ECB Review: On Hold Message to Convert to Easing on Disinflation

· The ECB increased its 2026 GDP and inflation forecast and appears happy with current policy rate levels. However, still tight financial conditions, plus easing wage growth, point to disinflation and growth disappointment. We see this switch the ECB from an on hold message to easing in a further two 25bps steps in 2026 to 1.50% ECB depo rate.

Figure 1: ECB and Continuum Economics Forecast (%)

GDP |

|

|

| HICP |

|

|

| |

2025 | 2026 | 2027 | 2028 | 2025 | 2026 | 2027 | 2028 | |

| CE current | 1.4 | 0.8 | 1.4 | 1.3 | 2.0 | 1.7 | 1.8 | 1.9 |

| Current Consensus | 1.3 | 1.1 | 1.5 | na | 2.1 | 1.8 | 2.0 | na |

| ECB (Dec) | 1.4 | 1.2 | 1.4 | 1.4 | 2.1 | 1.9 | 1.8 | 2.0 |

| ECB (Sep) | 1.2 | 1.0 | 1.3 | na | 2.1 | 1.7 | 1.9 | na |

Source: ECB/Continuum Economics

Market expectations of further ECB easing are waning with ECB communications and the 2yr Germany to ECB depo rate spread can become more volatile. Key points to note.

· ECB forecasts. The ECB raised 2026 GDP forecast on domestic demand views, while also raising 2026 inflation from 1.7% to 1.9% (Figure 1) on a somewhat pessimistic view of a slower decline in service inflation compared to September. However, wage inflation is a key driver of service inflation and this suggest downside surprise for the ECB in 2026. Additionally, the GDP forecast appears too upbeat, both given the upward distortion caused by Irish GDP in 2025; consumer caution and business adjustment to the U.S. tariffs. The ECB appears to be placing too much weight on PMI numbers, which are not backed by other soft survey numbers and hard data. The reduction in 2027 inflation and 2.0% forecast 2028 reflects the delay to 2028 in EU ETS changes that will slightly boost inflation. Regardless, it is notable that despite a cumulative 0.5 ppt upgrade to GDP projections, no material revision to the HICP outlook was made!

· ECB communications. ECB President Lagarde reconfirmed that policy is in a good place, which should be read as a signal of on-hold policy. Though Lagarde went on to say that this does mean static rates, this is more for the ECB to maintain its policy flexibility. In answer to the 2nd question, Lagarde also leaned against ideas of higher policy rates in the future by highlighting high adverse uncertainty. This makes sense as the majority of the ECB will want to see rate cuts feed through (which is not happening on the consumer side in particular) and ECB communications will likely lean against any 2026 rate hike expectations. In addition, with policy supposed to bite over an 18-24 month horizon, the fact that end-2027 core and headline HICP inflation is seen below target is surely a restraint on the ECB hiking and even talking aggressively.

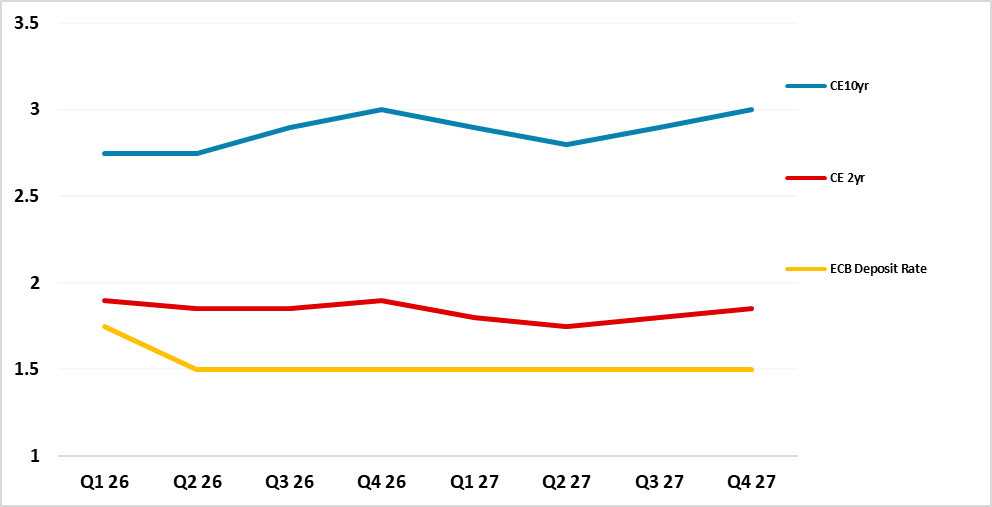

· Tight financial conditions. The ECB press conference left the impression that policy rates are in a good place. However, this contrasts with the more honest assessment from the recent ECB Financial Stability Report (FSR), which acknowledged concerns about weak credit demand and restraints to credit supply. In particular, the fresh increase in consumer loan rejections and the very modest drop in effective lending rates to the household sector can be seen as more cautious lending behaviour by banks. Secondly, the FSR notes that EZ corporates continue to face elevated debt servicing costs. While the recent cuts in interest rates have reduced costs for new corporate borrowing, the stock of outstanding debt is continuing to reprice at less favourable conditions, keeping debt service ratios elevated. Survey data also show that most firms believe their financial positions are under strain from weaker external demand, which is squeezing their profitability. Thirdly, the transmission mechanism of easier policy rates will likely worsen in 2026. Towards the end of an easing cycle short-dated yields and lending rates are not dragged down much (Figure 2). We also forecast rising 10yr Bund yields (extra bond supply) and French fiscal jitters widen sovereign spreads (DM Rates Outlook here). Finally, QT is modestly restrictive to the banking system.

Figure 2: ECB Deposit Rate, 2 and 10yr Germany Forecasts (%)

Source: Continuum Economics

· On hold and then 50bps of cuts. The ECB short-term communications points to a hold, but we feel this will change. As well as tight financial conditions, HICP inflation is seen dipping clearly into early-2026, possibly to 1.5%, something flagged by business survey selling price expectations (EZ Outlook here). Though Lagarde noted current higher than expected compensation per employee, she also noted that wage tracker points to wages falling below 3%! We still see a further two 25 bp rate cuts by mid-year and policy then being on hold into and through 2027. But even if ECB easing has ended, it is hard to see any early policy reversal, not least as it is difficult to see HICP inflation picking up strongly given both weakening jobs and wage growth and both direct and indirect tariff repercussions. Additionally, alongside ECB rate cuts in 2026, we see the ECB slowing APP and PEPP QT by around 25% to try to reduce the damage to the monetary transmission mechanism.