China: More U.S. Tariffs, No Yuan Depreciation?

• China is currently reluctant to see Yuan depreciation as it wants to get the U.S. to the negotiating table for a revised phase 1 trade deal and also over concerns about domestic capital outflows. Cuts to the 7-day reverse repo rate are now likely to be in 10bps steps and we look for the next move between March and May. Economic stimulus will come with fiscal policy, with details likely with the National People’s Congress starting March 5.

The U.S. has announced some investment curbs on China over the weekend, but still no Yuan depreciation or rate cuts has been seen. What are China policymakers next moves?

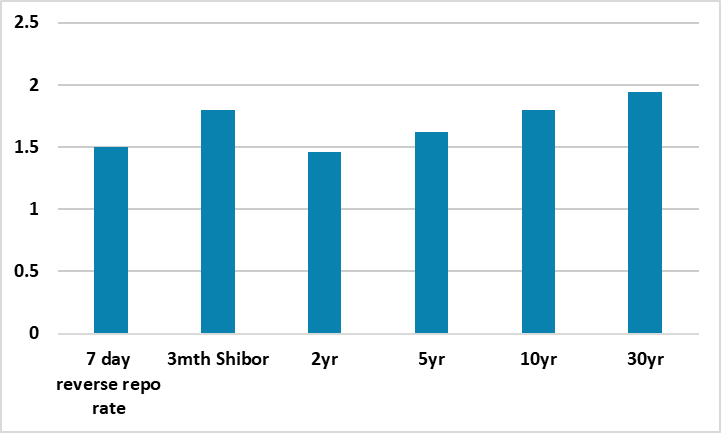

Figure 1: China Yield Curve (%)

Source: Datastream/Continuum Economics

The U.S. announced more curbs on China investment in U.S. tech/energy over the weekend (here), as the U.S. keeps up pressure on China. However, China has not followed the 2018 playbook in recent months and allowed the Yuan to depreciate. Is this a question of tactics or level of the Yuan. Some point to the Yuan starting point being weaker than 2018, when USDCNY was at 6.2. We feel China authorities are more concerned about two other considerations in stabilizing the Yuan at the moment.

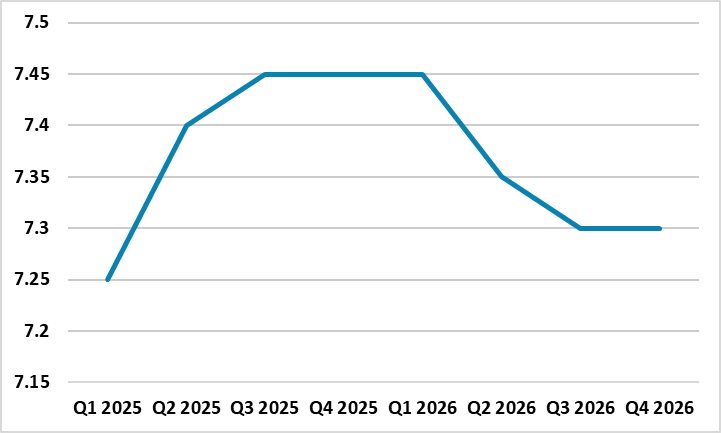

• Desire to get U.S. to the negotiating table. A Yuan depreciation now would likely prompt the Trump administration to threaten yet more tariffs and trade war escalation. This is the opposite of Beijing desire to quickly get the U.S. to the negotiating table and revise the phase 1 agreement with the U.S. China discussions with U.S. Treasury secretary Bessant on February 21 showed that the U.S. is still sizing up next steps with China, though President Trump has hinted that a new trade deal is possible. We feel that the U.S. will likely want to announce reciprocal and product tariffs in April before being willing to go to the negotiating table into the summer. This could mean that China’s authorities are reluctant to allow the Yuan to depreciate in the next few months. Some depreciation of the Yuan into mid-year is still likely to around 7.40-45 on USDCNY, especially as a 10bps cut from the PBOC to the 7-day reverse repo rate is likely between March and May – a 20bps cut are now less likely. However, the risk of a move to 7.75 is now lower probability provided that China and the U.S. start negotiations.

• Fear of capital outflows. China authorities are sensitive to domestic capital outflows, as it could led to protests about the economy and against the CCP. Current interest rate differentials versus the U.S. are large enough to weaken the Yuan. However, the authorities have kept money market relatively tighten to stop downward pressure and that why 3mth Shibor is well above the bond curve (Figure 1). Slow Yuan depreciation at the appropriate time is still feasible, as the real concern is that a quick Yuan decline trigger domestic capital outflows.

Figure 2: USD/CNY Forecasts

Source: Continuum Economics