EZ HICP Preview (Mar 3): Headline Back Down With Friendlier Core Messages?

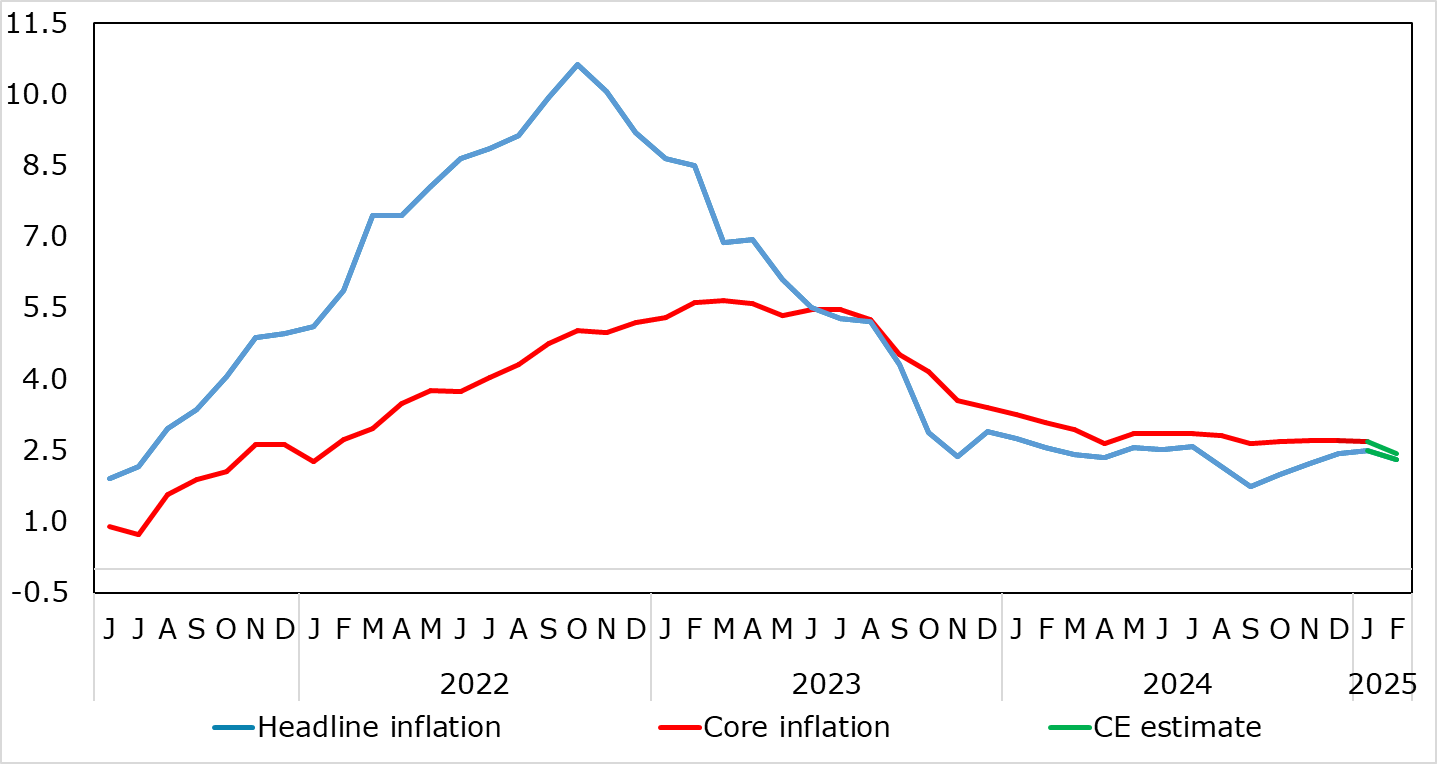

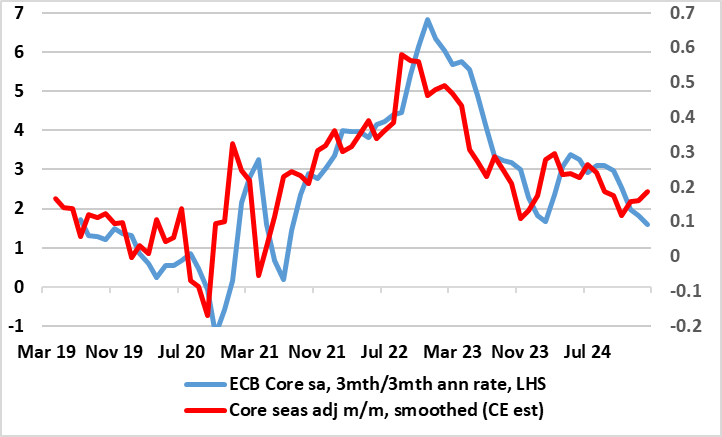

February HICP inflation numbers may deliver better news and broadly so (Figure 1) and thus contrast with the mixed messages in the higher-than-expected January flash HICP numbers. Indeed, for a third successive month in January, the headline rose but by ‘only’ 0.1ppt, to a six-month high of 2.5%, but where the core (again) stayed at 2.7%, partly due to what is seemingly relatively stable services inflation. February may see further energy cost rise but partly masked by base effects (Figure 1) should see both the headline core and services rate down around 0.2 pp. However, shorter-term price momentum data already suggest that core and even services inflation have slowed and are running around target (Figure 2) and given sharp falls in wage tracker data, we think headline y/y services inflation is succumbing, something backed up by surveys for the sector.

Figure 1: Headline to Slip as Services Resilience Cracks?

Source: Eurostat, CE, ECB

As we have noted previously, there are some signs in retailing surveys suggesting disinflation may have stalled. But this may be of increasing secondary importance to most of the ECB Council as a) inflation is already consistent with target; b) cost pressures are under control and may indeed be easing when it comes to wages and c) a fresh and more demand driven disinflation could be triggered by what seems to be a weaker real economy backdrop that could also exacerbate financial stability risks.

Figure 2: Core Inflation Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE

Admittedly, the January headline HICP was a notch higher than expected, but this still sits easily with ECB thinking as set out after last month’s Council meeting. This was explicit in suggesting that the Council saw inflation fluctuating around its current level in the near term but then settling sustainably at around target. And with a lower core reading envisaged this time around, and already consistent with target already in terms of adjusted short-term data (Figure 2), this also sits with ECB thinking that noted most underlying inflation indicators have been developing in line with a sustained return of inflation to target. It pointed to recent signals of a continued moderation in wage pressures and to the buffering role of profits.

But surely the dominant issue now – and even for the ECB - is the extent to which downside growth risks have turned into reality with it clear that growth worries have risen. Indeed, preserving growth does seem to have become the ECB policy priority and such worries may only be accentuated by the growing threat of tariffs and an ensuing trade war and possible dumping of goods to Europe by China. Moreover, these downside risks have other aspects, equally worrying, especially as, they could fan financial instability issues.

Regardless, the headline HICP rate may edge down a notch or probably two in February, where some further rise in fuel costs in m/m terms may be offset by base effects. But we see the core dropping – belatedly so that the headline and the core rate will be running a similar levels. And with adjusted data showing even apparently resilient services inflation succumbing (Figure 2), this being something that has been noted by some of the ECB Council. Indeed, it was suggested in the December minutes that a moderation in services inflation dynamics was evident in the three-month-on-three-month seasonally adjusted services inflation rate which we suggest fell further in January to around 2.6% and may be nearer 2.3% in February! This makes us that much more confident that headline inflation could fall back below target by mid-year.