Brazil CPI Review: Food and Energy Drive Inflation Up

Brazil’s October CPI rose 0.56%, pushing the year-over-year rate to 4.7%, above the Brazilian Central Bank’s (BCB) 4.5% target. The increase was driven by food and housing costs, especially due to rising electricity tariffs impacted by low hydroelectric reservoir levels. Although core CPI remains stable, inflation pressure from food and energy prices is likely to persist due to climate conditions. BCB is expected to continue rate hikes, aiming for a policy rate of 12.25% the end of the hiking cycle.

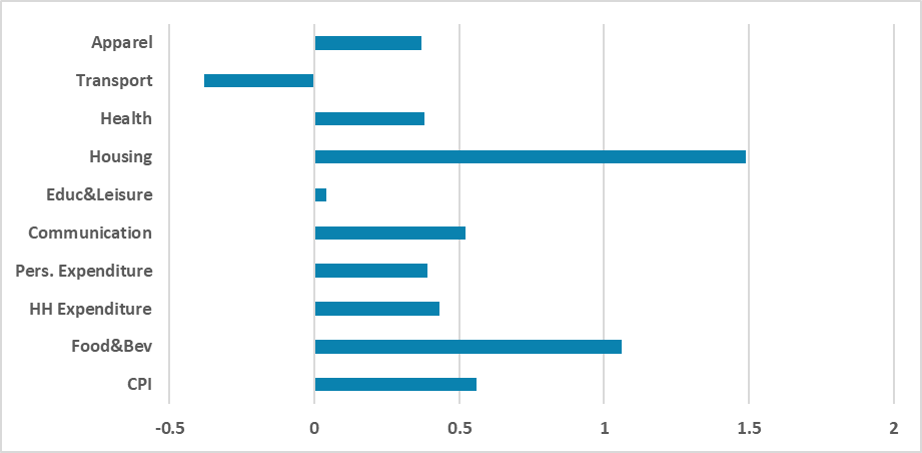

Figure 1: Brazil’s CPI (m/m, %)

Source: IBGE

Brazil's National Statistics Institute (IBGE) has released the CPI figures for October. The data shows that the CPI increased by 0.56%, bringing the year-over-year index to 4.7%, up from 4.5% in September and surpassing the upper bound of the Brazilian Central Bank (BCB) target (4.5%). The main contributors to October's CPI increase are the Food and Beverages group and the Housing group, heavily influenced by rising electricity tariffs due to low reservoir levels in hydroelectric plants as a result of adverse climate conditions. The Housing group’s CPI rose by 1.5% in October and has accumulated a 6.1% increase over the past year.

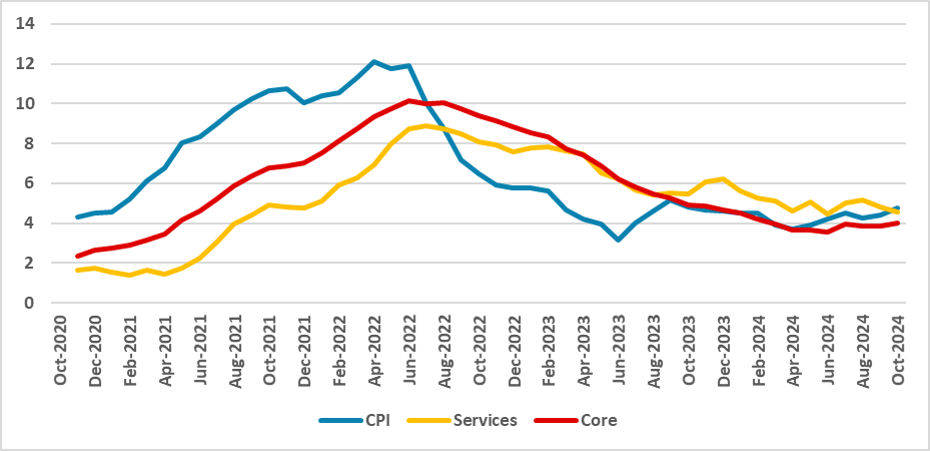

Figure 2: Brazil’s CPI (Y/Y, %)

Source: IBGE

The Food and Beverages group rose by 1.1% during the month, mainly driven by a rise in meat prices (+5.6% for the month). Its year-over-year CPI rose to 6.7%, marking it as the group with the largest increase over the past 12 months. The Transport group, however, dropped by 0.4% in the month, reflecting lower airfare ticker prices, which fell by 11%. The Services CPI grew by 0.35% month-over-month, while its year-over-year index decreased from 4.8% to 4.5%, which is positive news for the BCB, as this index is closely monitored by them.

Overall, the index has demonstrated favorable behavior, indicating a transitory pattern influenced by climate conditions. However, uncertainties remain regarding when a reversal might occur. Additionally, although the exchange rate has remained depreciated, this has yet to translate into higher inflation rates. So far, the inflation rise seems primarily influenced by food and energy prices, which the BCB has limited ability to control.

Looking ahead, inflation is likely to remain pressured by food and energy prices due to weather conditions, although core CPI continues to perform well. We are forecasting the CPI to finish the year at 4.7% year-over-year, exceeding the BCB’s upper target. We believe this outcome will not significantly alter the BCB’s hiking strategy, as we anticipate the BCB will continue to raise rates until the policy rate reaches 12.25%.