Elevated Inflation in Russia Remains Persistent and Sticky in October

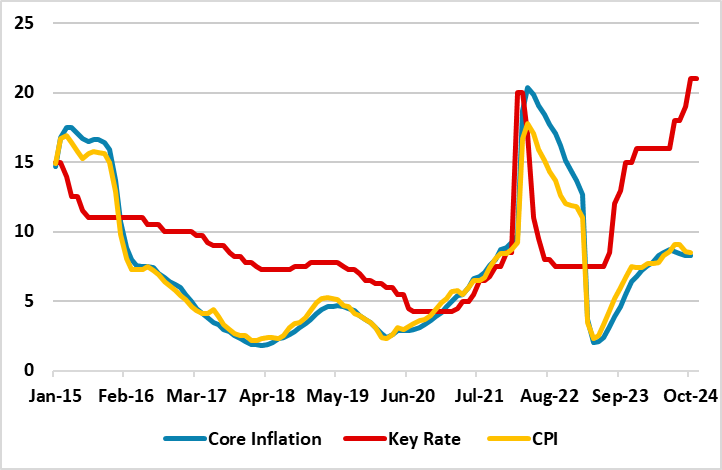

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data released on November 13, inflation slightly cooled off to 8.5% YoY in October after hitting 8.6% in September but remained well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices, weakening Ruble (RUB), elevated inflation expectations and huge military spending.

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – October 2024

Source: Continuum Economics

According to Rosstat figures, the inflation rate continued to stay high at 8.5% YoY in October. MoM price growth fastened to 0.75% in October from 0.5% in September driven by the services prices, which surged by 9.7% and 9.5% in annual terms, respectively. According to Rosstat, prices of nonfood goods went up by 5.7% YoY while the food prices rose by 9.0% YoY and 1.2% MoM in October.

October inflation remained far above CBR’s medium term target of 4% and on the upper bound of the CBR’s 2024 forecast range of 8.0-8.5%. (According to the CBR’s estimate as of October 21, annual inflation is expected to be in the range of and 4.5-5% by the end of 2024 and 2025, respectively).

Despite aggressive tightening continues with pace in Russia as the CBR decided to lift the policy rate by 200 bps to 21% during the last MPC meeting given inflationary risks and its hawkish forward guidance, it appears the economy remains overheated as the growth in domestic demand is still significantly outstripping the capabilities, military spending is growing, RUB is weakening, and inflation expectations is on the rise igniting persistent price pressures. (Note: The inflation expectations reached 13.4% in October from 12.5% in the previous month). As restrictive monetary policy partly suppresses prices with lagged impacts, we feel cooling off inflation will take longer than CBR anticipates since inflation expectations of households and businesses continue to edge up and higher market rates had not yet fully affected the lending dynamics as activity in the corporate segment of the credit market remain high.

The weakness of the currency continues to adversely impact inflationary expectations and pressures. RUB weakness remains as a major concern over the inflation trajectory as RUB weakened by around 20% against the dollar in 2023, and lost 2% of its value just in October. We expect RUB will remain weak and volatile the rest of 2024 since the sanctions continue to hurt.

According to the summary of CBR’s October MPC meeting summary released on November 6, the policymakers agree on the need to reinforce a tough signal due to growing inflation risks and to prevent premature expectations of an end to the tightening cycle. “While a rate hike at the next meeting is not predetermined, its probability is very high,” the bank noted, leaving the door open for a further rate hike during the MPC scheduled on December 20. The Bank’s governor Elvira Nabiullina has also recently warned that more drastic changes to monetary policy may be necessary to get inflation back under control.

It appears that mentioned economic strains are going to ease any time soon and the CBR will likely have hard times in Q4 and H1 2025 until inflation starts cooling off, RUB stabilizes and inflation expectations would converge to CBR’s forecasts. Given CBR’s hawkish forward guidance, we now think it will not be surprising if CBR will decide to hike the key rate to 22% on December 20 basically to curb the sticky inflation.