BoE Review: MPC Splits Enlarge to Suggest Cut Soon

As widely Bank Rate was kept at 5.25% for the seventh successive MPC meeting this month, with its rhetoric largely unchanged. But while there were still only two formal dissents, the minutes clearly suggested that for some of the remaining seven members the policy decision at this meeting was finely balanced. Indeed, for them, despite a real economy backdrop that the BoE sees another strong GDP outcome this quarter, upside news in services price inflation relative to the May Report did not alter significantly the disinflationary trajectory that the economy was on. This implies this group (which may be as large a four) could swing to an actual cut in August not least as updated forecasts due then may add to the disinflation ‘story’. The important thing is that even with a few cuts in the next six months, policy would still be clearly restrictive and the MPC has to consider ‘for how long Bank Rate should be maintained at its current level’. We see up to three 25 bp cuts this year and around four such moves next year not least against a backdrop where the disinflation to date has been largely supply driven and where weak demand factors have yet to anything fully filter through.

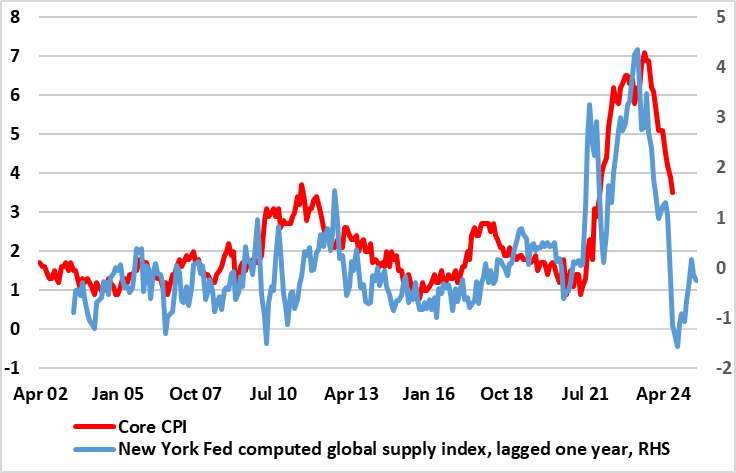

Figure 1: UK Disinflation – So Far Supply Driven?

Source: ONS, New York Fed Global Supply Chain Pressure Index

It is clear that real activity data are not having a material impact on MPC thinking regarding hoe durable and sizeable is the disinflation process. We are puzzled as why the BoE revised up its Q2 GDP outlook so markedly, especially against a backdrop where labor market developments (especially jobs) suggest a much weaker, if not weakening backdrop, not least domestically. Regardless, the BoE will probably agree with us that much of the recent (and possibly looming) disinflation is supply driven (Figure 1 shows the extent to which easing global supply pressures as computed by the New York Fed has probably driven UK underlying inflation). This means that even with some reduction in the excess supply picture evident in the May Monetary Policy Report (of 1% of GDP into 2027), domestic price pressures should add to this easing in supply strains – hence the clearly below target inflation outlook the BoE is likely to adhere to in August.

In addition, two key MPC recent reassessments have affected its inflation outlook and probably are influencing the dissenters and those that are erring. Firstly, came an acknowledgement last month that the feed-though from the recent surge in import prices has occurred faster than previously assumed and thus is now likely to have less of a further potential inflationary impact ahead. Secondly, the BoE seems to think any second-round effects from high CPI inflation into wages may now fade faster than previously thought. All of which helps explain the overall greater overall confidence in a softer inflation outlook and with risks much more balanced. Thus, it is not surprising that the BoE inflation profile has been revised down.

We will have to wait until after the election on July 4 for clearer policy clues and probably some enlightening of how sizeable this emerging group who see a finely balanced policy backdrop is. What remains the case is that the updated BoE projections offered last month at least validated the rate path discounted by markets, with below target inflation, this possibly suggesting larger easing than the two moves then seen through this year. This is something that chimes with the cumulative reduction of up to 75 bp by year end we are now forecasting and with around a full ppt in 2025. We think that even such a rate cut profile would still leave policy restrictive and thus bearing down on inflation further.