China Data: Mixed Data Backs More Stimulus

China October data is mixed with a bounce in retail sales helped by government trade ins and a holiday, but industrial production and housing construction disappointing. This all argues for further fiscal stimulus. However, given our view that some tariff increases against China by the U.S will be seen H2 2025, we now revise our end 2025 USDCNY forecast to 7.45.

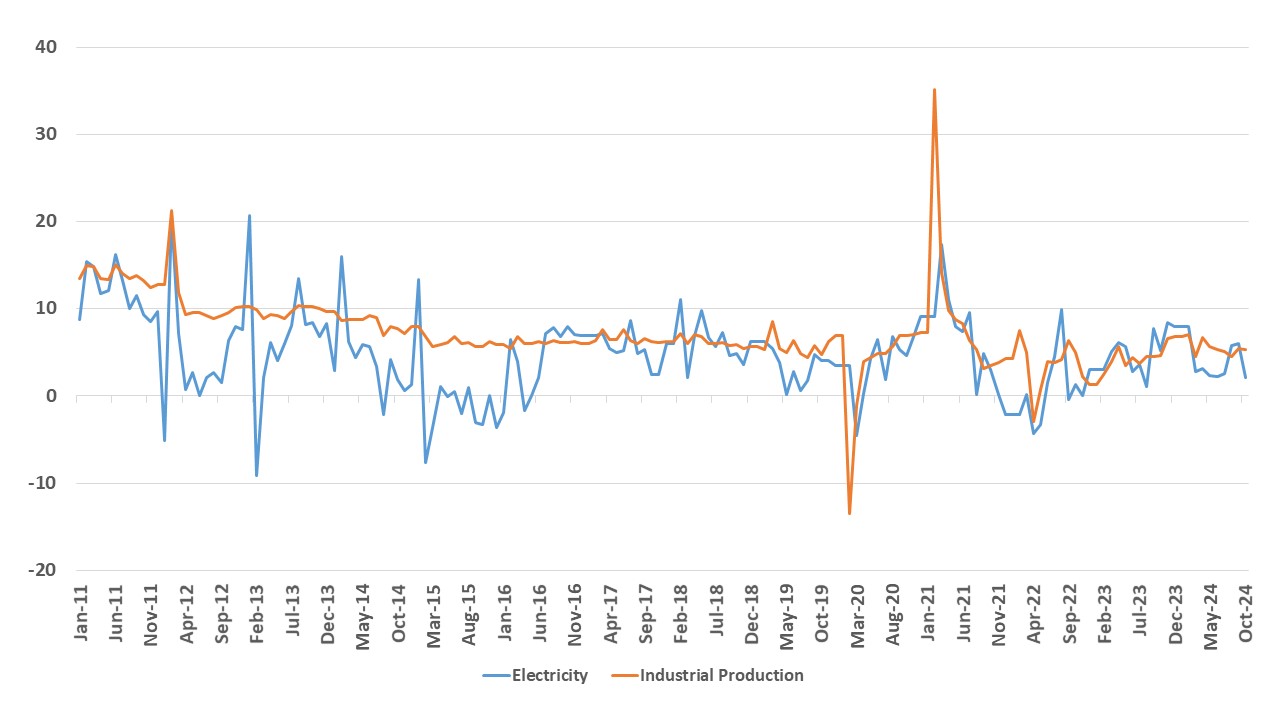

Figure 1: China Industrial Production Yr/Yr (%)

Source: Datastream/Continuum Economics

A mixed set of data for October. Industrial production was weaker than expected at 5.3% Yr/Yr versus the 5.6% expected. Meanwhile, October retail sales data rose +4.8% Yr/Yr versus +3.2% expected, with NBS reporting that the singles day shopping event starting October 14 and a week long holiday caused a sales surge. Retail sales were also boosted by the government trade in program for home appliances, where a jump to +39% Yr/Yr was seen. Meanwhile, numbers from the property sector also were mixed. Home sales picked-up, which fell -15.8% YTD Yr/Yr versus -17.1% in Jan-Sep. New Home prices fell 0.5% in October versus a 0.7% decline in September. The reduction in mortgage rates and policy rates has helped some households to be more confident. However, the overhang of complete and incomplete homes remains massive and even if a further sustained pick-up is seen in sales it will not translate into a pick-up in residential fixed investment in the coming quarters – worse at -10.3% YTD Yr/Yr versus -10.1% Jan-Sep. Indeed, we remain concerned that the household concerns over the property market are so large, that the bounce in home sales will slow into early 2025. Additionally, household confidence and employment are unlikely to pick up enough to allow a sustained bounce in home sales. The data does not change our forecast of 4.5% for 2025 GDP growth – though we now look for 4.9% for 2024 v our previous forecast of 4.8%.

This all argues for further stimulus. Additionally, fiscal easing will likely be evident, but the question remains on scale – the Yuan10trn of debt swaps will not have much economic boost (here). An announcement could come in December or Q1 2025 when the scale and timing of Trump tariffs against China should be clearer. Meanwhile, the authorities appear willing to allow a slow drift lower in the Yuan, given the broader USD strength. A quicker depreciation is unlikely near-term, but will likely be used at the time of the trade war like 2018-19 (here). However, given the U.S. election result, plus the hawkish appointments on China we do expect some tariffs by H2 2025, thus we revise our end 2025 USDCNY forecast to 7.45.