U.S. Election – Initial Thoughts

A Trump victory is now widely expected with results so far and has prompted knee jerk reaction in markets with U.S. Treasury yields and USD higher. Policy uncertainty is high over tariffs, though the 2017 tax cuts will likely be renewed with some additional tax cuts elsewhere -- House race is tight but expected to be GOP. Tackling immigration will also be a policy priority, but the scale of action is unclear. Two potential paths are either that Trump enjoys being reelected and policy action is less than feared or alternatively an aggressive tax cutting/tariff and deportation route is implemented that proves economically disruptive. House outcome/Cabinet and key personal appointees, but also executive orders after the inauguration in January will set the tone for policy and markets.

The initial results from the U.S. elections haves seen the Republicans win the Senate and run ahead in the Presidential race and House. What are the policy implications?

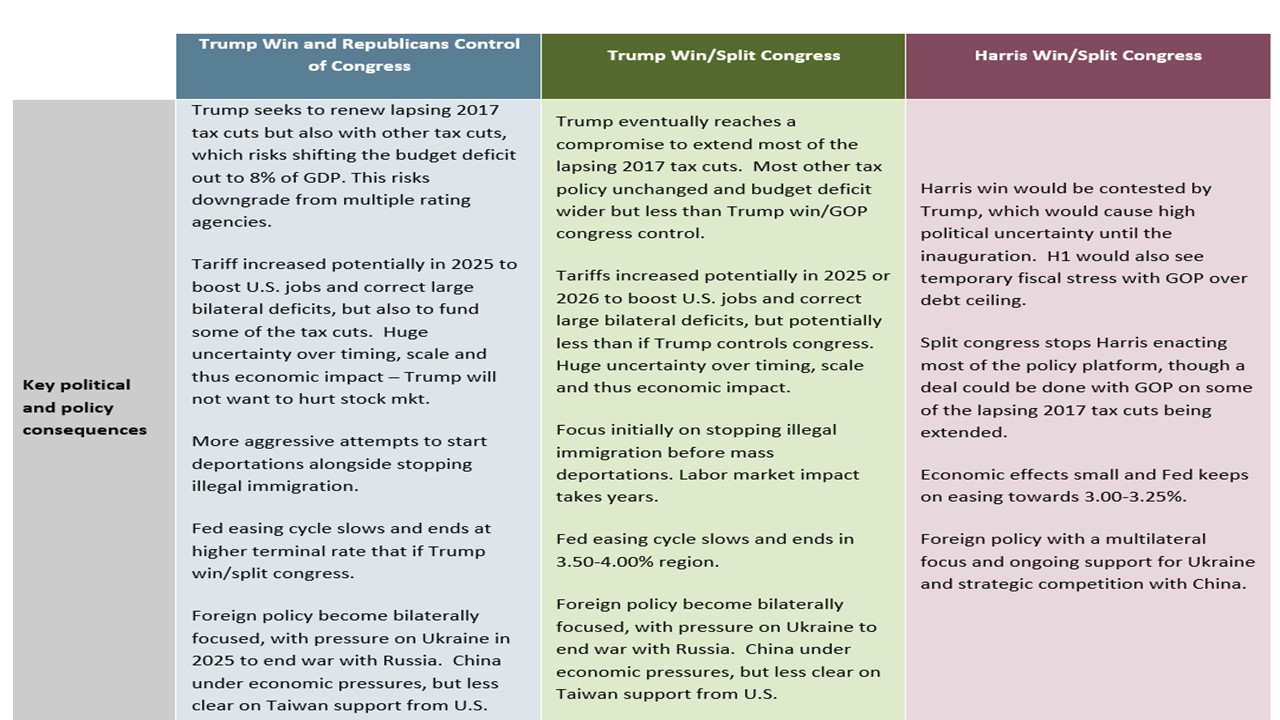

Figure 1: Main U.S. Election Scenarios

Source: Continuum Economics

A Donald Trump victory as president is widely expected after voting results show a better performance in voting so far than 2020, with the possibility that Wisconsin or Michigan could vote for Trump and cut off any route to a Harris victory. The Senate has already gone to the Republicans, with projections they could take a better than expected 55 seats. Finally, the betting markets are biased to a House victory for the Republicans, given the votes counted so far and the momentum for the Republicans in the presidential and Senate races. This all means that markets are already leaning into a Republican clean sweep (LHS Figure 1). While results are still coming in (and the House will not be clear for a couple of days), what are the implications for a Republican clean sweep?

Much depends on the House outcome and then Donald Trump’s decisions in the coming months re the cabinet and key personal in Congress (here), but also executive orders after the inauguration in January – which will set the tone for policy and markets.

A win for Trump would inject a large degree of extra uncertainty to the policy picture. On the campaign trail, Trump’s promises for tax cuts were getting increasingly more aggressive. Some, such as making his 2027 cuts permanent would clearly be a priority while others, such as excluding Social Security benefits from taxation, look less likely to be. However, Trump is clearly looking to cut taxes and has few serious proposals to reduce spending. Deficits of 8% of GDP look plausible if the Republicans also have a clean sweep, enough to cause real concern in the U.S. Treasury market and for the rating agencies.

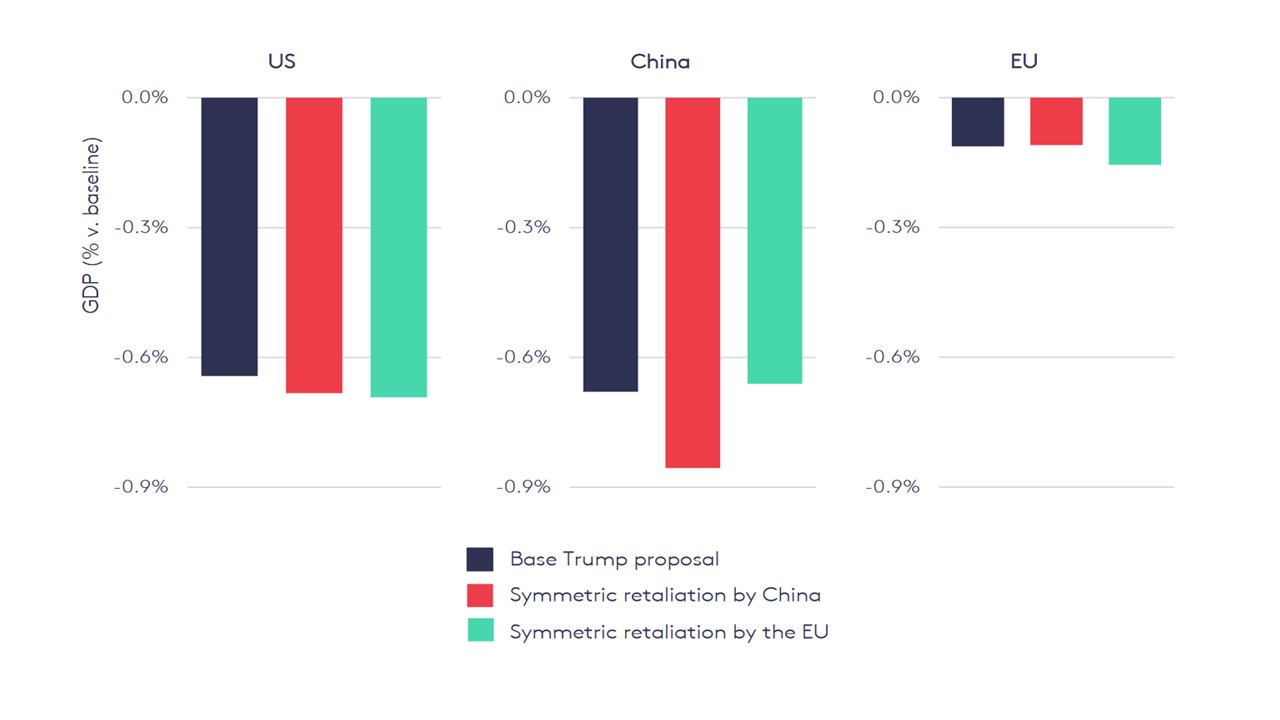

However, as Trump escalated his tax cut proposals, he also increasingly pushed tariffs as a means to pay for them, now suggesting 20% across the board rather than his original 10% suggestion with rates of 60% on China. A large increase in tariffs could, even with a reduction in imports, raise over 2% of GDP in revenues, but much of this would be a passed onto prices. Tariffs, which would surely see retaliation against US exports, would probably be a net negative on GDP. While the economy appears to have enough underlying strength to stay out of recession, Trump’s tariff proposals carry large risks. Simulation by the IMF (here box 1.2) and the LSE (Figure 2) shows similar adverse GDP impacts on the U.S. from a trade war and higher prices depressing GDP growth.

Figure 2: GDP effects of Trump Tariffs and Retaliation (% of GDP)

Source: LSE (here)

Whether Trump would go ahead if highly uncertain. He has the authority to do so if he invokes national security concerns. However, some Republicans will warn him that aggressive tariffs would weigh on equities, which Trump cares about, and would boost inflation, a rise in which was very damaging to Biden. If Trump inherits a growing economy with falling interest rates he may simply decide to take the credit for a healthy economy and avoid major policy actions. Aggressive or limited action on tariffs are both possible. Compromise options could involve taking action against a few countries, China and Mexico being particularly vulnerable.

Two examples illustrate the degree of uncertainty on all policy

· Trump 2.0. Trump enjoys being reelected and policy action is less than feared. Focus in 2025 on renewing 2017 tax cuts and some other modest new tax cuts that is modestly stimulative; deportations higher than the 1.5mln pace of the 1 Trump presidency but not mass deportations; threats on tariffs but no major universal action in 2025. Economic effects not too adverse and Fed keeps on cutting to 4.0% or potentially below.

· Aggressive Trump agenda. Large tax cuts partially funded by a universal 10% tariffs globally and higher for China that prompts retaliation. Mass deportations that slows employment growth but also supply. Inflation jumps 2% and Fed stops easing 4.5%, which prompts Trump pressure on Fed independence.

For financial markets the concern is that a shift towards a trade war and higher U.S. inflation will occur, with the knee-jerk already seen in higher U.S. Treasury yields and a higher USD. U.S. Treasury yields are key. With economic data showing that GDP momentum is still slowing, the Fed will most likely cut by 25bps on Nov 7 but forward guidance will be key. The lasting market reaction will depends on whether the reality is like Trump 2.0 or an aggressive Trump agenda.