China: Only Moderate Fiscal Stimulus

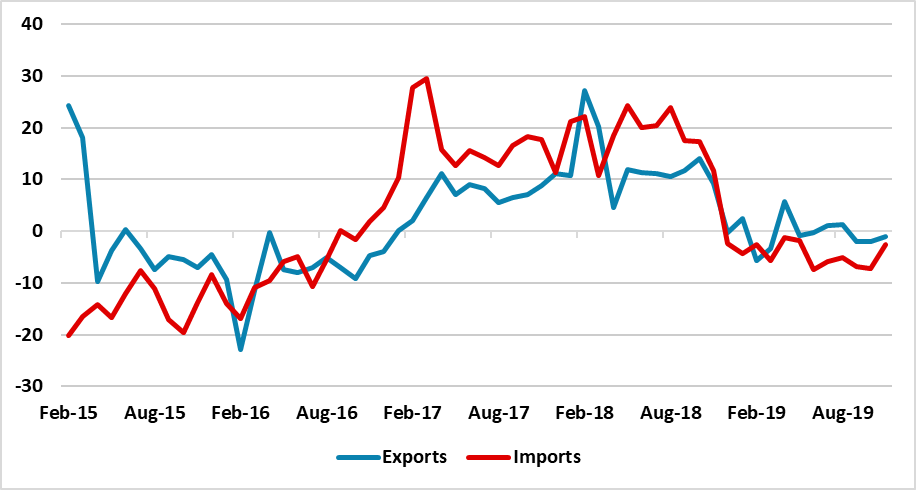

China announced some fiscal stimulus to help meet the expected 5% GDP target for 2025. Overall, we have not been surprised by the fiscal stimulus measures announced so far from the March NPC, that have been towards the lower end of expectations. However, officials on Thursday have hinted that more could come and we feel that the authorities will likely deliver some more fiscal easing once they have assessed the impact of U.S. tariffs. With the Trump administration having now added 20% to China exports to the U.S., the prospect is that net exports will likely subtract from GDP growth in 2025 – they were hit in 2018 (Figure 1). We maintain the view of 4.5% GDP for 2025.

Figure 1: Export and Imports Values USD (12mth % Change 2MMA)

Source: Datastream/Continuum Economics

The fiscal stimulus announced so far is broadly in line with expectations. Key points to note

· Bigger stimulus than 2024. An extra 1.4% of GDP in the budget (around Yuan2trn) is focused on demand stimulus up from 6.6% of GDP in 2024. This will likely include central government infrastructure spending and is the main part of the fiscal stimulus to reach the 2025 goal of 5% real GDP. The authorities also announced a target of 2% for inflation, rather than the previous 3% upper ceiling – given long-term fears over high inflation. Though this could be viewed as a more symmetric target, it is unlikely to be followed by monetary of fiscal policy that seeks to achieve 2% inflation. The inflation target will likely be more a reference and the key target will remain real GDP.

· Yuan500bln for bank recapitalisation. This is destined to boost equity capital/lending in the largest banks still further and make up for restrained credit supply from small and medium-sized banks. This is a positive development, given that M2 is a mere 7% (terrible by China standards). Some boost to lending is likely, but private household and business credit demand also needs to be boosted and less tangible measures are evident. The Yuan500bln is also smaller than the Yuan1trn suggested in the autumn.

· Domestic demand and consumer a focus, but. Emphasis in the statements on domestic demand and consumption to be boosted by income shows that the authorities understand the problems outside the residential property sector. However, the only tangible measure so far is a further Yuan300bln of cash for trade in, with no large-scale cash handouts to households or radical reform of structural safety nets for pensions, unemployment or health. Additionally, the government has so far not added extra fiscal funds to the purchase of complete and uncomplete housing, but last year’s measures are still feeding through to reduce the scale of the negative hit to GDP. Though Thursday press conference talked about a special campaign for consumption, we suspect that any extra measures will be incremental and insufficent. However, housing construction and wealth have not bottomed and this is a headwind for investment and consumption respectively. PBOC Pan on Thursday hinted at more rate cuts, but we feel that this will be modest at 10bps per quarter.

Overall, we have not been surprised by the fiscal stimulus measures announced so far from the March NPC. With the Trump administration having now added 20% to China exports to the U.S., the prospect is that net exports will likely subtract from GDP growth in 2025 – they were hit in 2018 (Figure 1). We maintain the view of 4.5% GDP for 2025.