UK GDP Review: Momentum Moderating?

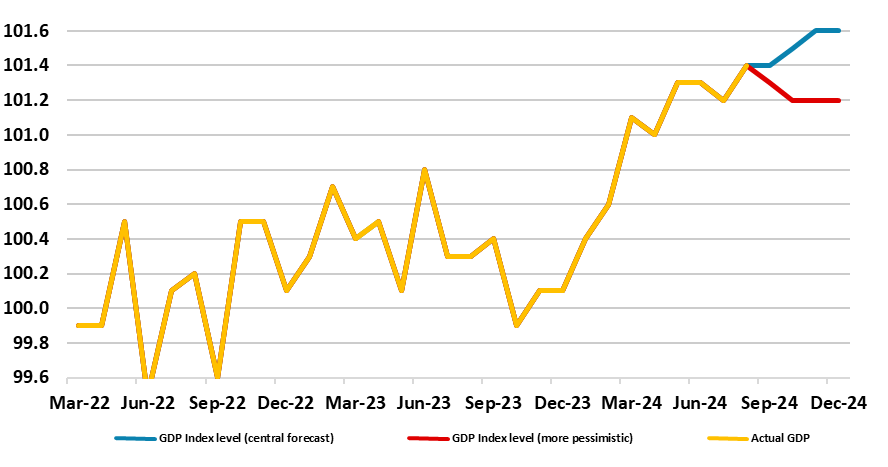

Much has been made of the UK’s economy’s apparent solidity, if not strength, so far this year given sizeable q/q gains in the first two quarters of the year of 0.7% and 0.5% respectively. But this may be something of a flash in the pan, not least as GDP growth has been positive in only two of the last five months of data with flat and pared-back readings in both June and July before this better August outcome (Figure 1). Indeed, in August GDP rose by consensus 0.2% m/m rise, in line with an already reported rise in retail sales, helped by more normal seasonal weather. Even with a further small rise likely to September, we see Q3 GDP rising by no more than 0.2% q/q, a notch below both the BoE projection for the quarter and the BoE estimate of an underlying pace – and with downside risks also to the 0.2% Q4 projection we have (Figure 1).

Figure 1: Momentum Ebbing??

Source: ONS

Monthly real gross domestic product is estimated to have grown by 0.2% in August 2024, after showing no growth in July 2024. Real GDP is estimated to have grown by 0.2% in the three months to August 2024 compared with the three months to May 2024. Services output grew by 0.1% in August 2024, following an unrevised increase of 0.1% in July 2024, and grew by 0.1% in the three months to August 2024. Production output grew by 0.5% in August 2024, following a revised fall of 0.7% in July 2024 but showed no growth in the three months to August 2024. Construction output grew by 0.4% in August 2024, following an unrevised fall of 0.4% in July

Regardless, the lack of growth in Jun/Jul has created a soft base effect for Q3 growth which we see advancing just 0.2%, a notch below the BoE estimate and maybe even weaker. Indeed, September GDP would have to rise by at least 0.4% in order for the BoE projection to prove accurate! This weaker immediate GDP backdrop is something that chimes more with labor market and public borrowing data and where HMRC payrolls paint a much softer backdrop and possible outlook that also conflicts very much with PMI survey numbers. Indeed, it could be argued that the labor market data (probably alongside growing fiscal considerations) may have had more impact on BoE thinking, this possibly one factor that persuaded Governor Bailey to hint at more aggressive rate cuts despite the resistance of his Chief Economist.