U.S. November Employment - Solid report but not a game changer

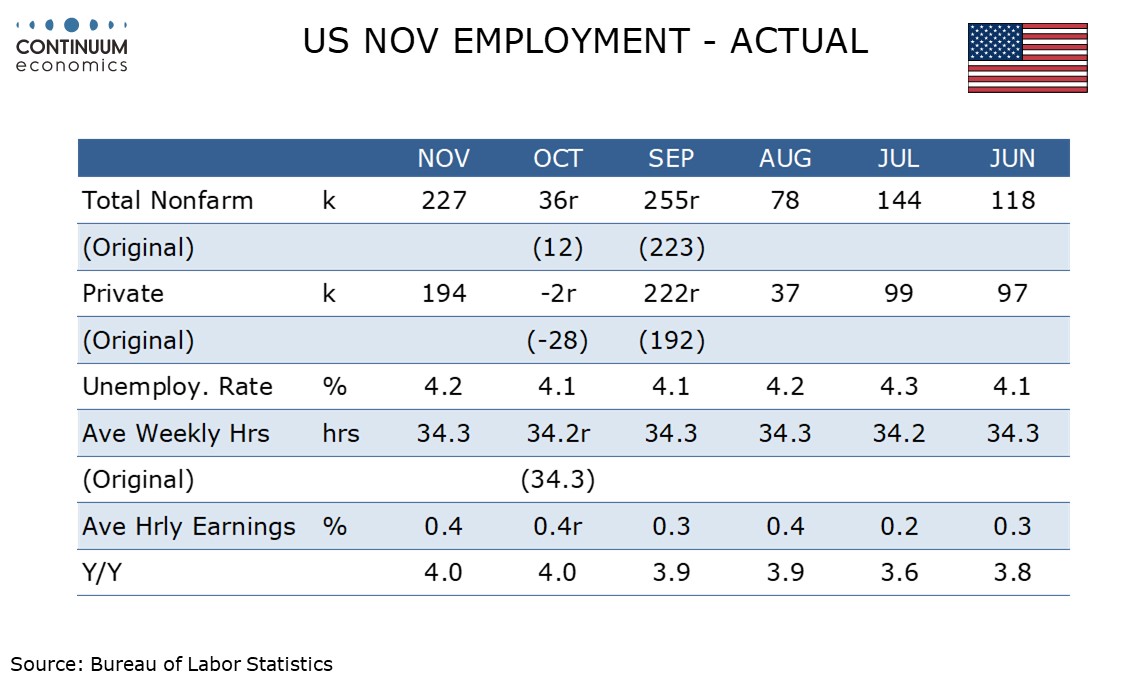

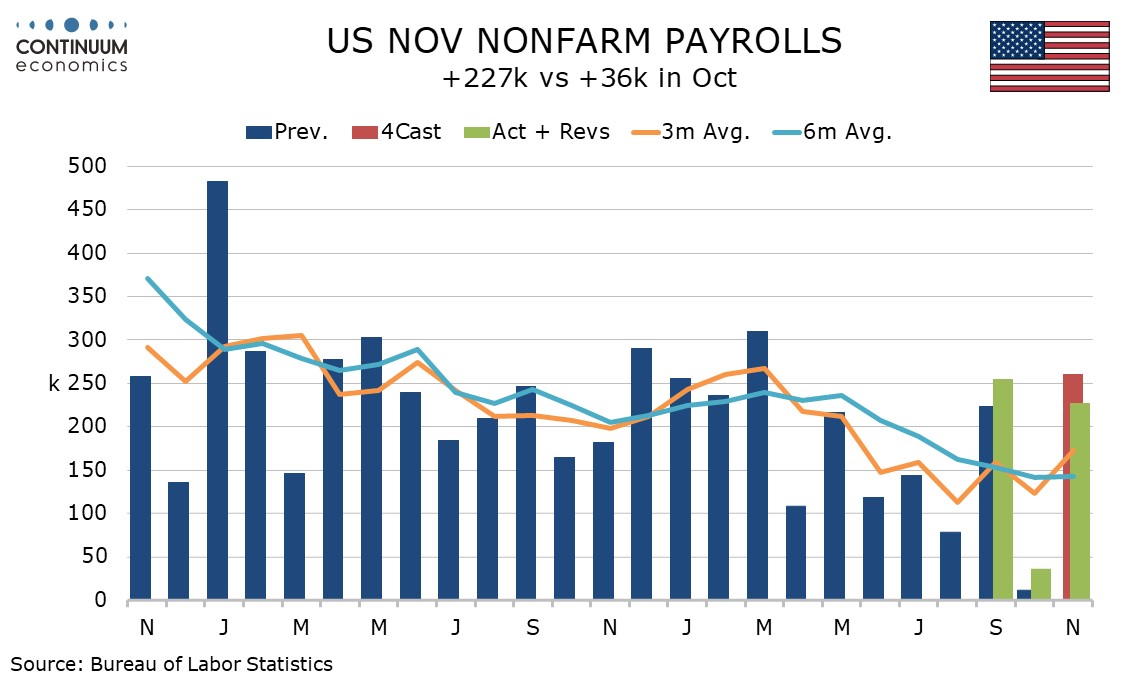

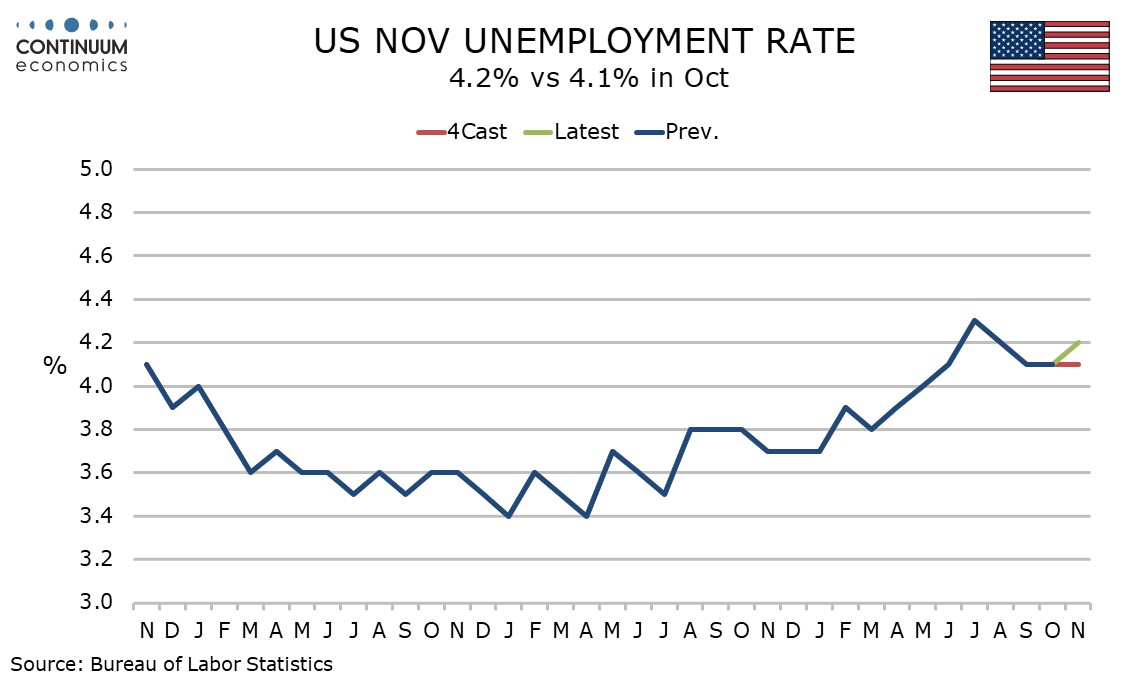

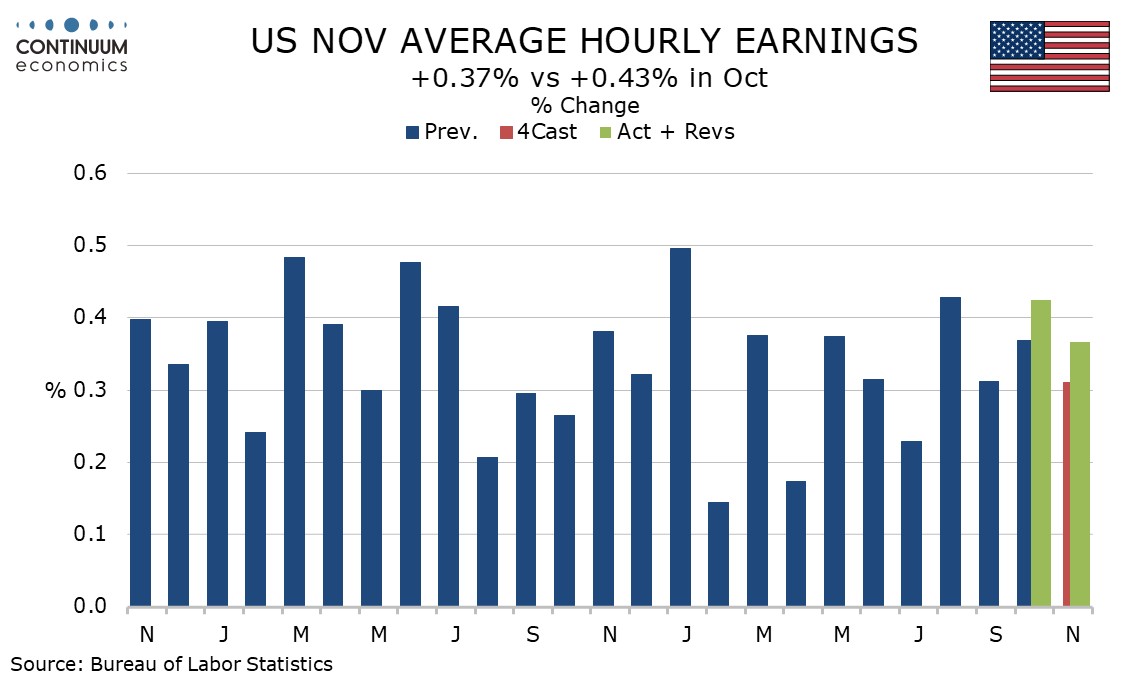

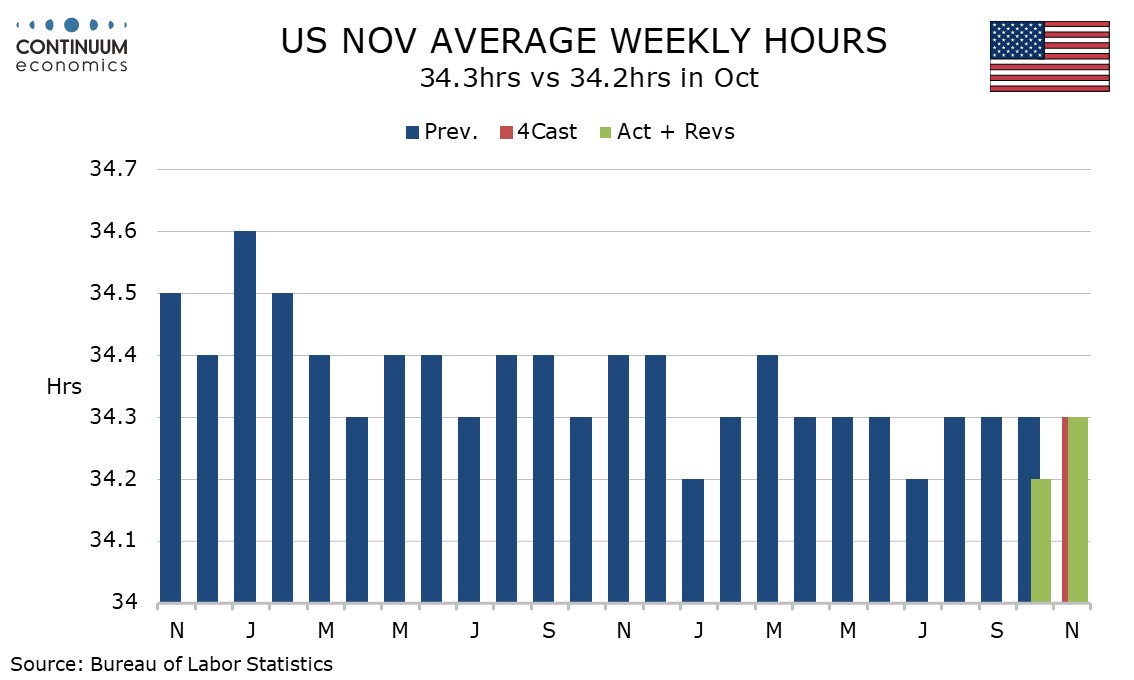

November’s non-farm payroll is near consensus with a rise of 227k with moderate upward revisions to both September and October totaling 56k. Average hourly earnings rose by a slightly stronger than expected 0.4% and the workweek rose (though only because October was revised down) but the unemployment rate nudged up to 4.2% from 4.1%. The number suggests the labor market remains solid, though the data is not a big surprise. We still lean towards a 25bps December easing though should CPI surprise on the upside, the FOMC could still decide to pause.

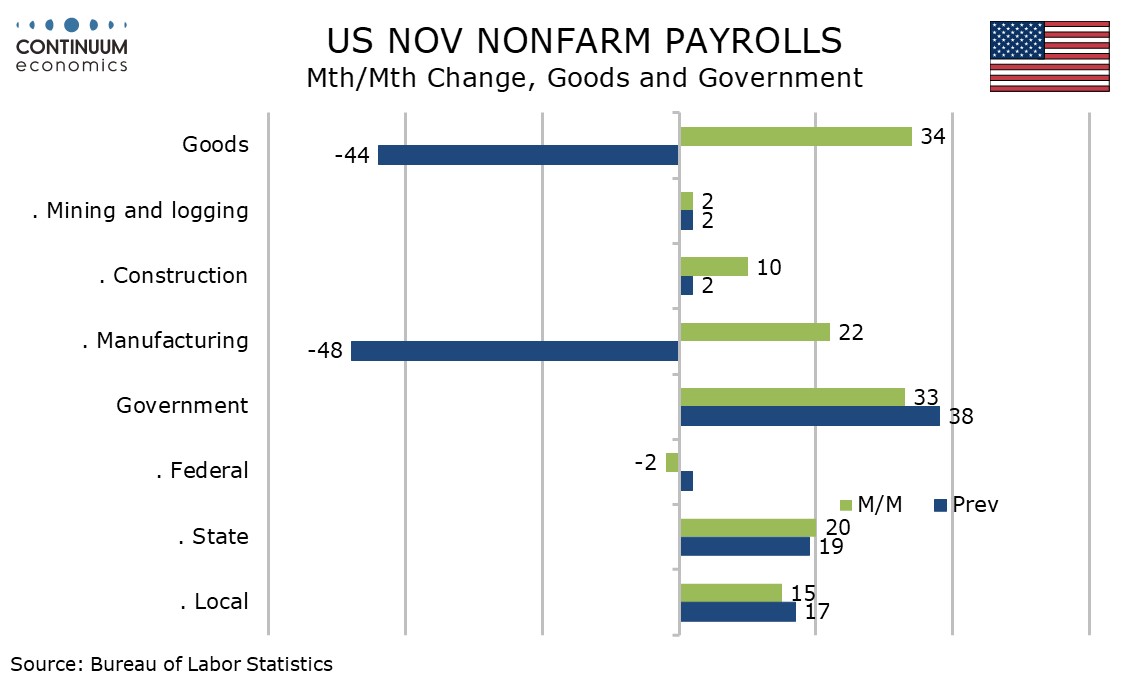

The data is supported by a rebound from October data which was depressed by two major hurricanes and a strike at Boeing. Manufacturing with a 22k rise after a 48k October decline is looking quite weak, extending a negative underlying picture after declines in August and September.

The 2-month payroll average of 131.5k is slightly weaker than the 6-month average of 143k while the private sector 2-month average of 96k is also slightly below the 6-month average of 108k.

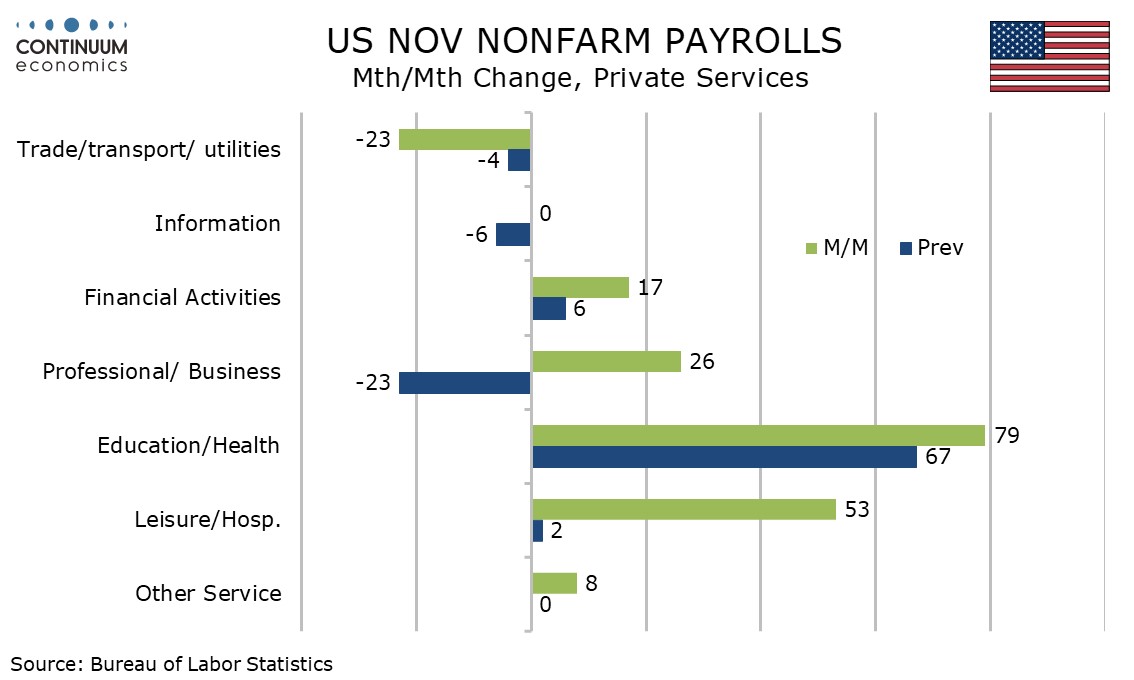

Leisure and hospitality at 53k showed a strong rebound from a 2k increase in October reflecting improved weather but construction at 10k from 2k did not show much of a bounce. Retail at -28k saw a weak month. Health care with a 72k increase remains the strongest sector.

The details of the unemployment rise are disappointing, with the separate household survey underperforming payrolls with a 355k decline in employment, lifting unemployment despite a 193k decline in the labor force. Before rounding the rate rose to 4.245% from 4.145%.

Average hourly earnings rose by 0.37% before rounding after a 0.43% rise in October, leaving yr/yr growth stable at 4.0%. Trend is showing tentative signs of regaining momentum after a modest loss of momentum earlier in the year. If immigration is reduced that could lead to upward wage pressure increasing.

The workweek of 34.3 hours matches that of August and September. October was revised down to 34.2 from 34.3, now showing some response to that month’s bad weather after being surprisingly resilient in the original release.

Aggregate hours worked rose by 0.4% after a 0.3% October decline, getting Q4 off to a positive start. Manufacturing bounced from a weak October but retail and construction showed unexpected weakness.