UK Election Aftermath: Labour’s Solid Victory

Labour have won a large seat majority, though with a modest vote share. This should provide political stability in the UK for the next 5 years. The key question for market remains how the fiscal rule will be meet and how slowly or quickly Labour will take actions to boost long-term growth.

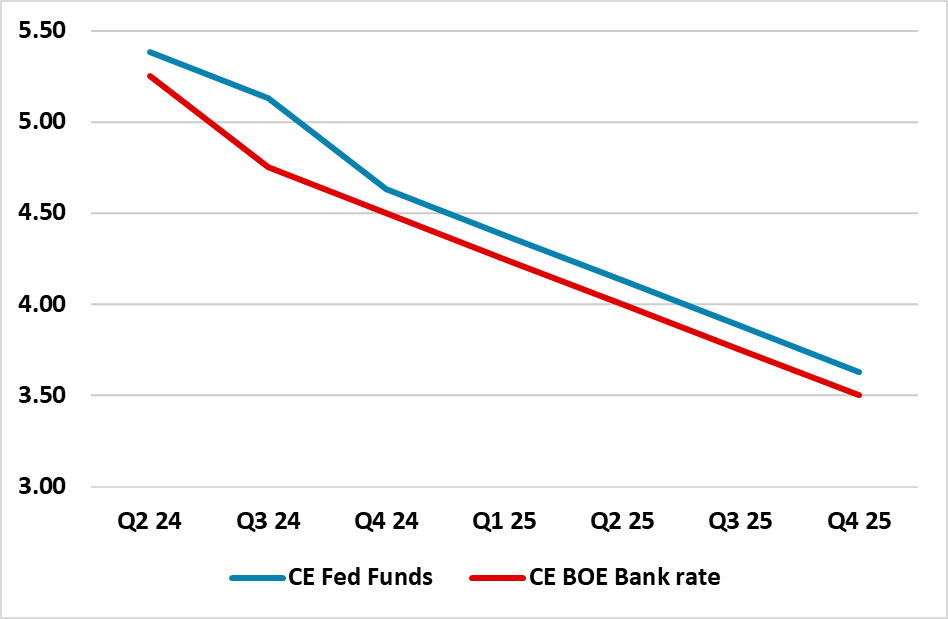

Figure 1: CE BOE and Fed Policy Rate Forecasts

Source Continuum Economics

The UK election results to 6am GMT are Labour 409 seats, Conservatives 118 and Liberal Democrats 70 seats. This compares to recent opinion polls seat by seat that had Labour between 430 and 516 seats; Conservatives between 53 and 126 and Liberal Democrats between 50 and 72. The prospective result is thus below the lower end of projected seats for Labour, though still leaves they with a large absolute majority. The Conservative prospects are not as bad as the worst case disaster projections, but still awful and point to a coming civil war for the direction of the party and how it can stop the other right wing party Reform before a 2029 election that is projected to take 15% of votes compared to 24% for the Conservatives. Finally, Labour 35-36% projected vote share is low for such a large seat majority, which reflects the swing against the Conservatives.

The focus will now switch to the cabinet appointment for hints on policy. Though Labour have been clear in their manifesto (here) on their priorities, the last Labour government quickly surprised with 1997 BOE independence -- though for now we are not expecting major surprises. Our baseline view is that the next few weeks and months will be focused on rolling out some of the policies and preparing for the budget that is expected in September or October. One issue we will watch closely is whether a Labour government is slow or quick to take actions on measures to boost long-term growth prospects (here), which is not clear at this juncture and will have an impact for sentiment on the UK equity market. For non UK clients, the biggest issue to highlight is that overall projected government spending has to be allocated by department, but independent think tanks questioning (here) whether this could end up revising overall budget spending up by £30-40bln by 2028-29 as healthcare commitments will likely require 3-4% real expenditure increase on the UK NHS. Does the size of majority mean anything for markets?

For the gilt market a large but not overwhelming majority calms some fears that Labour could spend more and relax fiscal rules knowing that they would be politically unrestrained, but most debt players feel it does not matter provided that the first budget is fiscally credible. For the UK equity market a solid majority provides stability and an ability to boost long-term growth, though the low Labour vote share means that fund managers will not pencil in a Labour victory in 2029.