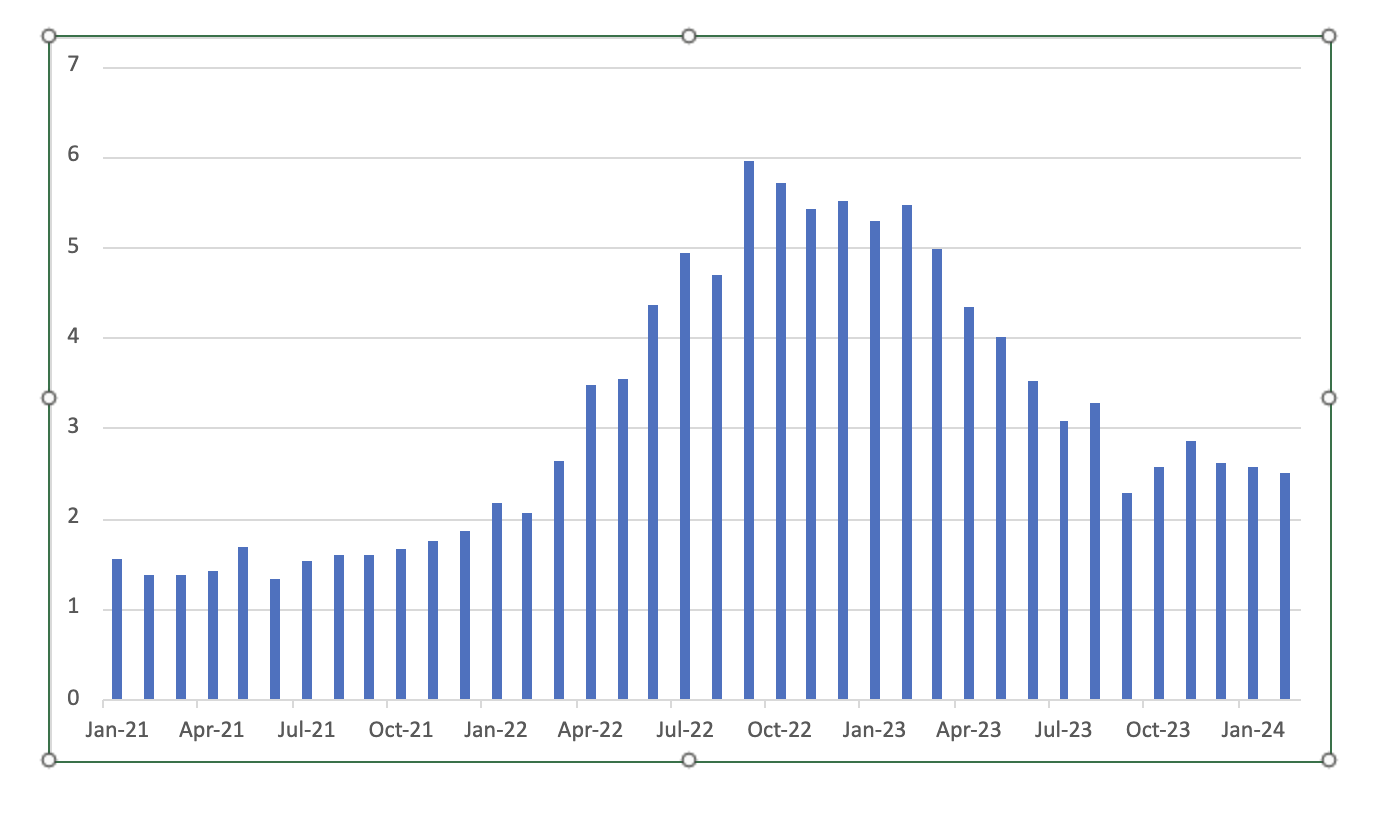

Indonesia Preview: CPI to remain broadly stable

Indonesia’s February inflation is likely to remain broadly stable. Food prices will maintain upward pressures but a tight monetary stance will keep headline inflation in check. Increased demand ahead of Ramadan could see prices spike in March.

Figure 1: Indonesia CPI (%)

Source: Continuum Economics

Indonesia is scheduled to report its February inflation on March 1, and we expect it to come in broadly stable at 2.5% y/y (2.57% y/y in January). Indonesia continues to witness elevated food price pressures owing to the impact of the El Niño on agriculture output. While price growth eased both on a year-on-year and month-on-month basis in January, the moderation was marginal. This suggests persistent inflationary pressures, maintaining sustained headline inflation level in February.

The primary driver of inflation continues to be price increases in the food, beverages, and tobacco category, which is expected to persist in the coming months. Although the government is following a rice aid programme and supporting the low income households, the government suspended the programme in the run-up to the elections. Additionally, the upcoming Ramadan season is also likely to prompt upward price pressures. Increased demand from households in the run-up to Ramadan is expected to have pushed up price levels across other sub-indices.

Bank Indonesia, the central bank has maintained a high interest rate environment. Bank Indonesia has maintained the interest rate of 6% after a surprise hike in October 2023 (largely in attempt to prop up the rupiah). The tight monetary stance will keep a lid on price pressures. Furthermore, the government has increased its food imports to ensure security and support domestic supply. Consequently, no threat is seen to the central bank’s new target range of 2.5+/-1%.