Bank Indonesia to Look Beyond Recent Uptick in Consumer Price Index

Indonesia's Consumer Price Index (CPI) data released by the Central Statistics Agency (BPS) indicates a notable uptick in inflation, reaching 2.75% y/y in February compared to 2.57% y/y in January. The three-month high inflation rate was primarily propelled by surging food prices, aligning with expectations, especially in the context of record-high rice prices.

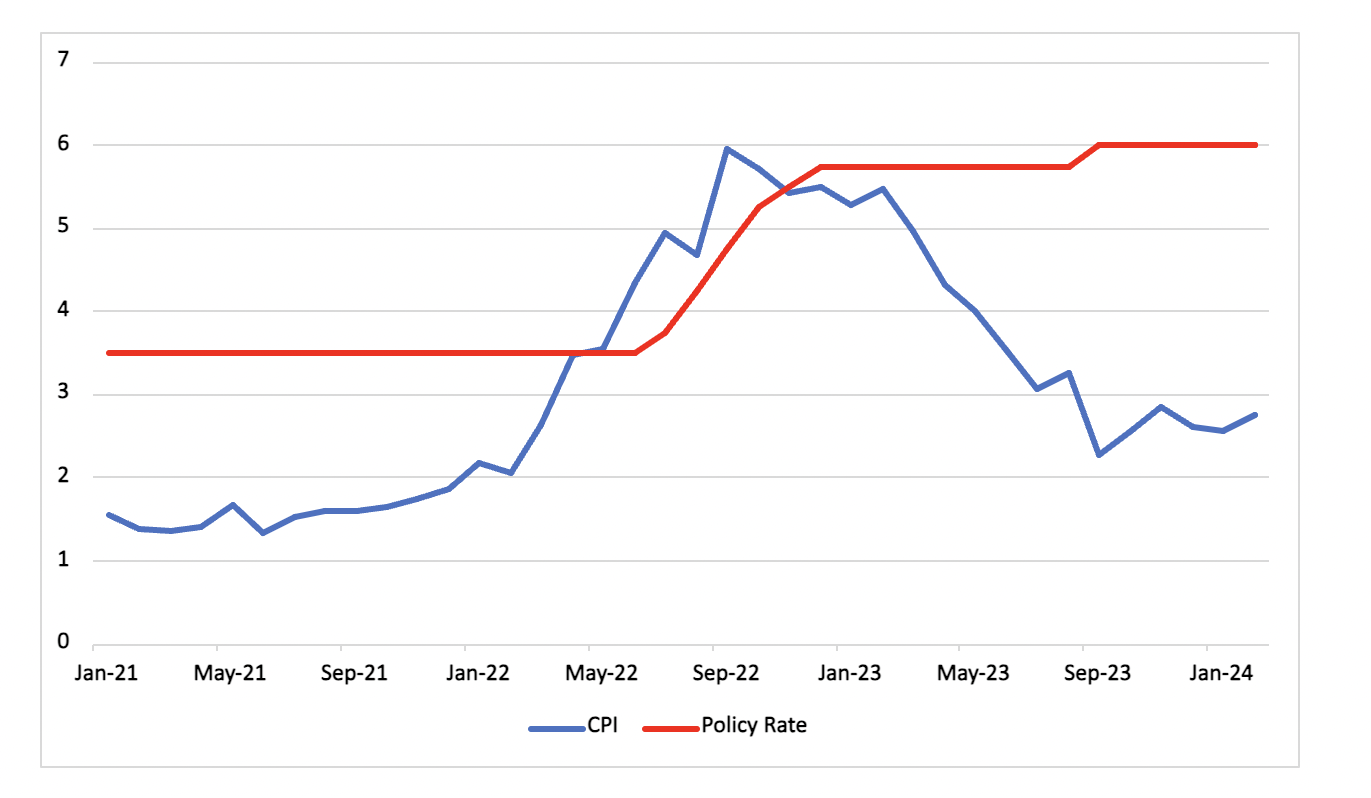

Figure 1: Indonesia Consumer Price Inflation (% y/y)

Source: Continuum Economics

Breaking down the data, the growth in food prices accelerated to 6.4% y/y in February from 5.8%y/y in January, contributing 0.2 percentage points to the headline inflation rate. Specifically, the inflationary pressures in the rice market remained elevated, experiencing a substantial surge of 19.3% y/y. Additionally, sectors such as healthcare, transport, and personal care witnessed a slightly accelerated inflation rate compared to the previous month. On the contrary, all other subsectors of the Consumer Price Index (CPI) reported a deceleration in inflation, with notable declines observed in clothing and footwear as well as household equipment.

Looking ahead, there is a likelihood that CPI inflation will continue to gain momentum, reflecting the persistent upward trend in rice prices. However, with the upcoming harvest expected to reach markets in late March, a temporary decline in inflation ahead of the Ramadan holiday may be observed. Beyond food prices, other inflationary pressures are anticipated to remain subdued.

Currency Concerns

Governor Perry Warjiyo of Bank Indonesia (BI) has expressed expectations of a weaker US dollar in the second half of 2024. He anticipates a 75-basis-point cut in the federal funds rate during this period, citing the weakening CPI inflation in the US. Downplaying concerns about the recent depreciation of the rupiah, Warjiyo suggested that the Indonesian currency would gain strength against the USD in the latter half of the year. This outlook raises the possibility of BI implementing rate cuts in the second half of 2024, while maintaining a stance of keeping the key rate steady until at least June.

Outlook

With CPI inflation now within the BI's target range, the central bank's focus has shifted towards ensuring the stability of the rupiah. Following a surprise rate hike in October, BI has maintained the key rate at a record high, anticipating signals from the US Federal Reserve regarding monetary policy adjustments. The recent CPI data is likely to be overlooked by the central bank and instead Warjiyo's comments reinforce our view of two potential rate cuts of 25bps each in H2 2024.