France Debt: Dependent on Non-Residents

Any further major fiscal slippage under a new government could prompt more of a reduction in French government bond exposure, which would likely mean a multi month/quarter risk premia for France and cause spillover difficulties for Italy. It is worth remembering that France is dependent on non-residents and has used debt to fuel growth since 2007, so the stock of French debt holdings is high.

France’s political situation is fluid before the two step parliamentary elections. Some initial reduction in exposure towards French debt has occurred, but it is worth remembering that France’s debt is dependent on non-residents.

Figure 1: France Non Resident Holdings High

| Non-resident holdings government debt (% of total) | Debt to maturity ave (years) | IMF projected Interest Rate-Growth Differential 2024-29 | Projected Budget Deficit 2024-29 |

France | 45.3 | 8.2 | -1 | -4.4 |

Germany | 40.8 | 6.8 | -1.5 | -0.9 |

Italy | 12.1 | 7 | 0.3 | -3.3 |

Japan | 25.4 | 8.4 | -2.2 | -3.8 |

UK | 24.1 | 14 | -0.4 | -3.7 |

US | 26.2 | 5.8 | -0.9 | -6.5 |

Source: IMF

Normally, French parliamentary elections have seen a swing away from the National Rally (NR) in the 2 round of voting, the next of which is due July 7. Centrist and left parties supporters combine via tactical voting to ensure that NR MP’s are limited. This was probably President Macron’s gamble that history would repeat itself.

However, opinion polls show that Macron’s Renaissance party is in 3 place, behind NR and the left/hard left Popular Front (PF). The next few weeks will be fluid and the centrists including centre right and left may not have the largest number of seats in parliament. Either NP or PF could have the largest number of seats. Neither appears willing to undertake fiscal consolidation required by the EU Commission and both have policies that could expand the budget deficit and risk instability.

It appears highly unlikely that any of the three political groupings will have an absolute majority and little prospect of any of the main blocs finding broad common ground except for a few issues. This point to ongoing political paralysis, especially as France cannot hold further parliamentary elections for 12 months.

This is not ideal, but is better than the worst case of a NP or PF absolute majority that could enact significantly different fiscal policies and risks a French budget crisis. However, this baseline scenario of political paralysis is not good news for the French bond market. France has been very good in the last 30 years at selling government bonds to non-residents, which in Q3 2023 were 45.3% of total government bonds outstanding (Figure 1) – around Eur1.1trn held by non-French residents. While the majority is likely to be other EZ countries, no currency risk exists and they could be slower than non EZ holders in reducing overweight positions of French government bonds. However, bond portfolios could decide to keep underweight positions in France until the political situation becomes clearer and this could mean intermittent selling throughout 2024 that keeps 10yr France-Germany spread elevated.

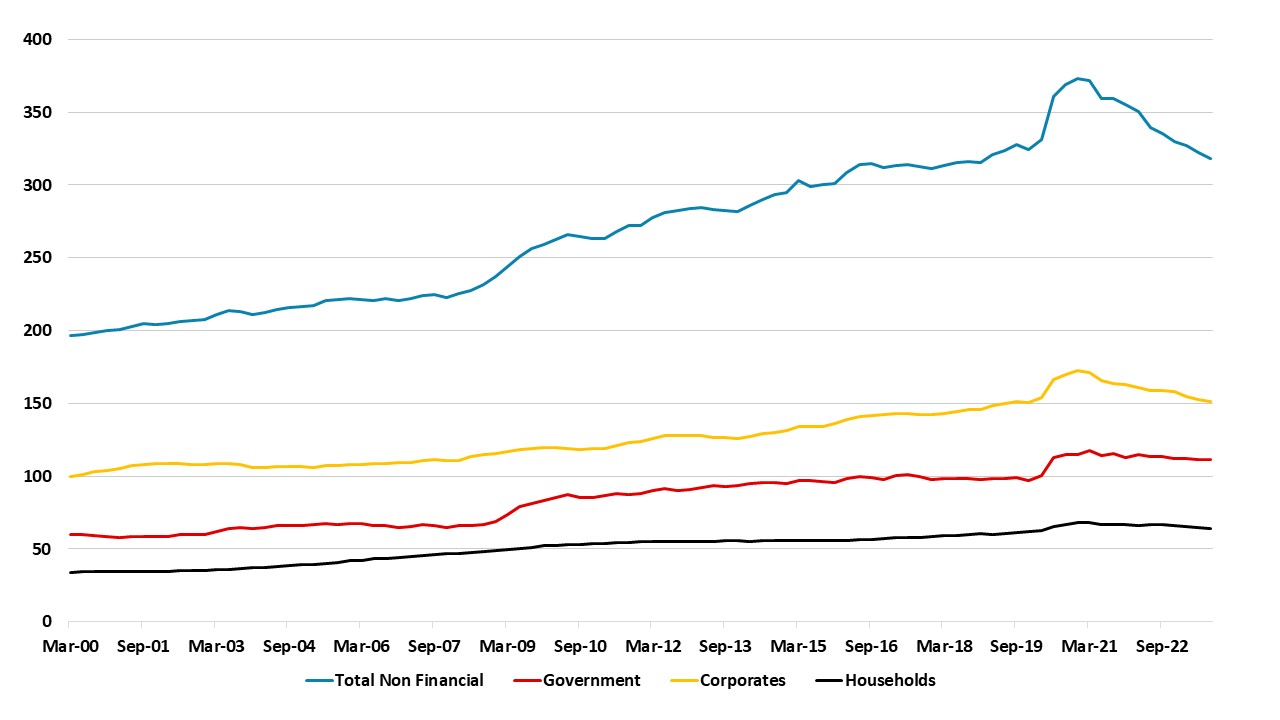

The French corporate and banking sector have also borrowed from nonresidents as well. As we previously noted (here), France government/corporate/household debt has surged since Q1 2007 (Figure 2) by 96% -- equal to Japan and only surpassed by China. France net international investment position is -23.6% of GDP in 2022, which is manageable. However, the IMF external sector review has warned that the gross liabilities of French entities is high at 325% of GDP – Italy is 170.5% for comparison. This has helped sustain French real and nominal GDP growth, but the debt hangover risks being a drag on French growth later in the decade if fiscal credibility is not reestablished.

Figure 2: France Debt/GDP Total and Key Sectors (%)

Source: BIS

This are also wider EZ implications. In theory, Spain or Portugal could trade below 10yr France given better government debt/GDP trajectories, if bond portfolios rotate away from France. This could be more difficult in practice as France is so important in the EZ. Meanwhile, Italy has a higher government debt/GDP and a rising trajectory, which likely means French 10yr yields plus a yield premia are required.

Meanwhile, though the ECB has the transmission protection instrument (TPI), activation for an EZ country would require the ECB to be comfortable about fiscal consolidation plans. TPI is also a double edge sword, as any prospect of its usage could accelerate portfolio shifts out of an EZ government bond market. The stakes are high for the 2 round of the French parliamentary elections.