Bank Indonesia Navigating the Path to Sustained Growth

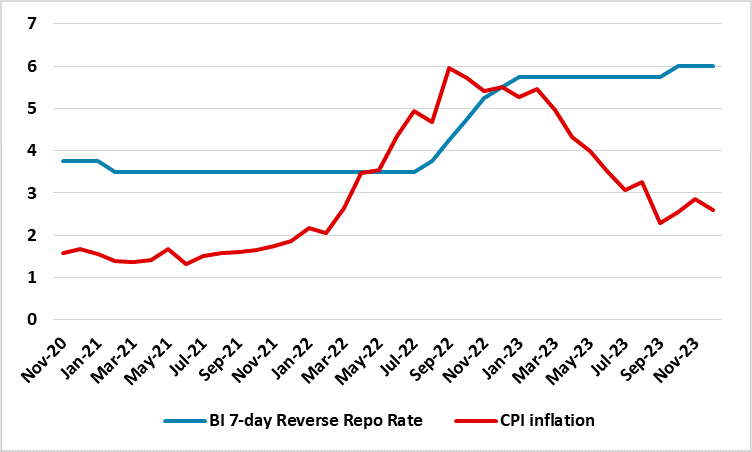

As Consumer Price Index (CPI) inflation eases and BI maintains a delicate balance, the nation's economic outlook takes centre stage. Recent data from Indonesia's Central Statistics Agency (BPS) reveals a slight deceleration in CPI inflation, dipping to 2.6% y/y in December from 2.9% y/y in the previous month. This downward trend places inflation comfortably below the midpoint of BI's target band of 3.0% +/- 1%, providing sufficient headroom to policymakers to focus on economic growth, which appears to be losing steam.

Delving into the components of CPI, the December easing is attributed to a multifaceted slowdown in both food and utility prices. Disinflationary pressures from household equipment, restaurants, and personal care items contributed to the overall dip. However, information and recreation prices exerted a subtle inflationary influence, adding complexity to the inflation narrative.

Figure 1: Indonesia CPI and Key Policy Rate (%)

Source: Bank Indonesia, Continuum Economics

Against this backdrop, BI's recent policy decision to maintain the key 7-day reverse repo rate at 6% during the December MPC meeting aligns with the cautious stance the central bank has adopted. While global economic uncertainties persist, BI remains vigilant, balancing the imperative of inflation control with the necessity of sustaining economic growth. Meanwhile, the Indonesian rupiah has demonstrated resilience, experiencing only a marginal 0.9% depreciation against the USD in 2023. While BI attributes this stability to Indonesia's ability to weather currency fluctuations, large trade surplus also remained supportive of the currency. However, it is likely that the central bank will shift focus towards growth in 2024, especially given easing export earnings.

Indonesia's economy recorded robust expansion in the third quarter, albeit at a more subdued pace than anticipated, marking its weakest performance in two years. Real GDP growth was recorded at 4.94% y/y in the July-September period, a decline from the 5.2%y/y growth observed in the second quarter. Given the expectation of a cooling trend, BI will be inclined to cut rates in 2024.

We foresee the central bank maintaining the key rate in H1, echoing the December decision, with a primary focus on safeguarding the stability of the rupiah in the near term. With CPI inflation effectively managed and currency stable, the priority will shift to ensuring sustained growth. Consequently, expect two rate cuts of 25bps each in H2-2024. It is crucial to highlight that in 2024, the Bank Indonesia (BI) forecasts a real GDP growth of 4.7-5.3% for 2024.