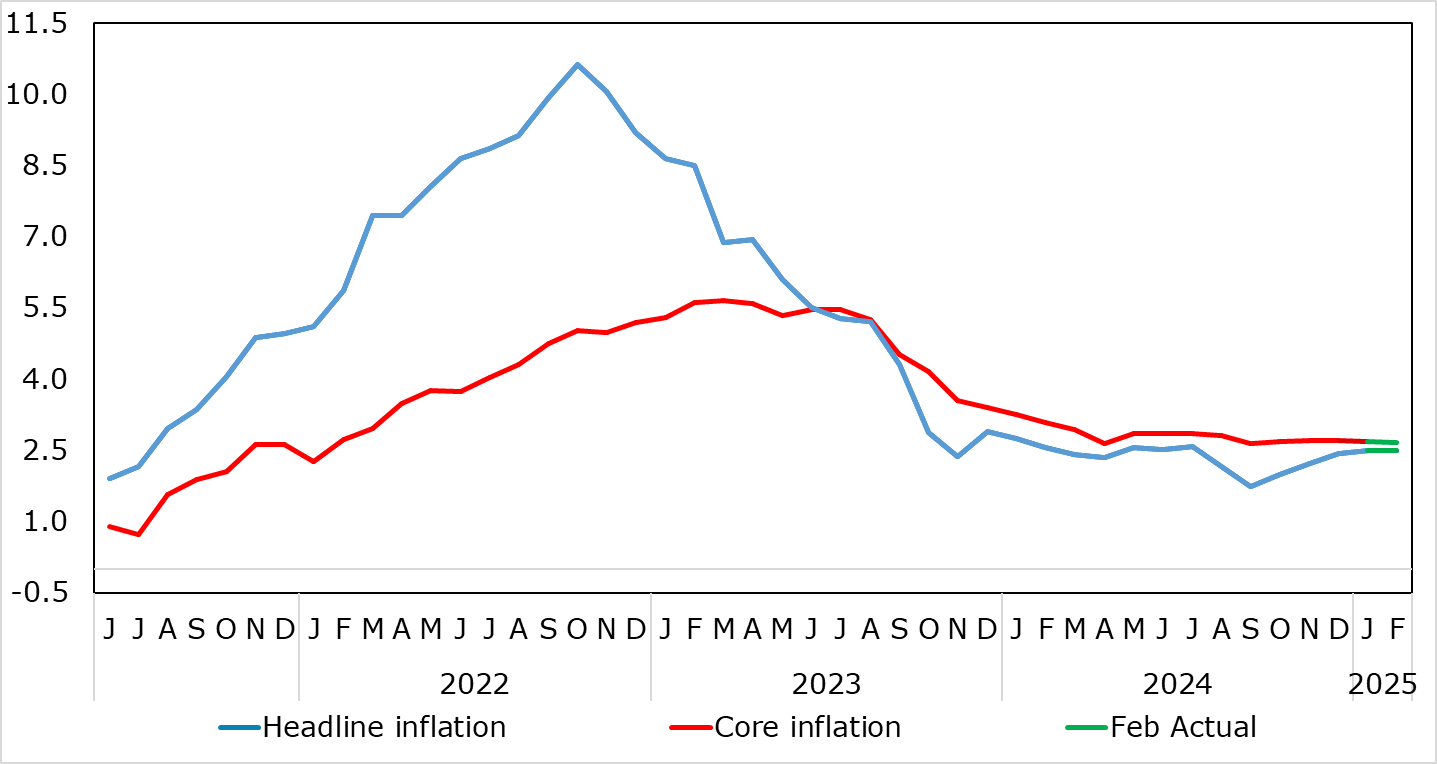

February HICP inflation numbers may did deliver better news and broadly but only marginally so (Figure 1) with the headline dropping 0.1 ppt to a higher-than-expected 2.4%. This ended a run of three successive rises and came about despite a rise in food inflation. Instead, the core also eased’ 0.1ppt from January’s six-month high of 2.5%. Most notable, however, was an easing in what had previously been seemingly relatively stable services inflation, down 0.2 ppt to a 22-mth low of 3.7%. The softer core and services messages have been flagged by shorter-term price momentum data and persistent price gauges which already suggest that core and even services inflation have slowed and are running around target. The data surely cement the case for a further ECB rate cut this Thursday but will do little to heal the growing policy divides between the more vocal hawks and the long-lasting doves.

Figure 1: Headline Slips Back as Services Resilience Starts to Crack

Source: Eurostat, CE, ECB