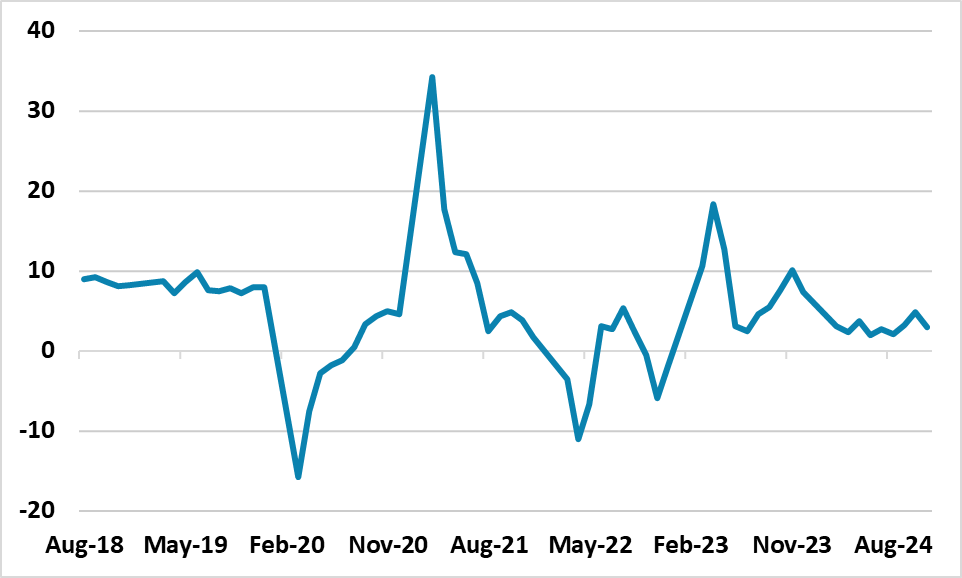

China Data: Retail Sales Disappoints

China November Retail sales disappointed with a low +3.0% Yr/Yr rise, due to broad based weakness outside of autos and home appliances – the latter boosted by trade in programs, which will likely be extended into 2025. The data underlines the imbalance between demand and supply, which argues for fiscal policy easing – though only some is likely to be targeted to households in Q1 2025 expected announcements.

Figure 1: China Retail Sales Yr/Yr (%)

Source: Datastream/Continuum Economics

The 3.0% Yr/Yr figure fell well short of the 5.0% expected, with the NBS saying this was due to the singles day shopping event partially being captured in the October figures whereas in previous years it had been all in November. Even so, the Oct and Nov average mth/mth change at 0.25% shows that the underlying pace of consumption is slow due to low consumer confidence amid fears over employment/wage growth and adverse housing wealth effects. Auto sales rose +6.6% and home appliances +22.2% Yr/Yr as trade in programs continued to help these areas. Though they will likely be extended into 2025, this is not enough in itself to boost overall consumption. Yr/Yr home sales did swing into positive territory for the 1 time since 2023 after September/October easing package, but the overhang of completed housing remains large and this kept house prices falling.

Though industrial production came out in line with expectations at +5.4% Yr/Yr, the imbalance with domestic demand suggests that disinflation pressures will remain aggressive and we see scope for CPI to swing to negative Yr/Yr reading in the coming months. Additionally, front loading of industrial production and exports to the U.S. due to tariff fears could sap industrial production growth in 2025.

Overall, the data underlines the need for stimulus, with fiscal policy likely to be the most effective. Given the December politburo statement (here), we could still get a 50bps RRR cut in December and 20bps cut in the 7-day reverse repo rate in Q1 2025. However, with households suffering balance sheet headwinds monetary policy effectiveness is in doubt. We look for the authorities to announce a Yuan 3-5trn set of fiscal stimulus in Q1. This will likely be mainly investment focused, with some household boost (low income family transfers and modestly improved structural safety nets). We stick with a 4.5% GDP forecast for 2025.