UK Markets After The Election: Will Labour Push for Growth Slowly or Quickly?

It is uncertain whether an incoming Labour government in the UK would slowly or quickly take action to boost trend growth and this is the most important question for post-election sentiment towards UK assets. For the Gilt market, the key is that the BOE actually starts cutting rates and that the 1 Labour budget likely by the autumn is consistent with some sensible fiscal rules. For UK equities, optimism on the long-term view, plus lower policy rates can push up the forward price earnings ratio and help the UK equity market to modestly outperform the U.S. in the coming 6-12 months.

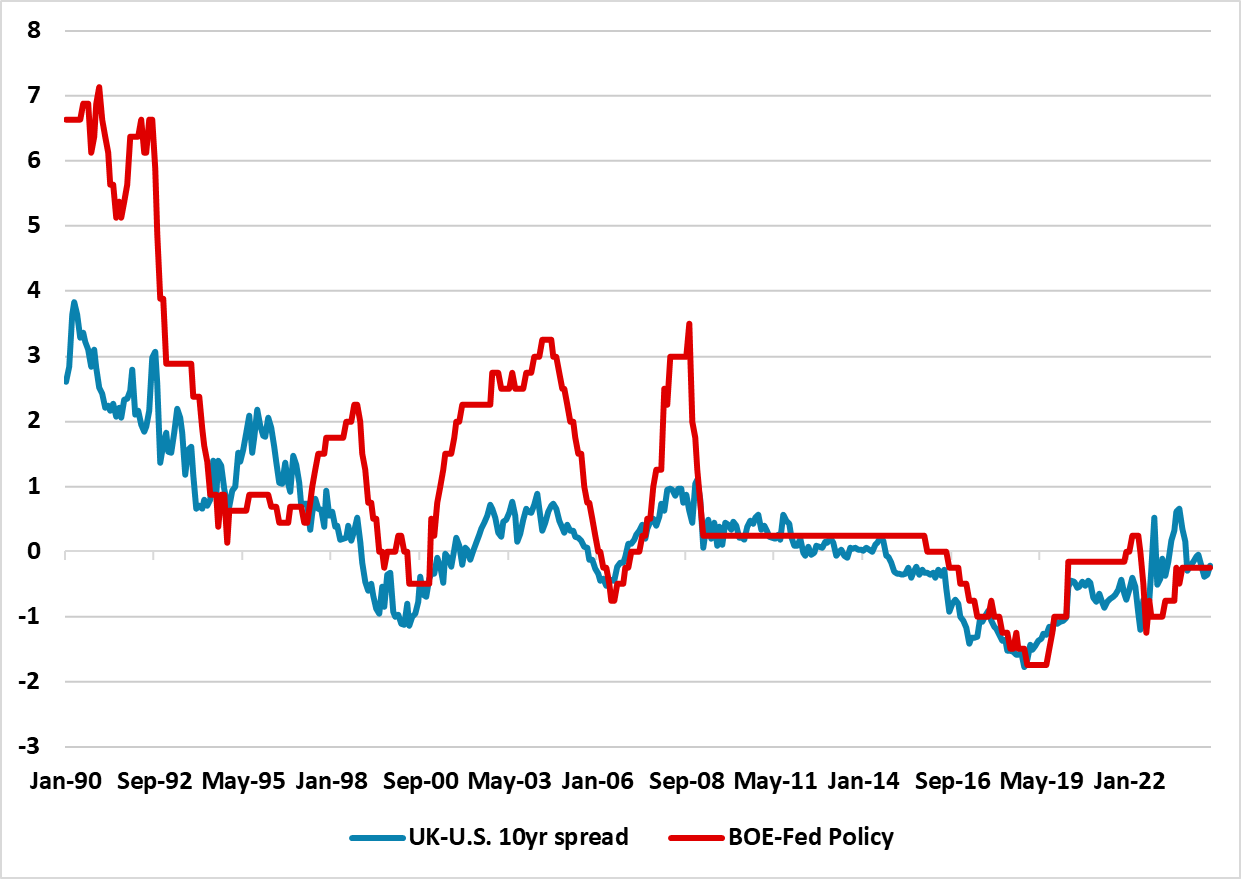

Figure 1: BOE-Fed Policy Rate Spread and 10yr UK-U.S. Government Bond Yield (%)

Source: Datastream/Continuum Economics

Our clients around the world are asking whether a Labour government would be a game changer for the UK and UK assets. Expectations are high for a sizeable Labour majority on July 4, which contrasts with the prospect of prolonged political instability in France after the 2 round of parliamentary elections on July 7 and elsewhere in Europe a shaky German coalition. The U.S. also faces an uncertain environment after the November election. We see fiscal stress either as a reelected Joe Biden faces strong Republican opposition over raising the debt ceiling or alternatively Donald Trump seeks to make permanent the part of the 2017 tax cuts that are due to lapse in 2025. The UK could look like an island of stability. If Labour achieve 450-499 seats it would fuel talk of 10 years of a Labour government, as speculation would start that a 2029 general election would be too soon for the Conservatives to rebuild. Anything in the 375-435 seats range for Labour would still be fine for global markets.

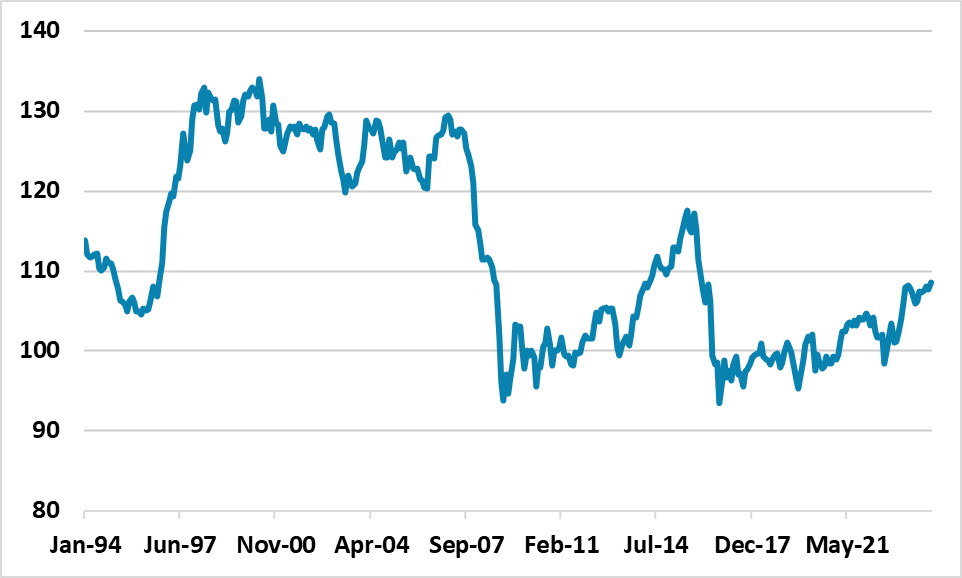

While the prospect of a stable (and not divided) government for at least the next 5 years is helpful, the most important question is how quickly or slowly action is taken to improve the economy. Initially, the focus will likely switch to the Bank of England and the August 1 MPC meeting, where we see a 25bps cut (here). One question we have been asked is whether a delay in Fed easing would restrain further BOE cuts in 2024/25. Our view is no. BOE policy is driven by UK forces with a different economic growth position and easy fiscal policy in the U.S. in contrast to fiscal tightening in the UK caused by the lack of income tax indexation. Additionally, the GBP real exchange rate is now well above the 2015 lows (Figure 2) and the exchange rate is unlikely to be a constraint, while we also see two further ECB rate cuts in H2 2024 – our view is also that the Fed will actually start cutting from September. We still see a cumulative 175bps of BOE cuts by end 2025 – for more see our June Outlook (here).

Figure 2: GBP Real Broad Exchange Rate

Source: Datastream/Continuum Economics

The September/October Labour budget will be watched closely and whether Labour take slow or quick action to boost growth. This is uncertain and is a question of politics. The options are

· Slow action. Independent fiscal analysis (e.g. IFS) argues that a £30bln shortfall exists even given unrealistically tight expenditure assumptions in future years and that this shortfall will likely have to be made up mainly from additional tax measures beyond those specified in Labour’s manifesto or alternatively a change from the current fiscal rule definition – public sector net debt ex BOE. The left leaning Resolution foundation notes that the public sector net debt including BOE would reduce some of the potential shortfall. There are alternative fiscal barometers a Labour Chancellor could credibly adopt such as public sector net financial liabilities or public sector net worth which provide wider measures of the government balance sheet. These measures as they both peak in 2024-25 and then fall through to the forecast horizon would provide a great deal of added fiscal headway. Medium to long-term growth measures could then be announced with the budget and afterwards to be implement in the coming years. Keir Starmer and Rachel Reeves have been careful, which could argue for this type of slow cautious action.

· Better EU relations – slow progress. The relationship will improve with the EU, but growth game changers are unlikely. Labour are focused first on a veterinary deal and a Europe wide security deal, with some reports of a focus on chemicals deal. Customs union, single market entry or an 18-30yr old 4 year visa deal would be growth game changers, but appear unlikely in the first two years of a Labour government.

· Quick momentum. An alternative view is that a Labour government with a large majority could be quick to start the process of boosting trend growth. This could come through; a more pro-active industrial strategy; attempts to boost labour participation and thus the employment rate; extra housebuilding momentum (via a material change in planning laws); getting Great British Energy off to a fast start and get private sector funding commitments quickly for the 10yr infrastructure plan. This would not change the 2024 and 2025 UK GDP outlook materially, but would open up a debate on 2026-28 GDP prospects and beyond. However, this is unlikely to get the OBR to lift its already relatively optimistic GDP forecasts for 2026-28 (which average just under 2% per year) and help reduce the fiscal shortfall, both given the OBR desire to see concrete policy action impacting growth and as the OBR already have high growth forecasts.

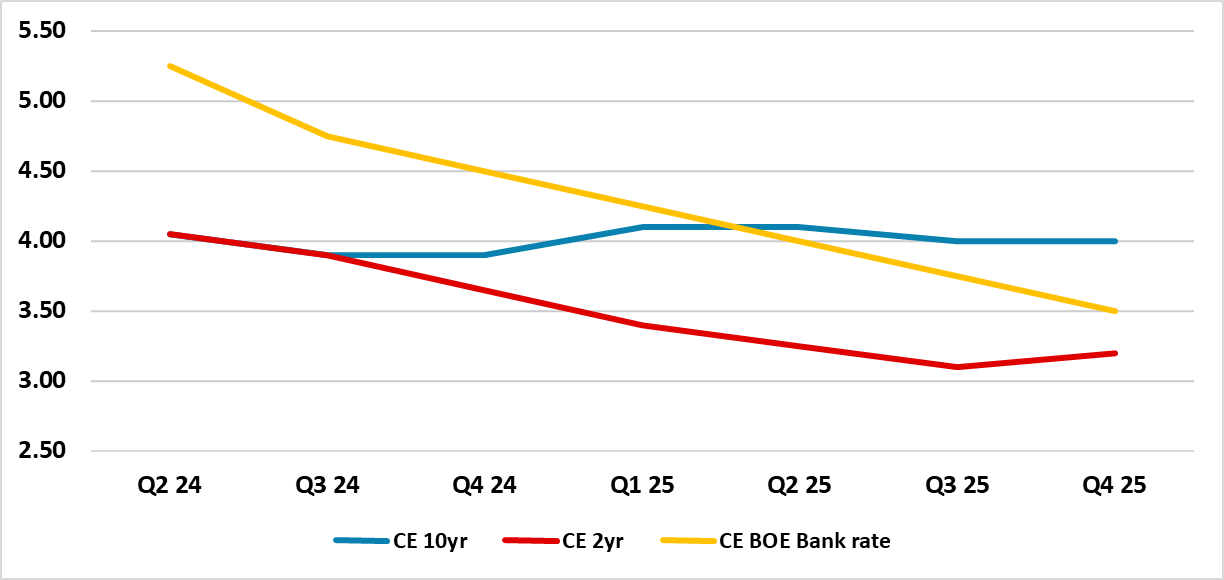

We will watch carefully in the coming weeks to see, which of these paths will be followed by a Labour government. For the Gilt market, a switch of fiscal rule definition is unlikely to be an issue and the key is a Labour commitment to a fiscal rule and independent OBR review after the 2022 Truss government debacle. We do see 10yr Gilt yields coming down to 4.0% by end 2024 helped by cumulative BOE easing and further disinflation from restrictive monetary policy. However, further yield decline will be slow given ongoing BOE quantitative tightening and we prefer the short-end of the gilt curve – we look for 2yr yields at 3.65% end 2024 and 3.2% end 2025 (Figure 3) – for more details see our June Outlook (here).

Figure 3: BOE, 2yr and 10yr Government Bond Yield Forecasts (%)

Source: Continuum Economics

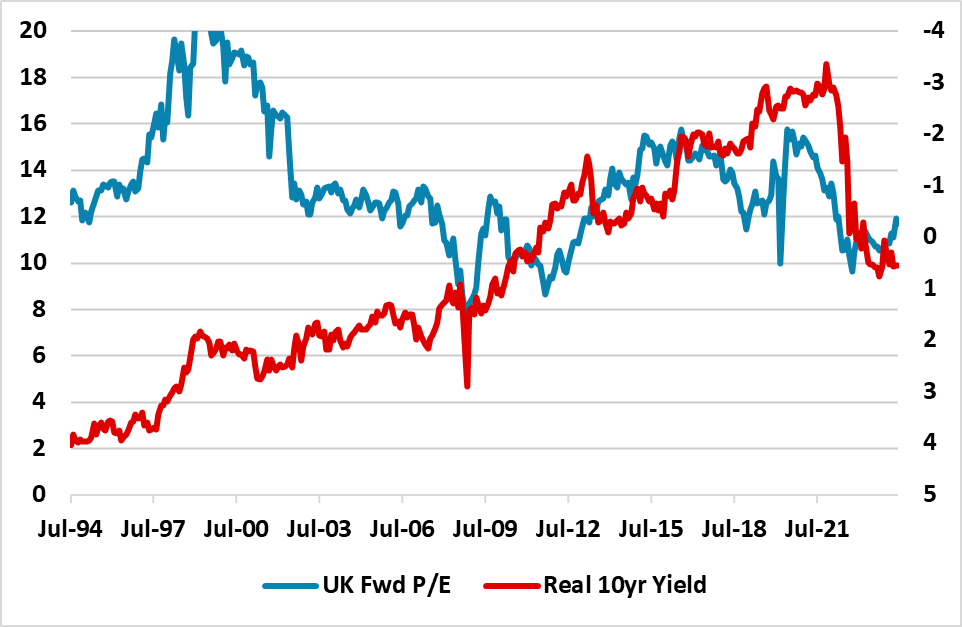

What about UK equities? The UK equity market is more forward looking than Sterling or the Gilt market and could focus on the prospect that 2026-28 growth and hence corporate earnings could be revised upwards. This will certainly help sentiment. However, 2024 and 2025 corporate earnings will likely not be revised significantly, but we do see a rise in the 12 month forward price/earnings (P/E) ratio and this can see the UK outperforming the U.S. in the next 6-12 months. The bulls would argue that the UK P/E ratio is low by historical standards and a swing to optimism could prompt a noticeable rise in the P/E ratio and hence the UK equity market. However, we would be more cautious as the forward P/E ratio is linked to the inverse of the 10yr real gilt yield using breakeven inflation rates (Figure 4). 10yr real gilt yields are now modestly positive and are unlikely to return to the noticeable negative real yields that existed between 2011 and 2021. Fiscal trajectories and QT likely mean the need for a positive real 10yr Gilt yield, while G10 inflation in the remainder of the decade will remains higher than the post GFC period due to de-globalization and the energy transition.

Figure 4: UK Equity Market Forward Price/Earnings Ratio (LHS) and 10yr Real Gilt Yield Inverted (%)

Source: Continuum Economics

We see the UK equity market (MSCI UK) outperforming the S&P500 by 5% by end 2024 and an additional 2.5 to 5% by end 2025. In the U.S. equity market we are looking for a small decline in H2 2024, as the market is overvalued and a growth slowdown and post-election U.S. fiscal uncertainties impact sentiment.