Waiting for China Fiscal Stimulus

It is not clear why China’s authorities are slow in announcing fiscal policy measures, but it could be either acceptance of 5% GDP trajectory or just below or alternatively a desire to see the timing and scale of extra U.S. trade tariffs on China from the incoming Trump adminstration. We see a total of Yuan3-5trn true fiscal policy measures coming in H1 2025, alongside further PBOC cuts in the 7-day reverse repo rate and RRR cuts. Overall, policy easing announcements in 2025 are unlikely to be enough to hit 5% growth and we stick with 4.5% for 2025 (here).

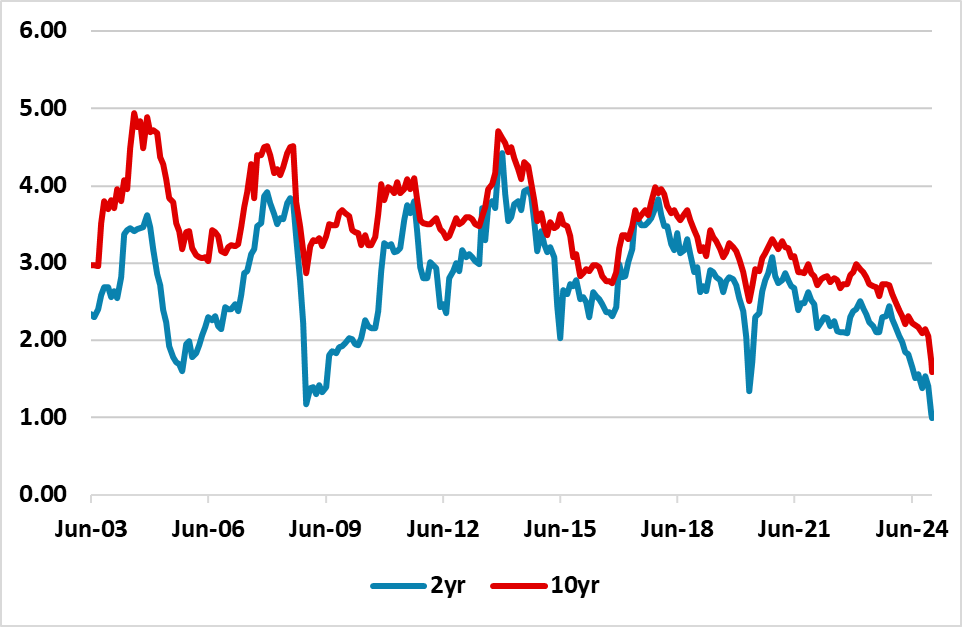

Figure 1: 2 and 10yr China Government Bond Yields (%)

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

China main fiscal stimulus has not yet seen clear policy details, despite the December Politburo and Workers council meeting statement. While certain measures have been announced (e.g. pay rise for public workers in January), they are targeted rather than a step-up in fiscal policy easing. One line of thinking is that China authorities are waiting to see specific trade tariffs from the incoming Trump administration before amending the size of the package. While this is feasible it could be that China policymakers are happy with a GDP outlook of 5.0% or just below for 2025, with President Xi says that growth is around 5% in his new year eve statement. Some state media have also been critical of the idea of speed fiscal policy announcements.

We do see a package of stimulative fiscal policy measures for 2025 including Yuan2-3trn infrastructure spending; Yuan1trn funds to buy completed homes for affordable housing and Yuan1trn capital injection to the big six state banks – see China Outlook (here). This is based on our view that the U.S. will threaten; then scale in tariffs incrementally, as the Trump administration seeks to get concessions from China. The total size of new measures that will likely be announced in H1 2025 are Yuan3-5trn. The Yuan6trn 2025-27 LGFV debt swap and Yuan4trn of 5 years of unofficial local government debt consolidation will also help growth on the margin, as they allow LGFV’s and local government to spend more normally rather than being debt restrained. Overall, this is not 2009 or 2015 aggressive stimulus and is designed to try to growth to 5%.

The problem for China authorities is that aggressive disinflation forces are becoming more ingrained. Production is outstripping domestic demand and putting downward pressure on prices, but also restrain wages and private sector employment. In turn this is another concern for households and suggests consumption will only see weak growth. The government bond market also looks like it fears deflation rather than flat prices (Figure 1). Interest rate cuts are not the answer, as a balance sheet restrained household and private business sector is less interest rate sensitive. While the PBOC has again signalled that it will likely cut the 7-day reverse repo rate from 1.5%, the PBOC is reluctant to consider ultra-low interest rates. Ultra-low interest rates would squeeze bank margins too much and restrain lending. The PBOC has also traditionally been reluctant to consider large scale QE and 2024 two side bond sales and purchases show that the PBOC is more fine tuning then set to start QE. Reports that the PBOC is also encouraging banks to do more risk-based lending as part of a long-term move to an interest rate-based system and move away from a broad lending push is also the wrong policy for current conditions.

Overall, policy easing announcements in 2025 are unlikely to be enough to hit 5% growth and we stick with 4.5% for 2025 (here).