Inflation Falls Less Than Expectations in November: 47.1% YoY

Bottom line: Inflation was higher than expected at 47.1% annually in November as food prices and housing costs continued to build. We envisage that inflation will continue to decelerate in December and in Q1 2025 by moderate slowdown in domestic demand and credit growth, but the extent of the decline will be determined by minimum wage hike in January, administrative price adjustments and TRY volatility. We think November inflation reading significantly reduces the prospect of an interest rate cut later in December, as we continue to foresee the first cut will happen in Q1 2025.

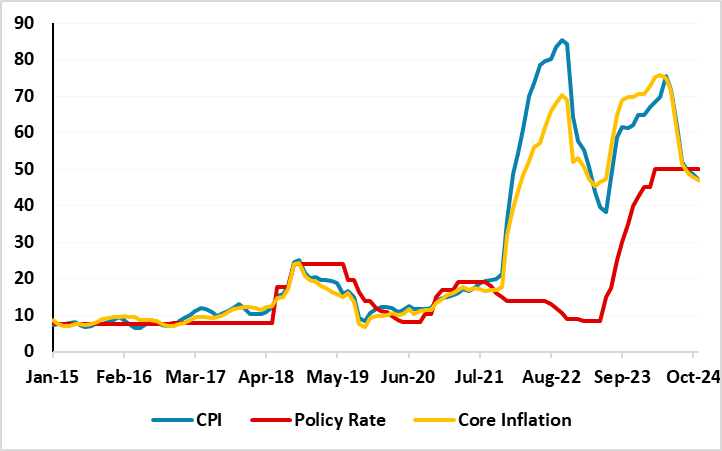

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – November 2024

Source: Continuum Economics

As we expected the deceleration trend in inflation continued in November supported by moderate slowdown in domestic demand and relative TRY stability. (Note: TRY lost 0.1% of its value against the U.S. dollar in November). CPI cooled off to 47.1% y/y in November from 48.6% in October, but slower less-than-expected.

MoM inflation rose by 2.24% in November as monthly inflation stood at slightly above expectations. The largest contributor to the headline inflation was food prices which surged by 5.1% MoM. Core inflation (CPI-C) recorded a 1.5% MoM increase, scaling up to 47.1% on an annual basis. November core inflation reading marked the best figure since September 2021, which was better than expectations. PPI stood at 0.7% MoM, demonstrating a drop to 29.5% YoY from the month prior which was driven by energy prices.

When annual rate of changes (%) in the CPI’s main groups are examined in November, transportation with 26.2% was the main group with the lowest annual increase while education recorded the highest annual increase with 92.5%. It is worth mentioning that housing (74.5%), hotels, cafes and restaurants (59.4%) also recorded remarkable YoY increases. Services maintained their downtrend to 67.9% YoY with continuing signs of improvement.

Commenting on the inflation print, Treasury and Finance Minister Mehmet Simsek highlighted that “The decline in services inflation and improving inflation expectations show that we have made significant progress in reducing rigidities.”

After its policy meeting last month, it is worth noting that the CBRT said it would set its rate to ensure the tightness required by the projected disinflation path, setting the stage for a cautious easing cycle. Under current circumstances, we expect cautious and hawkish CBRT to start cutting rates in Q1 2025, -not on December 26-, considering higher-than-expected November figure signalling ongoing challenges to disinflation efforts. We think CBRT will consider cutting rates if there is a permanent improvement in annual CPI as signalled by CBRT deputy governor Cevdet Akcay. (Note: Thus, our end year key rate prediction remains 50.0% for 2024, and 30.0% for 2025 given residual inflationary risks, and we believe 500bps cuts in every quarter in 2025).

As CPI continued to soften in November ignited by lagged impacts of aggressive tightening, slowdown in credit growth and relative TRY stability underpinning the inflation relief, we envisage that inflation will continue to decelerate in December and in Q1 2025, but the extent of the decline will be determined by minimum wage hike in January, administrative price adjustments and TRY volatility.