Eurozone: Wages – Good News Comes in Threes?

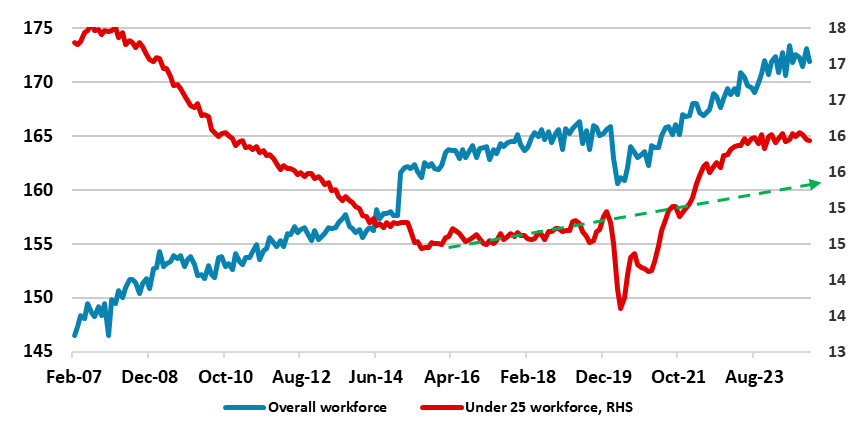

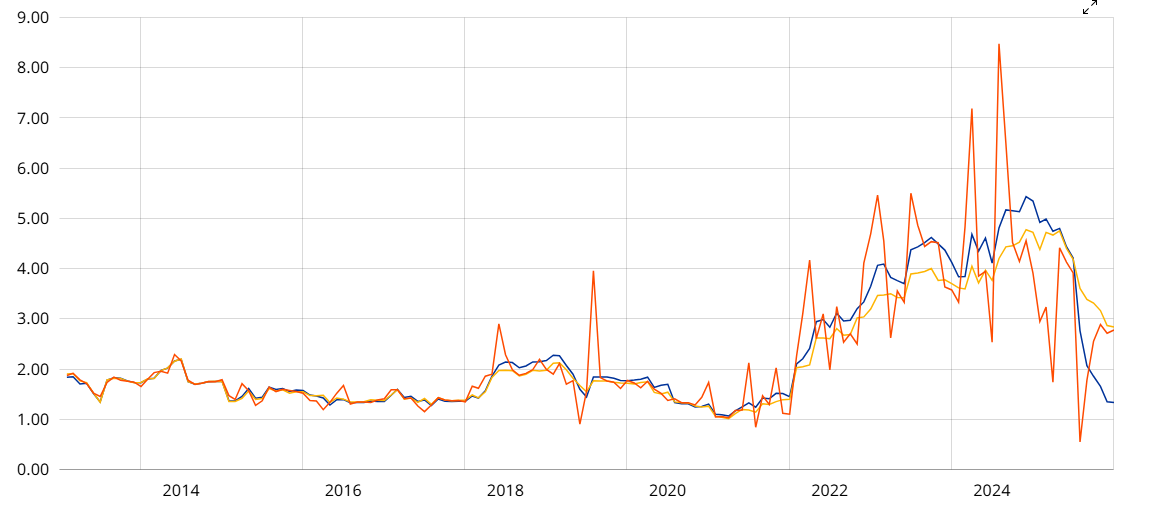

They say that good things often come in threes. For the ECB, Q4 data on negotiated wages just released adds to both INDEED compiled wage indicator and the central bank’s own wage tracker data in suggesting softening if not very muted cost pressures, something we attribute to the rising EZ labor sup backdrop we have flagged repeatedly (Figure 1). Indeed, the ECB wage tracker is actually suggesting wage pressures not only at a pace consistent with the inflation remit but back to pre-pandemic pace (Figure 2). All of which make further easing next month almost certain. It also suggests that policy should be taken back to neutral, although gauging the latter is difficult as it needs to take account of many factors over and beyond any particular reference rate. But the possibility is emerging that wage pressures may even undershoot the circa-3% pace embodied into ECB projections out to 2027. Admittedly, without a productivity revival (after he likely drop in 2024) this far from ‘guarantees’ unit labor costs growth of the 2% pace the ECB sees. But if there is continued weakness in real activity, this may also prevent the rebuild of profit margins that the ECB envisages from this year onwards.

Figure 1: Labor Supply Still Building

Source: Eurostat, CE, millions

In regard to wages, which are a key issue for the ECB s their recent resilience has been used to explain the stickiness of services inflation, there Has been more reassuring news. Negotiated wage data for last quarter slowed appreciably to 4.1% y/y, the second lowest reading in the current cycle. Negotiated wages are an important indicator in assessing if and how second-round effects develop. However, they do not tell the full labor costs story as they exclude bonuses, overtime, and other one-off factors all part of the bargainingprocess.

This why the ECB (justifiably) uses an array of wage indicators to assess the labor costs backdrop and outlook. One increasingly used measure is the monthly wage indicator produced by INDEED, the jobs searcher company. This has also produced more reassuring numbers into the current year, actually suggesting wage pressures (overall) below the circa3% pace most consider to be consistent with the 2% inflation remit. As such it tallies with the ECB’s own wage tracker numbers which offer insights into wages both with and without one off payments (Figure 1). As such they are a highly granular database of active collective bargaining agreements for Germany, Greece, Spain, France, Italy, the Netherlands, and indicate wage pressures that mechanically arise from the collective bargaining agreements already in place.

Figure 2: Wage Pressures Muted?

Source: --- ECB wage tracker, --- ECB tracker ex one-off payments, --- ECB tracker inc one-off payments

We think the softer wage developments of late stem from the increasing supply of labor as particularly the young have been attracted (back) in the labor market. Hence why soft wage pressures have emerged even given the apparent tightness of the labor market as hinted by a near-record low jobless rate backdrop (Figure 1). Regardless, this raises the possibility is that wage pressures may even undershoot the circa-3% pace embodied into ECB projections out to 2027. Admittedly, without a productivity revival (after the likely drop in 2024) this does not ‘guarantee’ unit labor cost growth of the 2% pace the ECB sees. But if there is continued weakness in real activity, which we think if highly possible into 2026, then the ensuing relative lack of demand may also prevent the rebuild of profit margins that the ECB envisages from this year onwards. They say that good things often come in threes. Well the ECB now has three alternative sources wag indicators all pointing I the same more benign direction and with at least two suggesting a wage growth backdrop in threes!