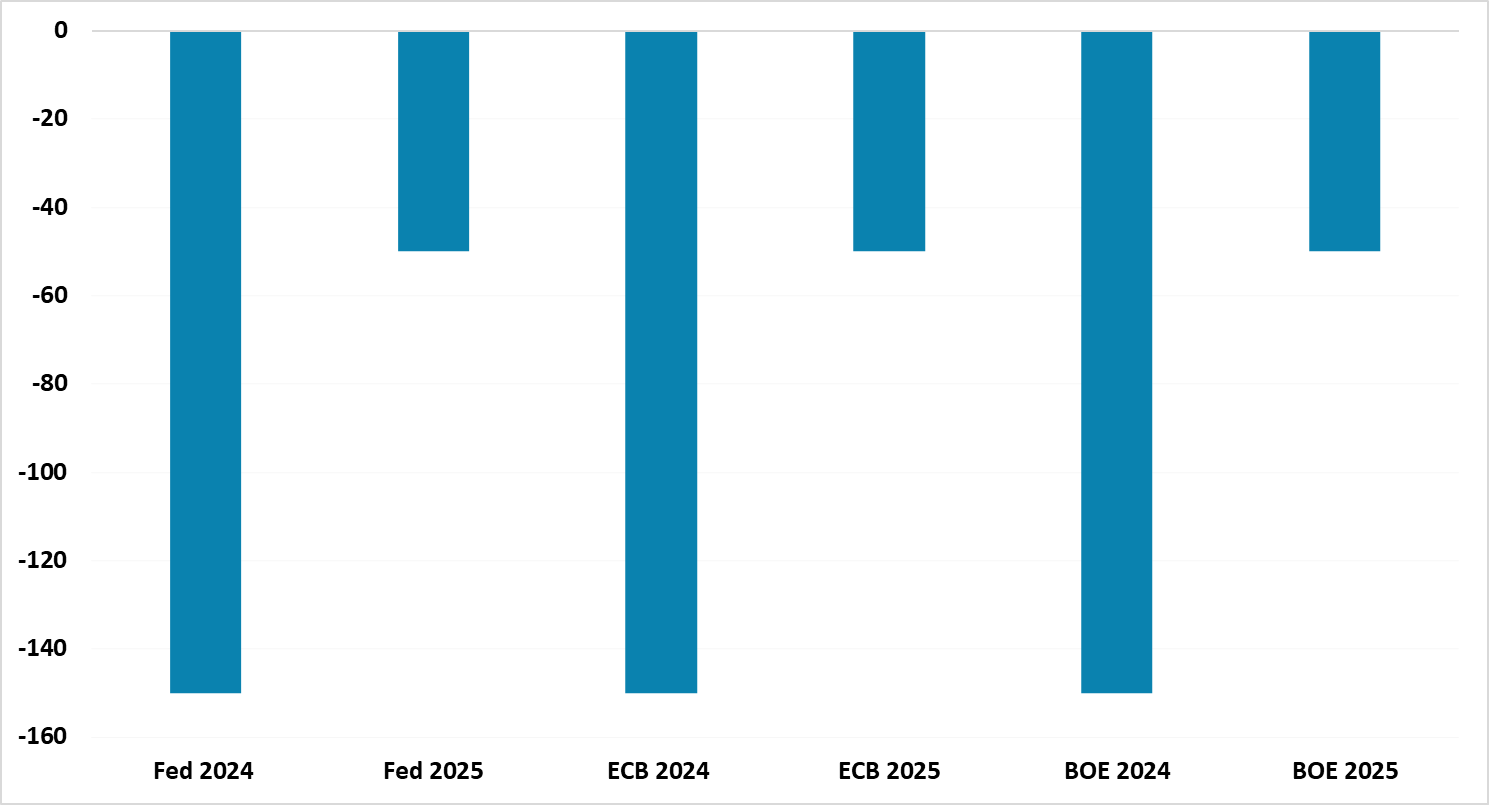

2024 and 2025 DM Rate Cuts

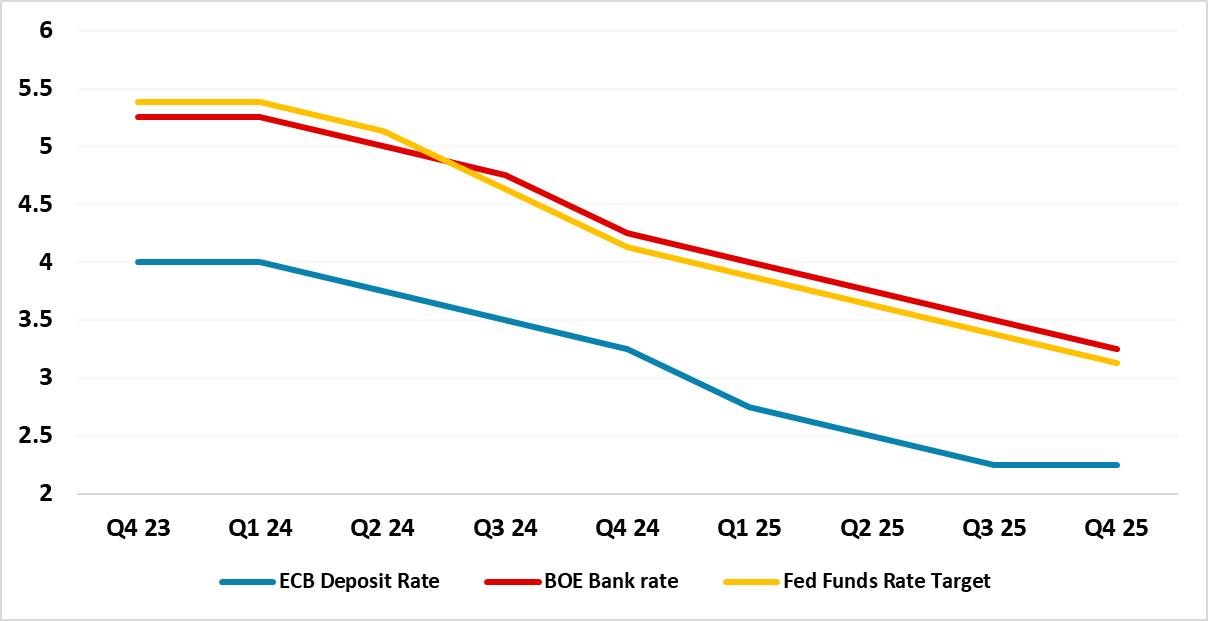

We feel that financial market expectations (Figure 1) are too aggressive in regard to the magnitude of anticipated central bank easing in 2024. We see easing coming more evenly over 2024 and 2025 (Figure 2). Some rejigging of rate expectations from 2024 into 2025 could occur in January. This is not as bad for optimistic financial markets, as the scale of 2024/25 easing being reduced. Even so, with U.S./EZ/UK government bond curves inverted, it could be enough to produce a corrective rise in 10yr bond yields and produce a headwind for equities in Q1 2024.

Figure 1: Aggressive DM Rate Expectations

Source: Bloomberg/Continuum Economics

December optimism over a Fed pivot has left financial markets starting 2024 with aggressive rate cut expectations. 150bps of cuts are now discounted by money markets from the Fed/ECB and BOE for example and then a further 50bps in 2025 (Figure 1). The first Fed cut is discounted for May, though March is seen to be a live meeting. The market is also convinced about an ECB cut in April and a BOE cut in May, with H2 then seeing more aggressive cuts.

The problem is that DM central banks may not encourage early and aggressive rate expectations, unless incoming real sector data see a sharp slowing. The November downside inflation surprises in U.S./EZ and UK cements the prospect of a pivot to 2024 easing, but central banks are normally reluctant to talk about easing in detail until closer to the first likely date of easing. This is particularly true of the ECB, where communications in press conferences tend to be backward looking to reinforce the effects of the tightening undertaken in 2022 and 2023.

Furthermore, central banks could push back against the scale of 2024 easing expectations. For the Fed, 150bps is aggressive at this stage when the economy is still maintaining momentum and is slowing rather than heading for a hard landing. This could see some Fed officials pushing back through the course of the next two weeks before the January 31 FOMC meeting. Fed Barkin and Logan are scheduled to speak this week, though others can make press comments.

For the ECB, centrists are admitting that the ECB is starting to pivot such as De Guindos before Christmas (here), but the ECB hawks are vocal and want to fight not just the scale of discounted cuts but also the idea that the 1st ECB cut will arrive in the spring. Even so, the ECB will likely sound more dovish at the January 25 Council meeting. BOE official communications in the next two weeks will likely stick to the “Table Mountain” analogy that rates need to stay high for a longer period to help get UK inflation back towards target – given remaining UK wage inflation concerns. However, this is partially an attempt by the BOE to temper rate optimism until the next monetary policy report and forecasts are published February 2. Those BOE forecasts will then have to incorporate the expectations of 200bps of cuts in 2024 and 2025 and this will likely partially endorse but partial reject market expectations.

Figure 2: Our Fed/ECB and BOE Policy Rate Forecasts

Source: Continuum Economics

Incoming real sector data will also be important and we feel that the EZ and UK are already in a shallow recession in H2 2023, which leaves the ECB and BOE at a worst starting point than the Fed. We would also highlight that all three central banks are underestimating money and credit signals. It not that we are monetarists, it is just that DM central banks appear to be overlooking this part of the jigsaw. In this context, it is worth looking at the BOE credit conditions survey January 18; ECB bank lending survey January 23; and the Fed senior loan officer survey due by early February.

Overall, we feel that financial markets are being too aggressive in discounting easing in 2024. We see easing come more evenly over 2024 and 2025 (Figure 2). Some rejigging of rate expectations from 2024 into 2025 could occur in January. This is not as bad for optimistic financial markets, as the scale of 2024/25 easing being reduced. Even so, with U.S./EZ/UK government bond curves inverted, it could be enough to produce a corrective rise in 10yr bond yields and produce a headwind for equities in Q1 2024 (here).