China Politburo: Help for Housing, But No Game changers

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.

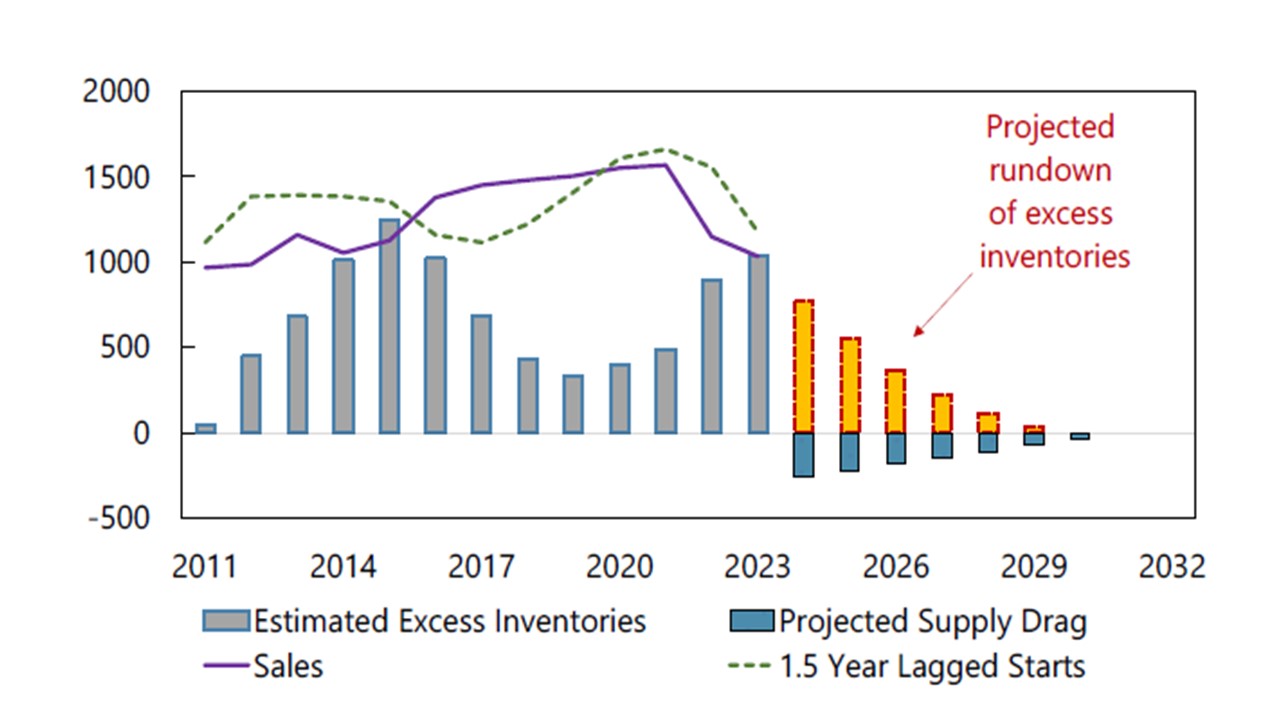

Figure 1: 1yr MLF and LPR and 5yr LPR (%)

Source: PBOC/Continuum Economics

The late April China Politburo meeting has raised speculation that China’s authorities will provide extra support for the battered residential property sector. The statement emphasized that the authorities would study ways to digest the housing stockpile and monetary policy should use interest rates and RRR flexibly. However, action will likely be incremental rather than radical.

Monetary policy more widely is still expected to be prudent, which reflects a desire to avoid overstimulation or to hurt the Yuan (here). Interest rate cuts could still come through a reduction in the 5yr LPR rate rather than the 1yr LPR or medium term lending facility (MLF). Given the politburo statement a 10bps cut in the 5yr LPR could arrive in May. The statement also points to the RRR as well and a 25bps cut could arrive June or July. Nothing more radical is likely given that real GDP prints are consistent with 4.5-5.0% growth in 2024 and some further fiscal policy will come through with the Yuan1trn special sovereign bond issue for infrastructure.

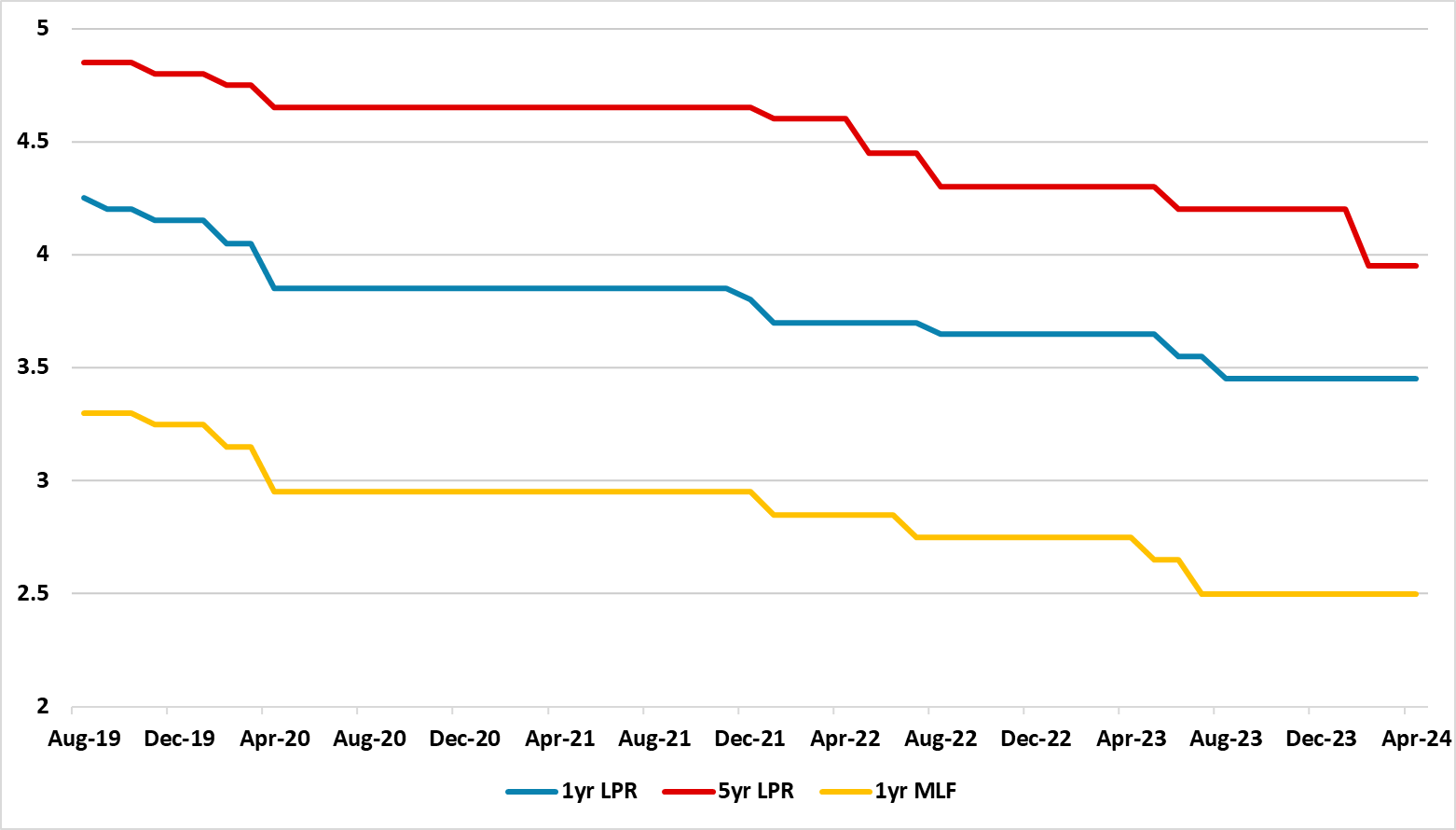

Figure 2: IMF Estimate of Developers Excess Inventory (Mln SQM)

Source: IMF 2024 selected issues (here)

The 2 area of help can come through a reduction in excess housing inventory, which is more evident in tier 3 than tier 1 or 2 cities. This is easier said than done, with the IMF in a recent estimate suggesting this will be an overhang until 2030 (Figure 2). Excess complete inventory, plus frozen partially build housing stock, is sapping house builders and buyers confidence. Game changing solution would be a) nationalizing all developers to support buyers confidence and manage an orderly reduction in inventory; b) Relaxing Hukou laws to allow rural workers to buy in tier 3 cities, though buying incentives or government subsidies would also be required; c) Quick sale of excess housing inventory, though this would require significantly lower prices and could hit buyers sentiment in the interim.

None of these options looks to be on the table. Instead, it is more likely that piecemeal options will occur that help reduce the excess housing inventory. This will help on the margin, but is not a game changer. Overall, we still see house builders and household sentiment remaining depressed and this will likely mean that residential property investment remains a drag on GDP in 2024-25. This is one of the reasons why we see 4.0% GDP growth in 2025.