U.S. Equities: Exceptionalism v Valuations

Bottom Line: Momentum towards further deregulation, tech optimism, and the prospect of aggressive tax cuts could help the U.S. equity market in H1 2025 before the fear of higher yields and Fed Funds hurts in H2. 6100 could be seen H1 2025, before a softening to 5850 for end 2025 S&P500. We see 2026 Fed tightening and high 10yr U.S. Treasury yields that are not discounted in equities and inconsistent with current elevated P/E ratios. These are likely to produce a correction in 2026 and we forecast 5700 by end 2026 for the S&P500. If the spike in 10yr yields goes to 5.50-5.75% it could trigger a fiscal crisis and a bear market for U.S. equities.

The U.S. equity market surge after the Trump and Republican clean sweep is driven from an equity viewpoint that deregulation will be accelerated and that fiscal stimulus will arrive to boost corporate profitability and also sustain the economy through the next few years. Renewing the lapsing 2017 tax cuts or more aggressive tax cuts are the two main option from the major 2025 budget bill and for now the equity market sees either as positive. Meanwhile, a 4mln target for deportations makes good politics for the Trump administration, but is likely to tighten the labor market only modestly. Finally, the exceptionalism narrative will remain in place, with the U.S. resilient compared to a slow recovery in Europe and major structural headwinds in China and deregulation/technology helping to provide an edge for the U.S. equity market.

What about tariffs and U.S. equities? Most in the equity market take the view that tariffs will likely be phased in against certain countries and industries. Our baseline agrees with this view on tariffs, where we see tariffs being scaled in against China first by summer 2025 alongside threats followed by modest tariffs against other countries (here). This is a transactional approach that has two potential implications for the U.S. equity market. Firstly, it curtails the adverse inflation shock to the U.S. and Fed policy, especially if the U.S. pivots back to more oil and gas energy production and lowers energy costs. Secondly, it does not worry the equity market about a prolonged trade war or deglobalization that could undermine internationally focused U.S. companies’ earnings.

However, timing and scale of tariffs remains uncertain and they could be earlier and larger, if the Trump administration decides it needs to deal with China early or if tariff revenue becomes key to the budget bill likely to be passed in H2 2025. This is the 1 potential downside catalyst for the U.S. equity market, but not a baseline worry.

We agree with elements of the exceptionalism story in the U.S. in terms of technology and less regulation under a Trump administration and this should keep the equity market buoyant for most of H1 2025. The S&P500 could reach 6100-6200.

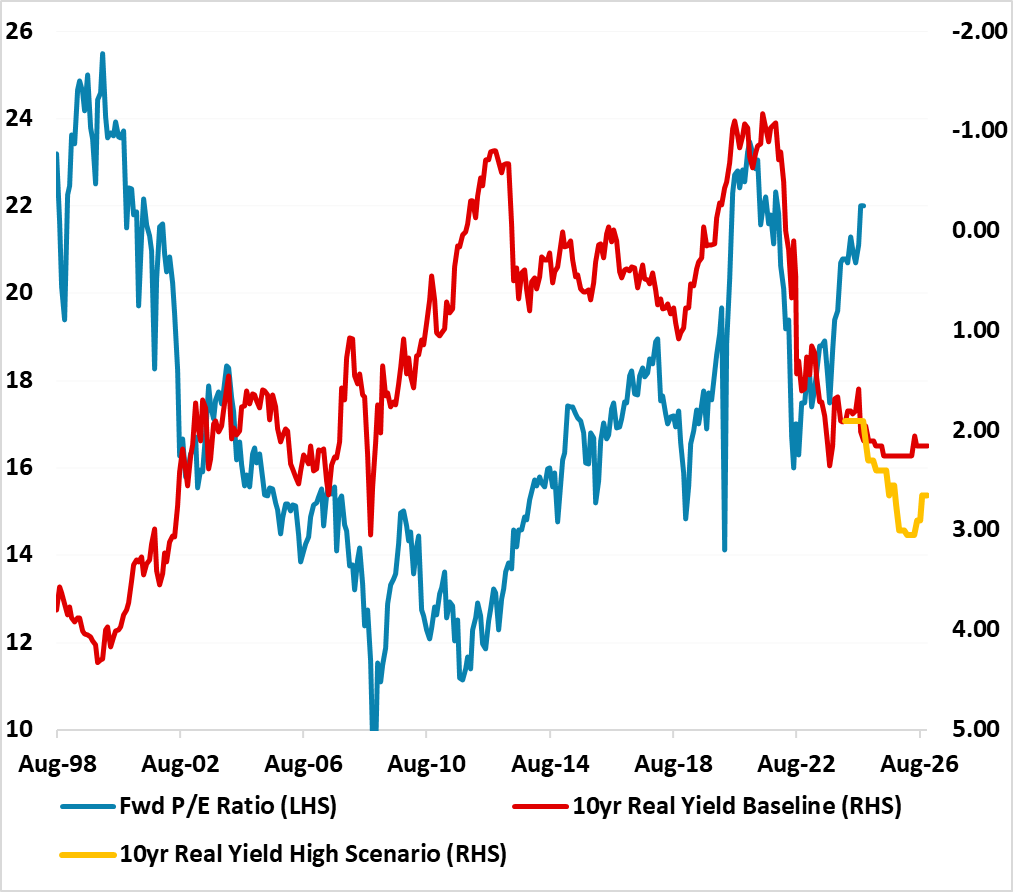

Figure 1: S&P500 12mth Fwd P/E Ratio and 10yr Real Government Bond Yield (inverted) (%)

Source: Continuum Economics (using index linked bonds).

However, our key baseline worry is that the bond and equity market are not discounting a Fed tightening cycle in 2026 and that the equity market is overvalued compared to nominal and real bond yields (Figure 1). Given the fiscal policy stimulus and modest inflation increase also from tariffs, we look for the Fed to stop easing at 3.75% by June 2025 and then start a 100bps tightening cycle from Q1 2026 (here). Additionally, the U.S. equity market will also be faced with a persistently higher 10yr yield trajectory from large issuance on our new baseline (Figure 2), which will be a headwind to the U.S. equity market. All of this can be a “rate” shock to the U.S. equity market in H2 2025 and 2026. We have revised our end S&P500 forecast to 5850 from 5600 with a lot of the 2025 corporate earnings growth feeding into a decline in forward price/earnings multiple.

We are more worried about the U.S. equity market in 2026 when heavy issuance will see 10yr yields towards their peak and the start of Fed tightening producing a rethink on the corporate earnings outlook – 13% currently on a bottom-up basis for the S&P500 for 2026. This can produce more derating on the price/earnings multiple and we forecast 5700 by end 2026. This would be like a repeat of 2022 when a rate shock hurt U.S. equities.

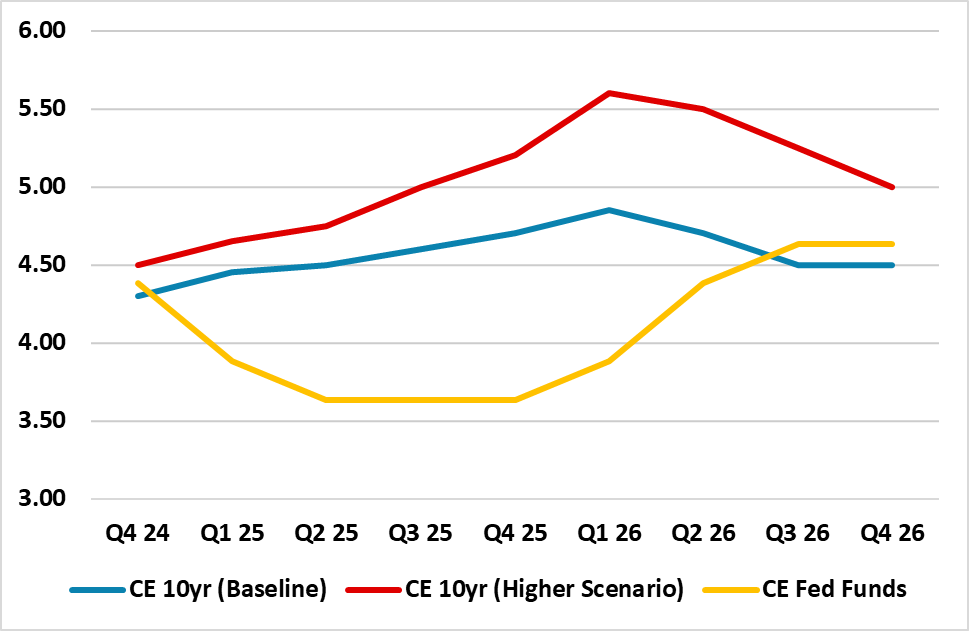

Figure 2: 10yr Baseline and High Yield Scenario (%)

Source: Continuum Economics

2026 could be worse however if the size of the budget deficit (circa 8-9% of GDP) and heavy issuance pushes medium to long dated yields up further than our baseline. Figure 2 shows our alternative scenario where these heavy funding pressures push 10yr yields up to 3% real yields and 10yr yields to a peak between 5.5-5.75%. This could produce a more severe derating of the U.S. equity market, especially if fears of a harder economic landing appear off the back of the yield shock and as it is politically difficult for Congress to do a partial U-turn with the November 2026 mid-terms approaching.

Big picture U.S. equity market valuations can diverge from real yields for some time, but if the divergence gets too large then it leaves the U.S. equity market highly vulnerable to a large P/E multiple derating and a sharp fall. In 1999-00 the forward price earnings ratio became detached from high real yields (Figure 1) and a mild recession was accompanied by a vicious bear market due to a sharp fall in the price/earnings ratio. Based on USD286 for 2026 S&P500 earnings, an 18 Fwd P/E ratio would be consistent with 5150 on the S&P500 and 16 Fwd P/E would be consistent with 4600. A spike in yields on heavy issuance could risk a bear market in 2026.