Turkiye Inflation Review: CPI Further Cooled Off to 51.9% in August

Bottom line: After easing to 61.8% y/y in July down from 71.6% annually in June, consumer price index (CPI) cooled further down to 51.9% y/y in August backed by the favourable base effects, tightened monetary and fiscal policies, additional macro prudential measures and relative slowdown in credit growth helped relieving the pressure on the inflation. We expect the falling trend will continue in September on base effects while and-year inflation will likely hit around 43% despite Central Bank of Turkiye’s (CBRT) year-end inflation forecast remains at 38%. We don’t expect cautious CBRT to start cutting rates in the rest of 2024 until there is a sustained decline in the underlying trend of monthly inflation is observed.

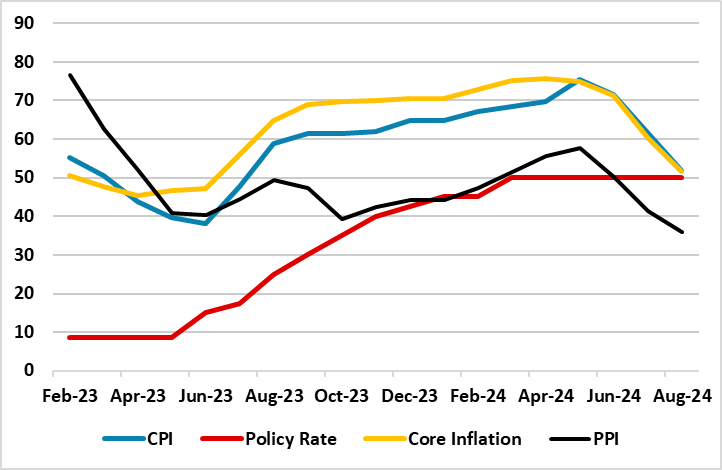

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), February 2023 – August 2024

Source: Continuum Economics

Turkish Statistical Institute (TUIK) announced August inflation figures on September 3. Accordingly, CPI cooled down to 51.9% y/y in August, reaching its lowest level in the last thirteen months as CPI traditionally eases in Turkiye during summers, as energy consumption falls, current account deficit falls, and tourism brings in foreign currencies.

When annual rate of changes (%) in the CPI’s main groups are examined in August, transportation with 28.9% was the main group with the lowest annual increase while education recorded the highest annual increase with 120.8%. It is worth mentioning that housing (101.5%), hotels, cafes and restaurants (67.7%) also recorded remarkable YoY increases.

While the annual inflation rate eased in August, it rose by 2.47% MoM compared to July. Core inflation (CPI-C) recorded a 3.0% MoM increase, scaling up to 51.6% on an annual basis. The domestic PPI was up 1.7% MoM in July for an annual rise of 35.8%, the data showed.

Treasury and Finance Minister Mehmet Simsek highlighted the progress of disinflation with August figures on September 3 saying that inflation will continue to drop by year’s end. “Thanks to strengthened financial stability, economic adjustments, and improved expectations, we anticipate a reduction in the monthly inflation trend in the last quarter. Consequently, we project that inflation will fall within the forecast range by year’s end,” the minister said.

CBRT released the third quarterly inflation report of the year on August 8, and held its year-end inflation forecast unchanged at 38%. CBRT’s forecast for end-2025 is still at 14%, while inflation is seen falling to 9% by the end of 2026. CBRT sees a slowdown in domestic demand in the rest of Q3 in addition to the decrease in the current account deficit and an improvement in external trade, said the report. The report highlighted that the slowdown in credit growth has become more pronounced as a result of monetary policy decisions and other steps supporting the monetary tightening process.

According to the results of the Survey of Market Participants in August, inflation expectations for the current year-end and the end of the next year edged up by 0.3 and 0.2 ppt to 43.3% and 25.6%, respectively. We continue to think that it would be very hard to achieve this figure by the end of 2024 as our forecast for the annual average inflation remains at 58.8% and 35.3% in 2024 and 2025, respectively.

Additionally, according to the CBRT’s summary of the MPC meeting released on August 27, CBRT stated that the regulator remains highly attentive to inflation risks, and indicated that the tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is observed. CBRT emphasized that the despite goods inflation is declining, the stickiness in services inflation, inflation expectations, and geopolitical developments keep inflationary risks alive.

As CPI further softened in August, we foresee that favourable base effects coupled with tightened monetary and fiscal policies, lower credit growth, and additional macro prudential measure will continue to dominate the inflation outlook and help relieve the CPI in September, but the extent of the decline will be determined by administrative price adjustments and TRY volatility. (Note: It is worth noting that TRY lost %3 of its value against the U.S. dollar after relative stability underpinning the inflation relief between March and July). In spite of aggressive monetary tightening helping inflation relief in Q3, we think stickiness in services inflation, deterioration in pricing behaviour, and inflation expectations will continue to cause pressure on the general level of prices in the rest of Q3 and Q4.