Bank Indonesia indicates H2 easing

In a bid to support the stability of the Indonesian economy and the rupiah, Bank Indonesia (BI) has opted to keep its benchmark interest rate unchanged at 6% in its latest monetary policy committee decision today (February 21). This decision aligns with BI's commitment to balance economic growth while monitoring potential inflationary risks, emphasising a cautious approach to currency vulnerability.

BI has injected about IDR 163tn in liquidity as of December 2023 and views economic recovery as intact with real GDP growth estimate for Indonesia unchanged at 4.7%-5.5% for 2024. Notably, credit grew at an accelerated pace of 11.8% y/y in January, marking the fastest rate in over a year, as banks redirected funds toward lending in their areas of expertise.

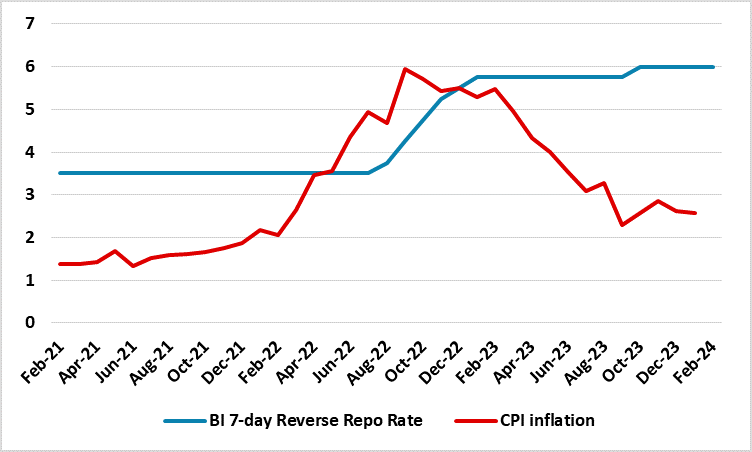

Figure 1: Indonesia CPI and Key Policy Rate (%)

Source: Continuum Economics

The IDR showed some election related volatility in recent months, but has been broadly stable since the election results last week. Despite the passing of risks associated with election uncertainty, BI remains vigilant about the currency's vulnerability, acknowledging that any weakness could contribute to imported inflation. The IDR has also experienced volatility, influenced by shifts in investor sentiment regarding the timing of a Federal Reserve rate cut, especially after strong US employment and inflation data this month.

Governor Perry Warjiyo stated that, with the Federal Reserve unlikely to pivot until the second half of the year, the pressure from rising US Treasury yields on emerging-market currencies, including the IDR, persists. BI aims to maintain currency stability and foster appreciation through interventions in various markets, including the spot, domestic non-deliverable forward, and bond markets. Additionally, the central bank will continue the strategic sale of IDR and US$ securities to attract inflows. Additionally, currency volatility is of concern in the context of a current account deficit; BI is anticipating a current account deficit in 2024, projected to range between 0.1% and 0.9% of GDP.

Speaking of price pressures, BI remains attentive to global supply chain disruptions that could elevate domestic food costs, potentially impacting inflation. The central bank is coordinating with the government to ensure that food prices do not disrupt BI's monetary policy direction. Headline inflation stood at a manageable 2.57% y/y in January, well within BI's target range of 1.5%-3.5% for the year, with the core gauge at a two-year low of 1.68% y/y.

Looking ahead, BI is cautiously observing the upcoming power transition as President Joko Widodo's term concludes in October. While early indications suggest incumbent defence minister Prabowo Subianto as the potential winner, BI emphasises its commitment to maintaining independence in decision-making, irrespective of campaign pledges that may impact government spending and debt.

However, while reaffirming the current policy stance of rate hold, BI Governor Perry Warjiyo expressed openness to potential policy rate cuts in the latter part of the year. BI appears inclined to observe the initiation of the Federal Reserve's rate cut cycle before implementing its own reductions. With expectations that the Fed might reduce rates by approximately 75bps in the latter half of the year, BI is likely to follow suit, aiming for a similar magnitude of policy rate reduction.

The prospect of a BI rate cut hinges on two key factors: the Federal Reserve's initial rate adjustments and the IDs maintaining a certain level of stability. Should both conditions be met, BI is poised to transition into an easing mode, providing an additional impetus to bolster growth momentum. For now, our forecast for policy rate remains unchanged in H1-2024. BI is anticipated to trim its benchmark policy rate in H2 with two small rate cuts of 25bps each to 5.5% by end-2024.