Mexico CPI Preview: Well Behaved March

On April 9th, Mexico's National Institute for Statistics will release March's CPI data. Forecast suggests a 0.4% rise, keeping YoY CPI stable at 4.5%, mainly due to base effects. Core CPI likely to remain steady at 4.5%, showing progress in disinflation despite non-alignment with Banxico's 3.0% target. Negative inflation expected for the next two months due to seasonal energy price changes. Despite Banxico's rate cuts, tight monetary policy persists, aiding inflation reduction. Labor market heat and government fiscal policies pose ongoing risks.

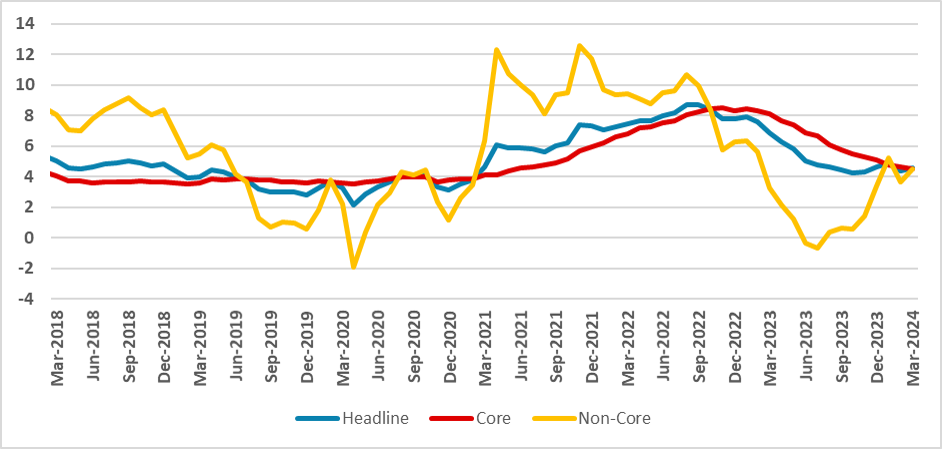

Figure 1: Mexico’s CPI (%, Y/Y)

Source: INEGI and Continuum Economics

On April 9th, the Mexico National Institute for Statistics will release the CPI data for March. We are forecasting the CPI to have increased by 0.4% (m/m) in March, and therefore, the YoY CPI is likely to have remained stable at 4.5%, mostly due to base effects. In the first half of March, the Bi-weekly CPI has shown that the non-Core component of the CPI has increased in both of its groups (food and energy). This comes after a strong drop in food prices in February.

Core Goods and Services are likely to have behaved according to their seasonality for March, with both growing by 0.3% and 0.4%, respectively. This will likely lead Core CPI to remain stable at 4.5%. Both Core and Non-Core YoY CPI are likely to be at 4.5%, which, although not aligned with the Banxico target (3.0%), shows significant progress in the disinflation process. It is also important to remember that in the next two months, Mexico CPKI is likely to register negative inflation. This occurs due to the seasonality of those months on energy prices, which are likely to revert the upswing seen in the winter due to the higher demand for electricity, which will likely put YoY Inflation below the 4.0% mark.

In terms of monetary policy, it is important to remember that although Banxico has already begun the cutting cycle but the high level of interest rates will still keep the monetary policy tight for quite a long time, which will also contribute to easing inflation. Once the seasonal effects subside, it will be clearer for Banxico that the disinflation will be on the right track to converge to the Banxico level target of 3.0%. However, some risks still persist as the labor market continues to show signs of being hot and the fiscal impulse promoted by the government, which could have inflationary effects.