Long Term Themes

View:

June 25, 2025

June 20, 2025

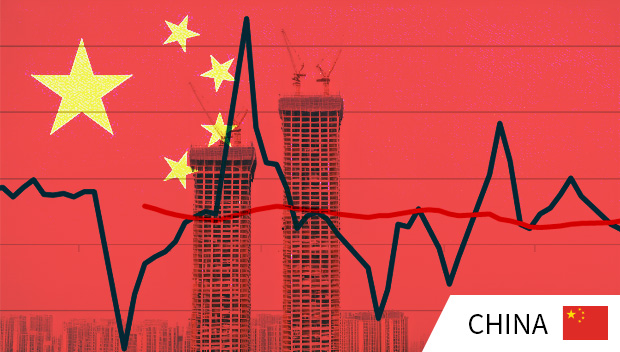

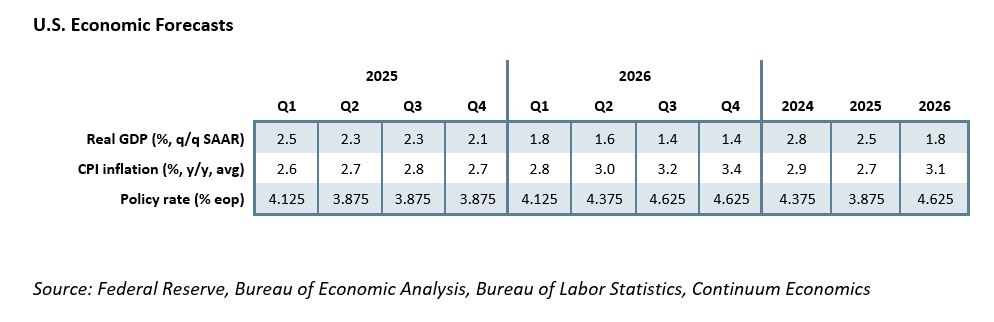

U.S. Outlook: Slowdown but not Recession, Cautious Fed Easing

June 20, 2025 2:14 PM UTC

• Policy uncertainty remains high and final details of the tariffs will depend on the decisions of the courts as well as those of President Trump. However the magnitude of the tariffs is becoming easier to predict than the detail. Trump looks set to insist on a minimum average tariff of at

March 27, 2025

March 24, 2025

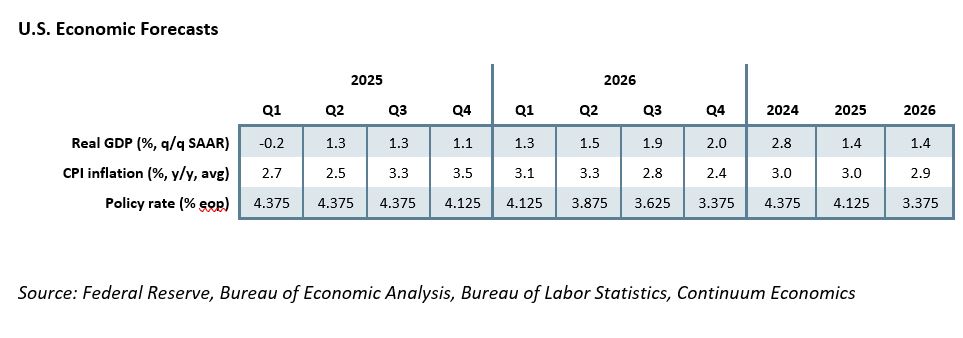

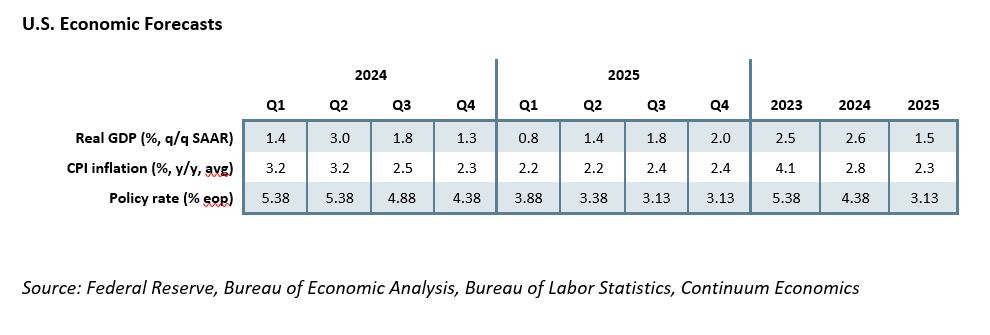

U.S. Outlook: How Much Damage Will a Trade War Do?

March 24, 2025 3:45 PM UTC

• The U.S. economy, consumer spending in particular, ended 2024 looking healthy, but with inflation still above its 2.0% target if well off its highs. The Trump administration’s more aggressive than expected trade war has made a return to the inflation target more difficult and raised dow

March 06, 2025

China: Only Moderate Fiscal Stimulus

March 6, 2025 7:55 AM UTC

China announced some fiscal stimulus to help meet the expected 5% GDP target for 2025. Overall, we have not been surprised by the fiscal stimulus measures announced so far from the March NPC, that have been towards the lower end of expectations. However, officials on Thursday have hinted that mo

February 28, 2025

China: How Much U.S. Trade and Taiwan Pressure?

February 28, 2025 9:05 AM UTC

· Trump eventually wants a trade deal with China and this could occur by the end of 2025, but the U.S. will ask for penalties if targets for U.S. imports to China are not met and this will lead to difficult negotiations. Reciprocal and product specific tariffs on China are also likely i

February 25, 2025

China: More U.S. Tariffs, No Yuan Depreciation?

February 25, 2025 9:30 AM UTC

• China is currently reluctant to see Yuan depreciation as it wants to get the U.S. to the negotiating table for a revised phase 1 trade deal and also over concerns about domestic capital outflows. Cuts to the 7-day reverse repo rate are now likely to be in 10bps steps and we look for the

February 14, 2025

China: Private Sector Balance Sheet Recession?

February 14, 2025 10:45 AM UTC

Overall, we maintain the view that parts of China’s household sector are showing signs of a balance sheet debt consolidation, due to the excess buildup of debt in the past 20 years relative to disposable income. The non-financial corporate sector is more difficult to interpret, due to strengt

December 30, 2024

December 20, 2024

December 19, 2024

U.S. Outlook: Healthy Economy Facing Policy Risks

December 19, 2024 8:01 AM UTC

• The U.S. economy, consumer spending in particular, has continued to show surprising resilience, and is growing at a pace probably in excess of long-run potential near 2.0%. Inflation has fallen significantly from its highs, with core PCE inflation now running slightly below 3.0%, but rema

September 23, 2024

U.S. Outlook: Fed Focus Turning To Downside Risks

September 23, 2024 2:16 PM UTC

• The U.S. economy is showing clear signs of labor market slowing which poses downside risks to the still impressive resilience of consumer spending, which has sustained healthy GDP growth through Q2 2024. We expect GDP growth below potential in the second half of 2024 and the first half of

July 05, 2024

UK Election Aftermath: Labour’s Solid Victory

July 5, 2024 5:24 AM UTC

Labour have won a large seat majority, though with a modest vote share. This should provide political stability in the UK for the next 5 years. The key question for market remains how the fiscal rule will be meet and how slowly or quickly Labour will take actions to boost long-term growth.

June 28, 2024

UK Markets After The Election: Will Labour Push for Growth Slowly or Quickly?

June 28, 2024 7:14 AM UTC

It is uncertain whether an incoming Labour government in the UK would slowly or quickly take action to boost trend growth and this is the most important question for post-election sentiment towards UK assets. For the Gilt market, the key is that the BOE actually starts cutting rates and that the 1

January 29, 2024

South Africa: Structural Issues to Dominate Long Term Growth

January 29, 2024 9:00 AM UTC

Bottom line: We expect 1.3-1.5% GDP growth in South Africa in the 2025-2030 period. We are concerned with the structural problems affecting economic dynamics negatively, including loadshedding, transportation bottlenecks, and shrinking trade surplus. Despite structural problems; growing population,

January 26, 2024

Climate Change: 2025-30 Rather than Long-Term Impacts

January 26, 2024 4:15 PM UTC

Bottom Line: In the 2half of the 2020’s GDP in DM economies will benefit from climate change investment, though the net positive impact will likely be modest on an annual basis. The impact on EM economies will be more mixed, as lack of fiscal space restrains the scale of green investment and some

January 05, 2024

China: Five Headwinds To Long Term Growth

January 5, 2024 9:00 AM UTC

The catch-up productivity argument would point towards 4-5% growth in China in the 2025-2030 period. However, we are concerned that the residential property downturn and rewiring of global supply chains will be persistent headwinds for China GDP growth in the coming years and that the adverse popu

January 03, 2024

AI and Technology Impact on Growth and Inflation

January 3, 2024 10:30 AM UTC

Bottom Line: The full benefits of the latest AI wave will likely not kick in until the late 2020/early 2030’s.However, 5G over the last couple of years has been enabling more connectivity via the Internet of Things and allowing more big data analysis, including AI tools and algorithms. In the 2hal

November 24, 2023

LatAm: Long Term Growth Differences

November 24, 2023 11:52 AM UTC

In Latin America, distinctive long-term growth patterns are emerging. Brazil faces challenges of an aging population and constrained capital growth, aiming to return to pre-pandemic growth at 1.7%. Mexico anticipates growth through nearshoring, intensifying existing industries for a 2% long-term pro

November 16, 2023

November 14, 2023

South Africa: Structural Issues to Dominate Long Term Growth

November 14, 2023 1:07 PM UTC

Bottom line: We expect 1.3-1.5% GDP growth in South Africa in the 2025-2030 period. We are concerned with the structural problems affecting economic dynamics negatively, including loadshedding, transportation bottlenecks, and shrinking trade surplus. Despite structural problems; growing population,