China: Private Sector Balance Sheet Recession?

Overall, we maintain the view that parts of China’s household sector are showing signs of a balance sheet debt consolidation, due to the excess buildup of debt in the past 20 years relative to disposable income. The non-financial corporate sector is more difficult to interpret, due to strength for SOE/high tech manufacturing and private sector confidence being less impacted than consumers. Fiscal policy is favored in this environment, as interest rate cuts alone risk being ineffective for sections of the household sector.

Does China show signs of a private sector balance sheet recession after years of excessive debt growth? What does it mean for policy?

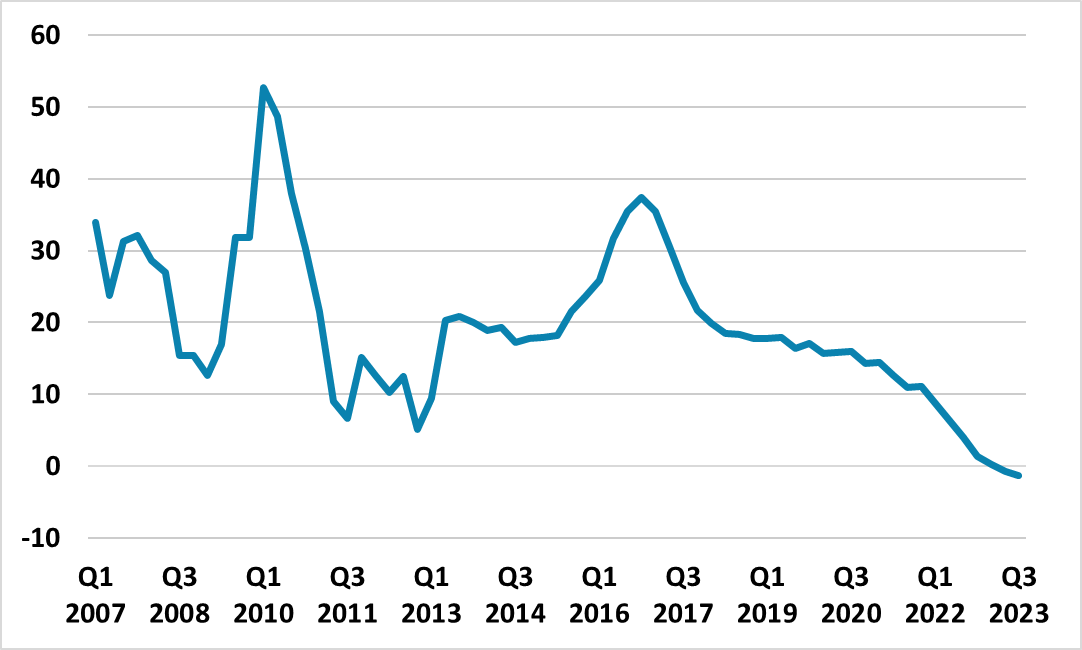

Figure 1: China Mortgage Lending (%)

Source: Datastream/Continuum Economics

Sluggish China retail sales are a familiar feature of China monthly deluge of economic data, with production outstripping demand and causing disinflation for CPI and a run of negative numbers for the GDP deflator. One structural headwind for China’s consumer is the downturn in the property market. The excess of complete and uncomplete residential property has caused a 70% slump in construction activity for new residential property compared to 2021. This has then adversely impacted employment in construction and related industries and bonuses and pay. The housing hangover is so large that it will be towards the end of the decade before house sales versus new construction finds a proper bottom.

The 2 impact is that the housing overhang is causing a decline in residential property prices that will likely not find a bottom until 2027-28, as tier 1 and 2 house price/income ratios still remain excessive. The combination of property construction slump and lower house prices has prompted a significant shift lower in mortgage lending to the point that lending is now being repaid on a net basis (Figure 1). This is a sign of distress for some consumers.

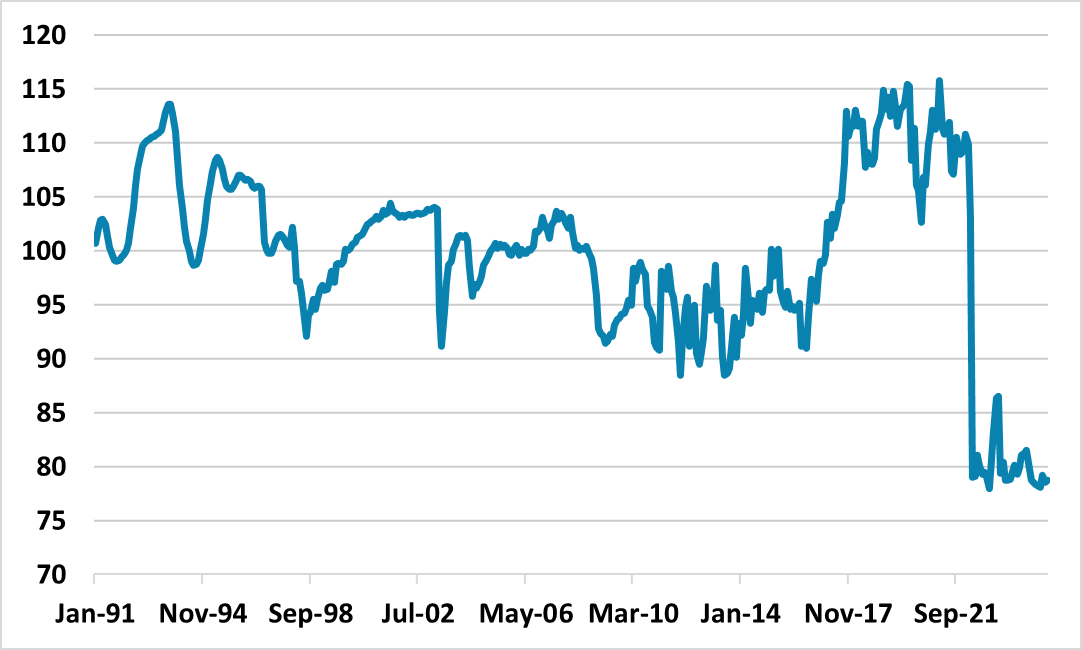

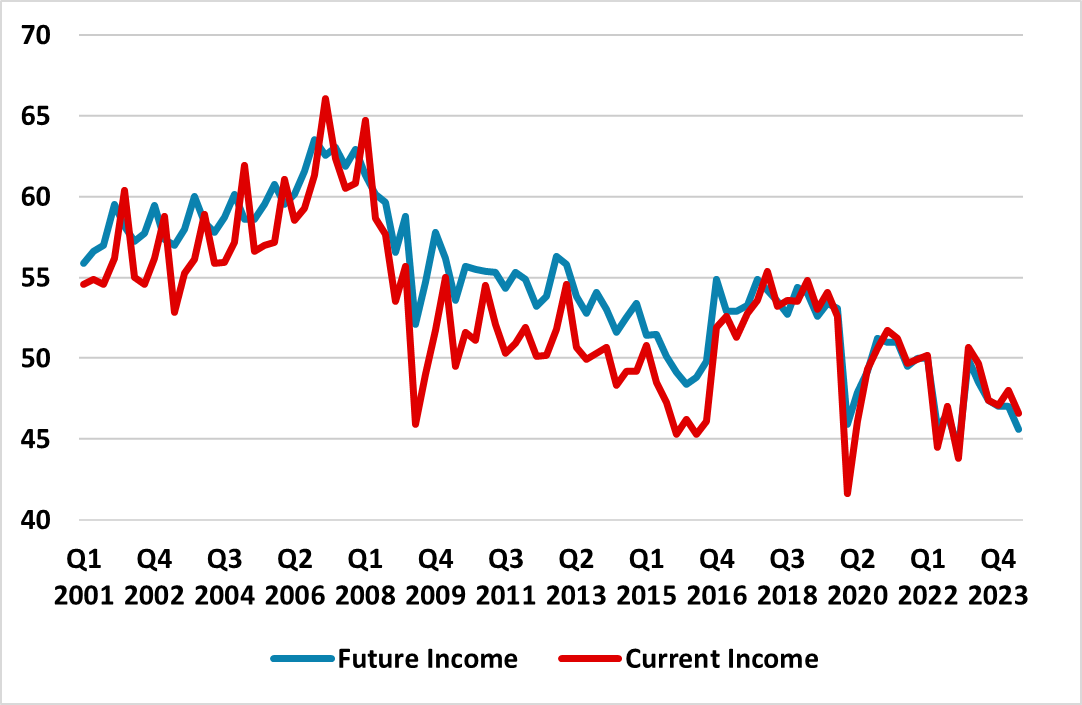

Consumer sentiment is also poor. The late days of the zero COVID policy and since the reopening have seen a sharp decline in NBS consumer sentiment (Figure 2). No doubts part of this is declining housing wealth, which is the main asset for the Household sector. However, current and expected income prospects have been weak in the past few years (Figure 3). The explanation for this is that private sector employment growth has slowed and wage growth has been squeezed. This is not just a story for the construction sector, but also reflects a shift of attitude towards private sector business compared to the boom years of 1990-2019. President Xi is focused on targeted production sectors rather than allowing enterprenuers free rein and this has tempered private sector employment and investment growth.

Figure 2: NBS Consumer Confidence (2000 q1 = 100)

Source: Datastream/Continuum Economics

Figure 3: NBS Consumer Confidence (2000 q1 = 100)

Source: Datastream/Continuum Economics

Meanwhile, high household savings have been a structural feature of China’s economy due to weak government safety nets for health, unemployment and pensions. Significant structural reform would help to reduce precautionary savings and help provide a boost for consumption, but this still does not appear to be a priority with the authorities more focused on infrastructure spending and high-tech production.

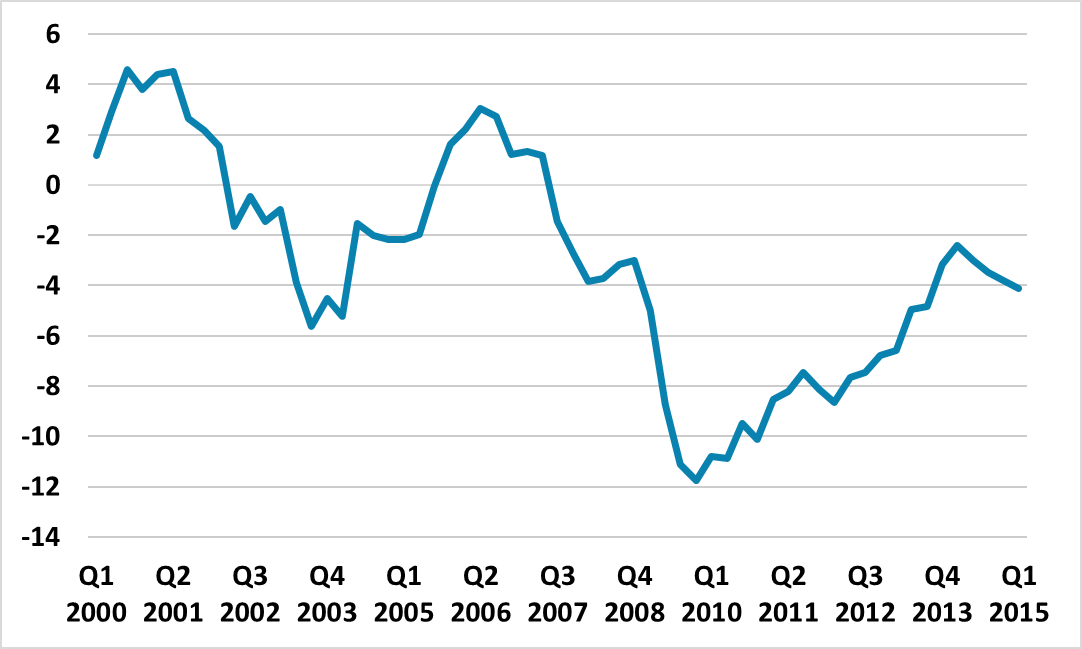

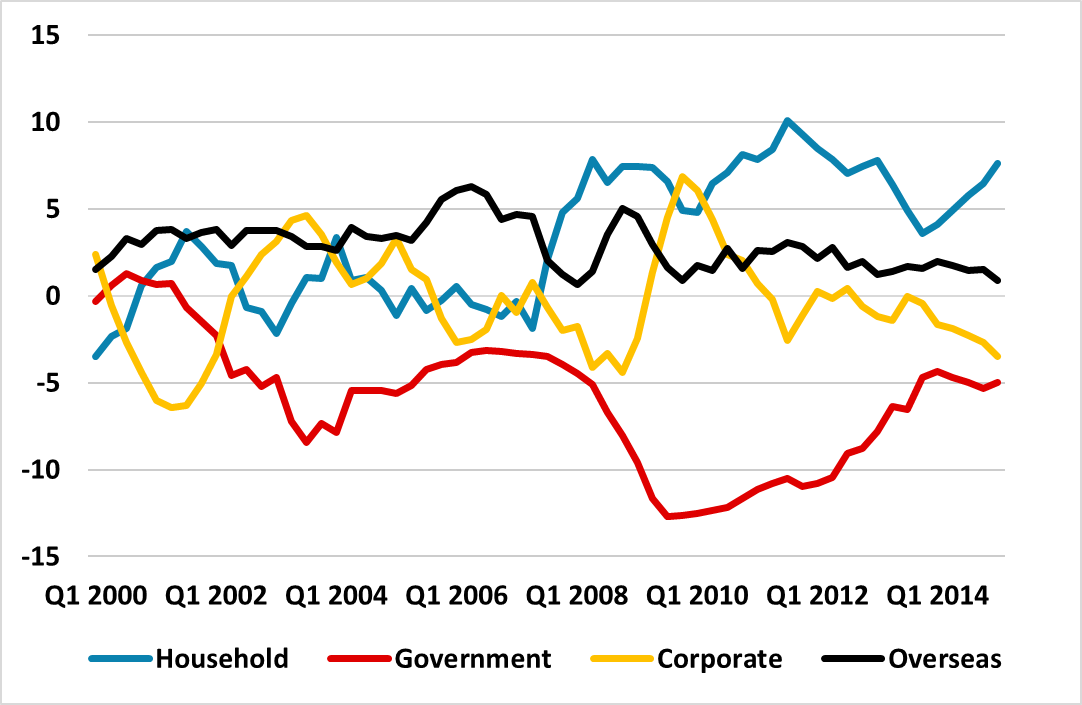

China data has lot of missing parts and so any assessment has to be partial rather than full. However, we do have data for the government and current account to GDP, whereby a larger deficit for government and overseas would be accompanied by a larger surplus for households and non-financial corporates. By way of illustration Figure 4 shows this balance for the U.S. economy after the 2007-08 global financial crisis with a very large swing into deficit. The Federal Reserve sectoral balance data in Figure 5 shows that this was prompted by a persistent shift in the Household sector into surplus, as consumer suffered a balance sheet recession and switched to not taking on more debt.

Figure 4: U.S. Government + Overseas Sectoral Balance (% of Nominal GDP)

Source: Datastream/Continuum Economics

Figure 5: U.S. Sectoral Balances (% of GDP)

Source: Datastream/Continuum Economics

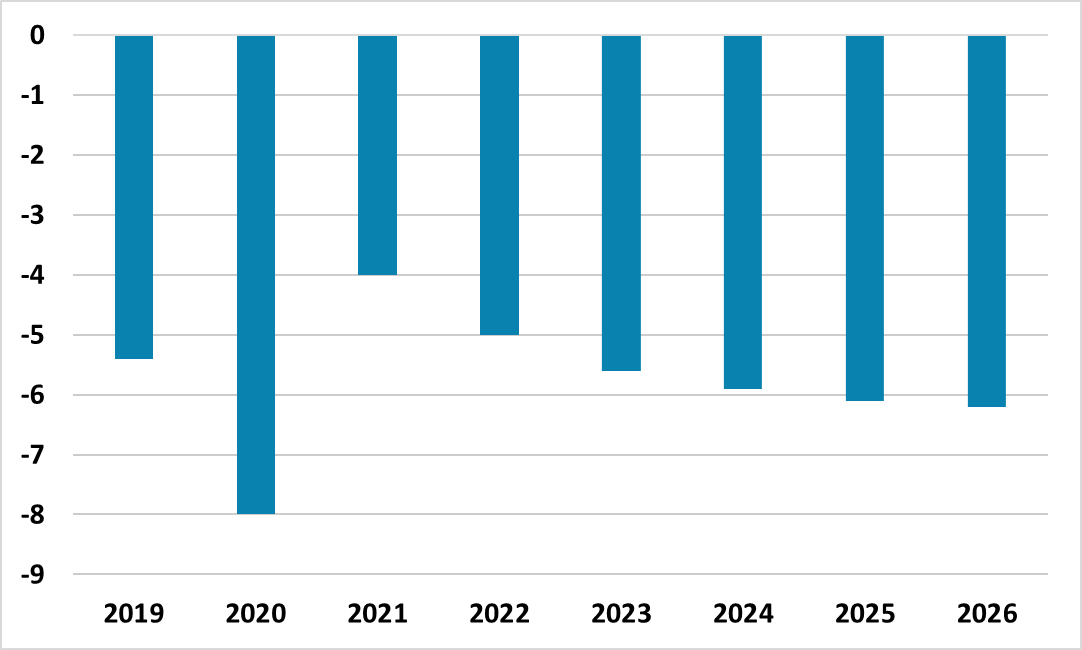

We do not have sectoral balances for China, but we do have government deficit and current account data. Using the IMF measure of the China General Government budget deficit from the Article IV August 2024 report (official estimates are too narrow), Figure 6 shows a sharp widening in 2020 when initial COVID lockdowns caused a swing to a larger household surplus. After revenge spending post COVID, the combined government and overseas balance has become larger again, which suggests that the household and non-financial sectors have a larger surplus and this could be a sign of balance sheet recession forces.

Figure 6: China Government and Overseas Balance (% of Nominal GDP)

Source: IMF Article IV Aug 2024/Continuum Economics

Overall, we maintain the view that parts of the household sector are showing signs of a balance sheet debt consolidation (this could turn into a balance sheet recession still that more significantly adversely impact consumption growth), due to the excess build up of debt in the past 20 years relative to disposable income. The non-financial corporate sector is more difficult. Firstly, it includes SOE’s that have seen better business investment momentum in recent years than the private sector. Secondly, sections of the private sector are doing well e.g. high tech manufacturing and the sectors championed by the Made in China 2025 policy. It is certainly the case that noticeable sections of private industry do not have the spark of 1990-2019, but the evidence is not clear enough that this is solely due to excess debt versus poor sentiment.

In terms of policy, boosting demand in China economy is best done by fiscal policy stimulation. We do see a package of stimulative fiscal policy measures for 2025 including Yuan1-3trn infrastructure spending; Yuan1trn funds to buy completed homes for affordable housing and Yuan1trn capital injection to the big six state banks. The total size of new measures that will likely be announced in H1 2025 are Yuan3-5trn. If this is not delivered then the economy will likely falter. In contrast, reducing the price of money via 7-day reverse repo rate cuts is ineffective for those segments of the economy that are focused on balance sheet clean up. Increasing lending and money supply growth would be helpful and the Fed and BOE post GFC launched liquidity programs to encourage lending. China moral suasion in the past has been successful in boosting the quantity of lending, but the PBOC does not appears to be placing greater emphasis on this currently – M2 is currently at a low 7.3% by China standards.