ECB Starting Talk About Rate Cuts

Bottom Line: ECB De Guindos today indicated that a precondition for a rate cut is inflation converging “towards” 2%. While the ECB is cautious on this happening, we see this occurring by Q2 2024, which is when we see the first 25bps rate cut occurring. Hawks protests about early easing talk should ebb into the spring, as the ECB finds growth and inflation below their forecasts.

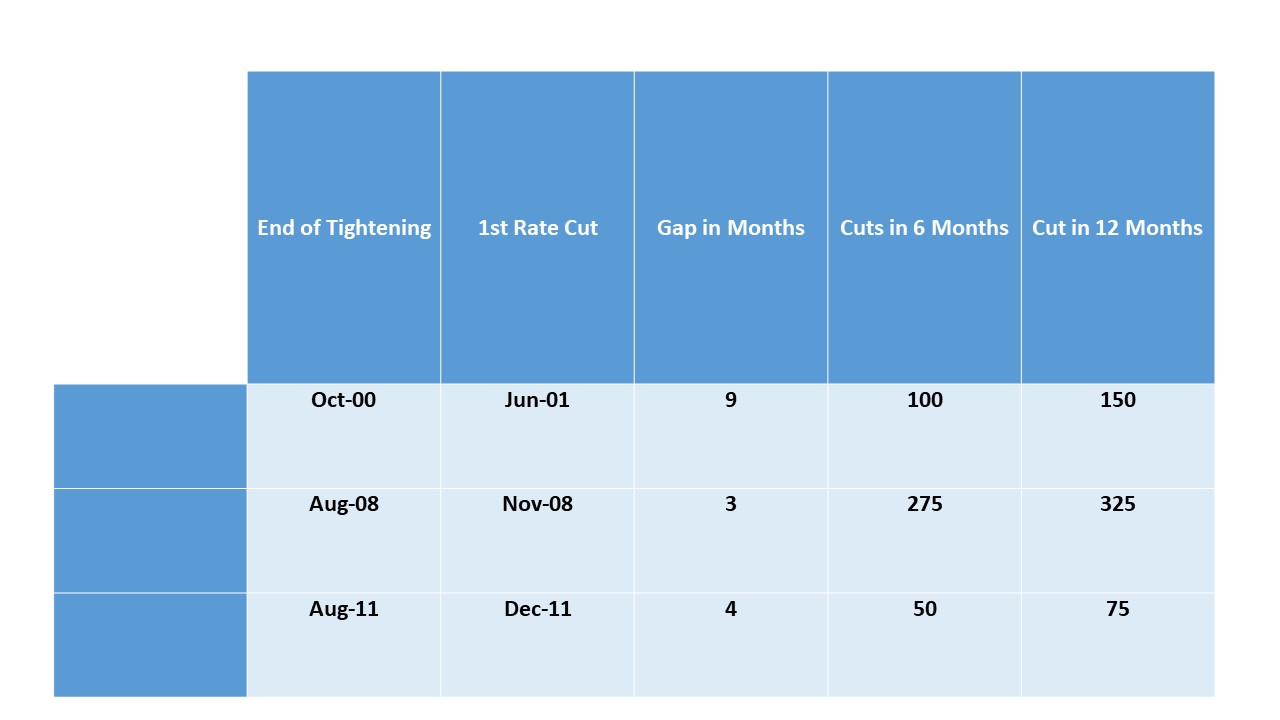

Figure 1: Previous ECB Easing Cycles

Source: Continuum Economics

ECB officials have started talking about rate cuts, in contrast to the last ECB press conference that was backward looking and designed to reinforce the tightening that had already occurred. ECB officials have a tendency to look backwards, due to the large size of the ECB council and the struggle to reach common ground at times. Additionally, ECB analysis tends to be framed by Yr/Yr inflation rate, which are distorted upwards by inflation 6-12 months ago. Looking at the ECB own seasonally adjusted CPI monthly data on a smoothed basis suggests that monthly pace is now down to between zero and 0.1%.

The ECB is also too upbeat about 2024 growth prospects and we forecast a poor +0.3% (here). Real sector data and surveys point to this picture, while the money and credit numbers are actually consistent with recession. Fiscal policy will likely be tighter than previously assumed, as Wednesday EU finance minister’s deal on fiscal policy will likely led some countries to tighten after the June EU parliament elections.

The ECB will likely reset their forecasts lower at the March ECB meeting on growth and expectations and shift the tone on policy. However, the ECB may only signal a rate cut is coming weeks before they actually act and this means capitulation will likely come in the spring before the May or June ECB meeting. We see a 25bps cut by the June meeting, as we project CPI inflation to be below 2.0% in q2. Hawks such as Nagel and Knot will be the last too change tune and their recent push back against rate cuts will likely fade through the spring. It is worth listening to the centrists such as De Guindos more closely.