BOE: Gradual to Activist?

The contrast between BOE Bailey and Pill comments suggest a debate is occurring in the BOE over more easing than a simple quarterly pace of 25bps cuts. This is not just about data, but some members could be putting more weight on forward looking forecasts than current inflation trends. The December meeting is now a close call, but BOE Pill comments means it is not yet certain that a cut will be delivered. Our forecasts backs the need for cuts to 3% eventually, but more shifts in attitude from hawks and centrists will be required for this to deliver faster rate hikes consistently.

BOE Bailey Guardian interview saw him saying that the BOE could become a bit more activist. However, BOE Chief economist on Friday has said the BOE should be gradual. How can this impact BOE decisions in the coming months?

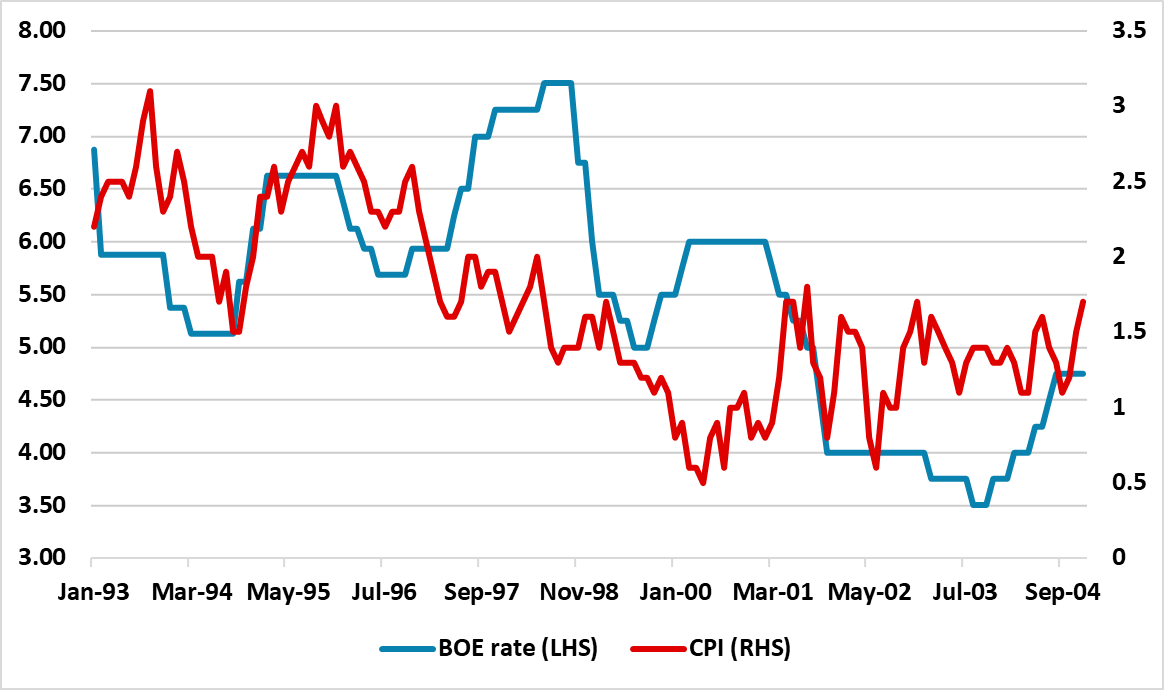

Figure 1: UK CPI Yr/Yr and BOE Bank rate (%)

Source: Continuum Economics

While a lot of traders are focused on new data to switch to a more activist BOE, BOE Bailey comments could equally be a shift of attitudes among some members putting more weight on forward looking projections versus current inflation trends. A couple of points are worth mentioning.

· Wage inflation and service inflation set to slow further. Our view has been clear (here) that the lagged effects of monetary tightening will slow wage inflation and service inflation further. Though the UK economy has appeared resilient in H1, this is due to one off factors and the trend will slow in H2. Consumption growth is only modest and likely to be restrained by the October 30 budget with taxes on households widely expected to be increased. BOE Greene (a hawk) has recently question why the UK consumption growth is so modest and part of the answer is that UK households wealth was hit more than other countries by the 2021-22 fall in fixed income and the hit to pensions (here) plus the level of wages being lower than CPI since 2019. This week IDS data shows slowing wage growth, while CPI services ex volatile items is more subdued than the CPI services.

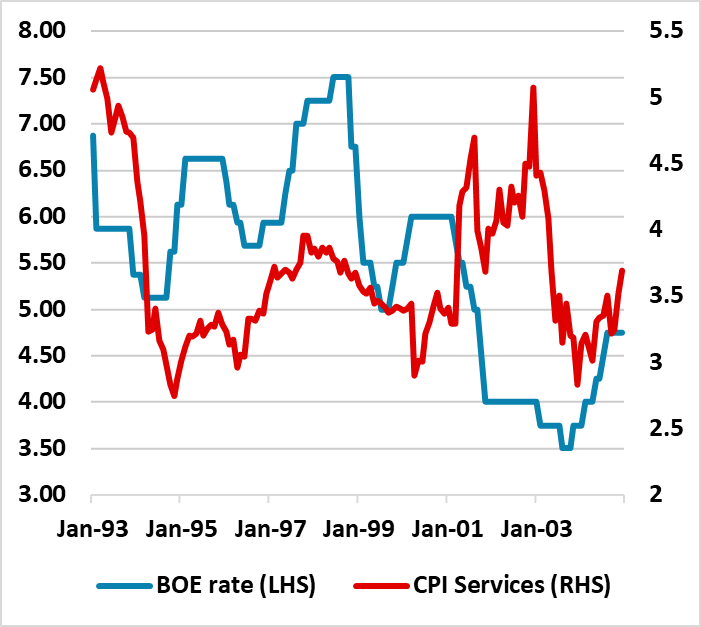

· Backward looking data to forward projections. Part of the gradual rate cut narrative has been driven by the hawks and some of the centrists (e.g. BOE Pill) on the MPC putting a lot of weight on current inflation trends than others. Central banks can move from gradual to a bit more activist on either data or a change of consensus. This has happened for the MPC in the past. Recent historical guides are less frequent, but the BOE had three modest/moderate easing cycles in 1995/1998/2001 (Figure 1). In 1995 CPI services was going up when the BOE was cutting rates (Figure 2). Meanwhile, current BOE inflation projections have an upward skew interpretation by the MPC. Remove the upward skew and the BOE has reasons to speed up rate cuts.

Figure 2: UK CPI Services Yr/Yr and BOE Bank rate (%)

Source: Continuum Economics

· BOE Bailey v Pill. Bailey view on Thursday has been partially counterbalanced by BOE Chief economist Pill on Friday. Pill has backed the case for gradual cuts, as caution is needed in judging the removal of inflation persistence. Pill also cautioned against cutting interest rate too far or too fast.

What does these contrasting views mean for rate cut prospects? The September minutes appear to signal a strong consensus that a 25bps cut is likely to be delivered in November. Pill’s warning against cutting too far or too fast suggests that some want to move quicker beyond a November move. Bailey’s comments suggests that some of the hawks could be more flexible in their view now that signs of selective inflation persistence are ebbing. Some of the doves could be arguing to drop the upside inflation skew in interpreting the projections. We feel that the current and prospective data do warrant the BOE getting down to 3% BOE Bank rate, but the previous communications from the BOE has made us reluctant to forecast more than a quarterly BOE pace to end 2025 plus a March move. Bailey’s comments suggest that a December move is now a close call and will also depend on the data (to sway some of the centrists and hawks). For 2025 prospects we need to hear from more BOE speakers to judge how much change of thinking is occurring in the MPC.