U.S. December CPI - Moderate rebound from weak November leaves a subdued Q4

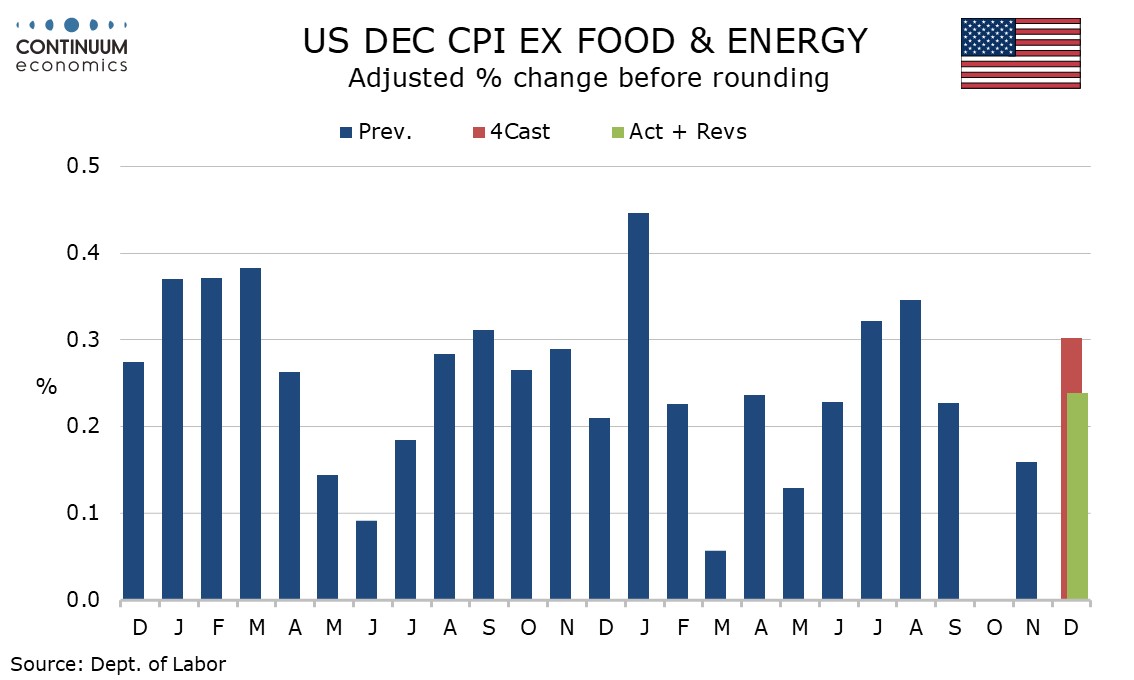

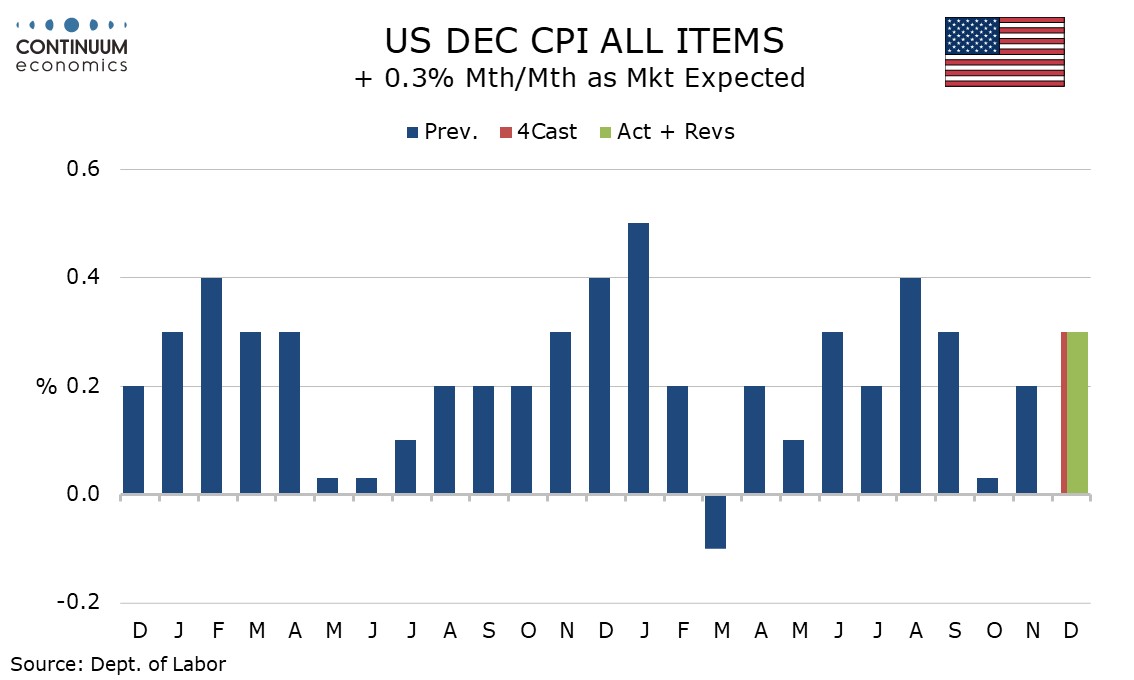

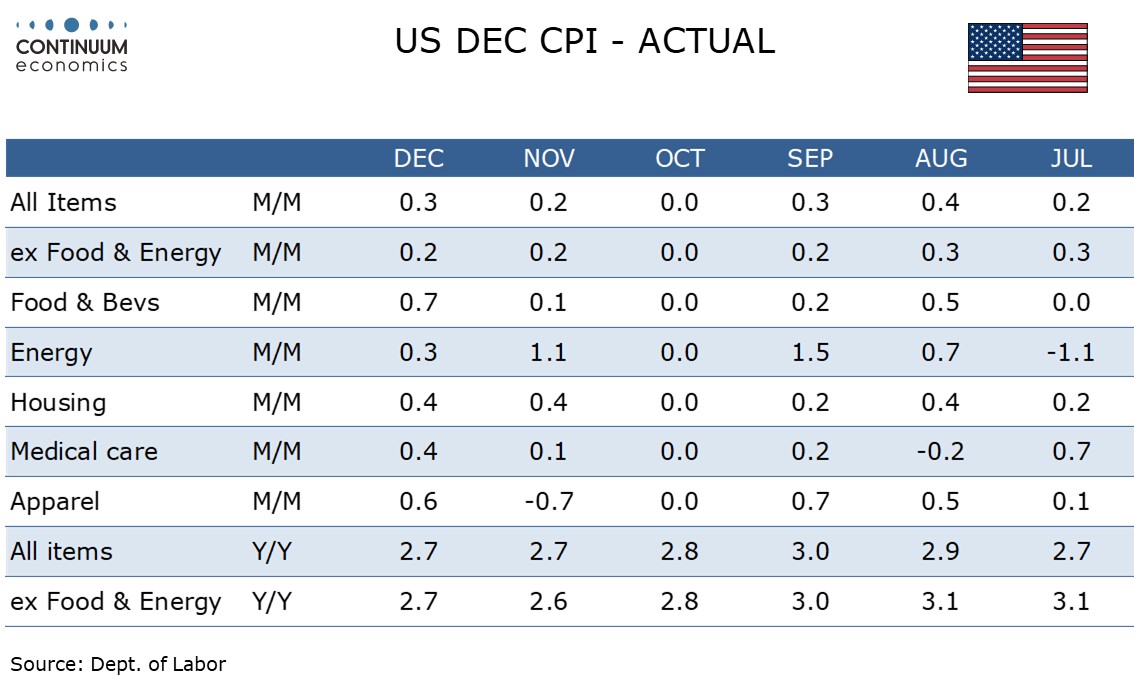

December’s CPI has come in slightly softer than expected, not showing a strong rebound from the weak 2-month change in November and thus leaving a subdued Q4. December CPI rise by 0.3% as expected but with the core rate weaker than expected at 0.2%, 0.24% before rounding. CPI ex food, energy and shelter rose by only 0.1%.

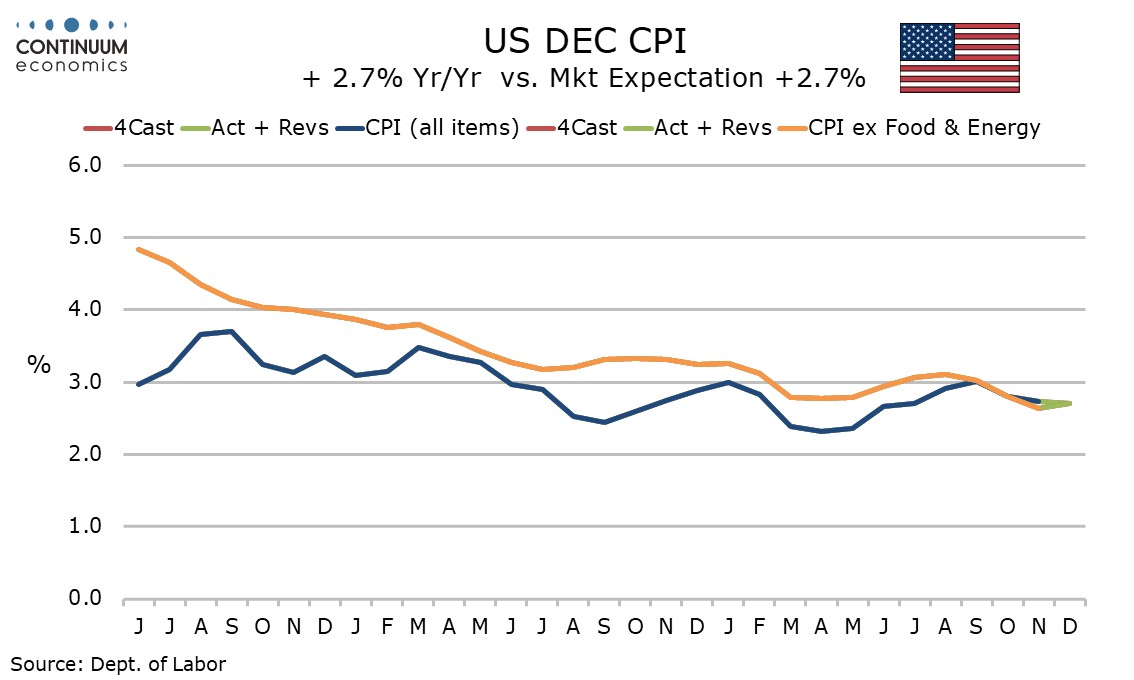

This leaves core CPI up 0.4% from September, an average monthly gain of 0.13%. Yr/yr rates are unchanged from November at 2.7% overall and 2.6% ex food and energy, and down from 3.0% in each series in September. The yr/yr core rate is the lowest since March 2021.

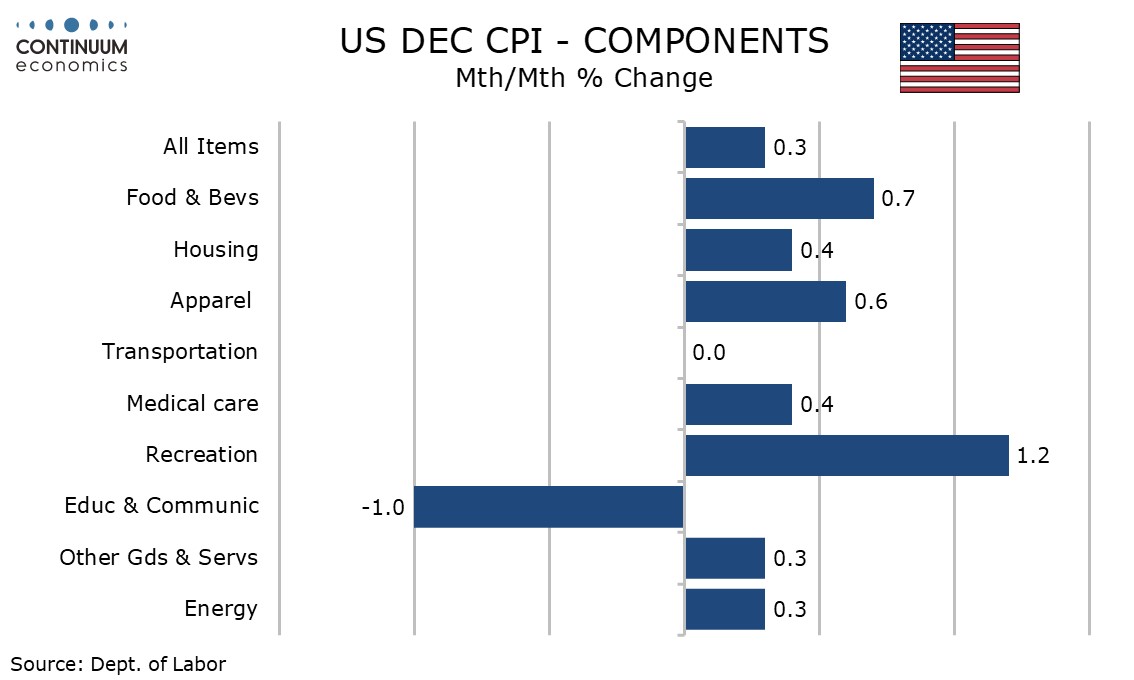

Food had a strong month at 0.7% after rising by only 0.1% through October and November while energy rose by 0.3% despite a 0.5% fall in gasoline with energy services up by 1.0% led by piped gas.

Commodities less food and energy, which had picked up since April’s tariff announcement, were unchanged, restrained by a 1.1% decline in used autos, which may prove erratic, while new vehicles were unchanged. Apparel was firm at 0.6% but this follows a 0.7% in October through November. Tariff feed through may be fading, though it is also possible pricing decisions are simply being delayed to the new year or the Supreme Court verdict on tariffs.

Services less energy rose by 0.3%. Shelter rose by 0.4% with owners’ equivalent rent up by 0.3% and the volatile lodging away from home up by 2.9%. Medical services rose by 0.4% and transport services rose by 0.5% led by a 5.2% rise in air fares, which looks like a correction from recent weakness. With two of the most volatile components of core services, lodging away from home and air fares, firm, the services data may slightly overstate underlying trend. Recreation was firm after weakness in November but education and communication corrected a strong November.

This report is subdued enough to be encouraging to the FOMC though there does not appear to be any urgency for a near term easing. Recent years have tended to see above trend gains in Q1 CPI so it makes sense to wait for Q1 data, and possibly also the Supreme Court tariff verdict. The timing of that is uncertain, but could come as soon as tomorrow.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.