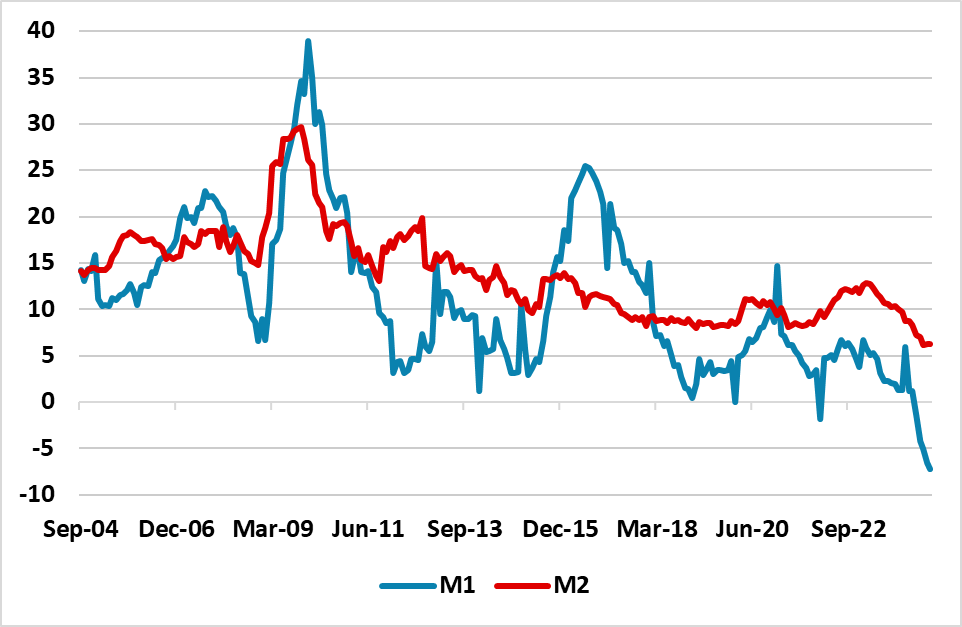

China Outlook: Unbalanced Growth and Slowing

Growth is benefitting from momentum in public investment/exports and high tech production. However, domestic demand is slower and this is a drag on H2 2024 and 2025 growth prospects. Aside from the ongoing negative drag from the residential construction crisis, consumption is also softer. There is uncertainty about employment and wage growth; adverse wealth effects, as well as less pent-up demand after the reopening post COVID.

· We forecast 4.6% 2024 GDP growth and 4.0% 2025 still, though we have cut the 2025 inflation forecast from +0.9% to +0.6%. The excess of production over domestic demand is causing aggressive disinflation on core inflation.

· The 20bps cut in the 7 day reverse repo rate September 24 is helpful (here), but the package is not a game changer as monetary policy in less effective with households and private businesses structurally low credit demand. Targeted extra policy measures are likely in the next six months and we pencil in two to three 25bps cuts in the RRR rate in H1 2025 and a further 20bps in the 7 day reverse repo rate (the new key policy rate) to 1.3%. However, households are paying down debt and this is reducing the effectiveness of easier monetary policy. We also look for targeted extra fiscal policy measures in H2 2024 and H1 2025.

· Risks to the Outlook. The risks are skewed to the downside for real GDP growth, as the adverse feedback loops from the sharp fall in new construction of residential property could be larger than our baseline, while consumption is slowing and volatile. This would hit 2025/26 GDP growth more than 2024. We feel that the risk of a war with Taiwan is low in the next 5 years (here) and being overestimated, both with a pro-China speaker in Taiwan parliament and given the massive naval build-up required. Meanwhile, if Donald Trump is elected we would see a 5-10% Yuan depreciation when tariffs are implemented.

Slowing into 2025 and Harder Landing Risks

We maintain the view of 4.6% for 2024 GDP growth, though for political reasons the reported number could be 5%. The bigger issue is H2 momentum into 2025, with China’s economy unbalanced – as seen in August’s data (here). One positive factor is that public sector investment from the Yuan 1trn central government infrastructure program has still to feedthrough, which should provide support. Meanwhile, reasonable global growth, plus a refocus of China companies on exports and competitive pricing, has helped net exports provide support for the economy. Finally, momentum in the high tech manufacturing sector has been good and provides some boost to the economy. The problem is that production is outstripping domestic demand.

Consumption is one of the critical issues. Post COVID tourism, eating out and other consumer services have provided momentum to consumption over the past six quarters. However, these sub sectors of consumption are seeing slowing growth, as pent up demand is met. Other aspects of consumption show an unbalanced position. Residential related sectors such as furniture and appliances remain very weak, but auto sales are also weak and luxury/jewellery softer trend shows that China consumers are more volatile (here). This volatility is a function of less certainty over private sector employment and wage growth, plus adverse wealth effects from the crisis in the housing sector (here). Our baseline is for a further slowing in consumption growth, but uncertainty over the adverse issues is significant and this is one of the main reasons behind our 30% probability of a harder landing in 2025 and 3-4% GDP growth (here).

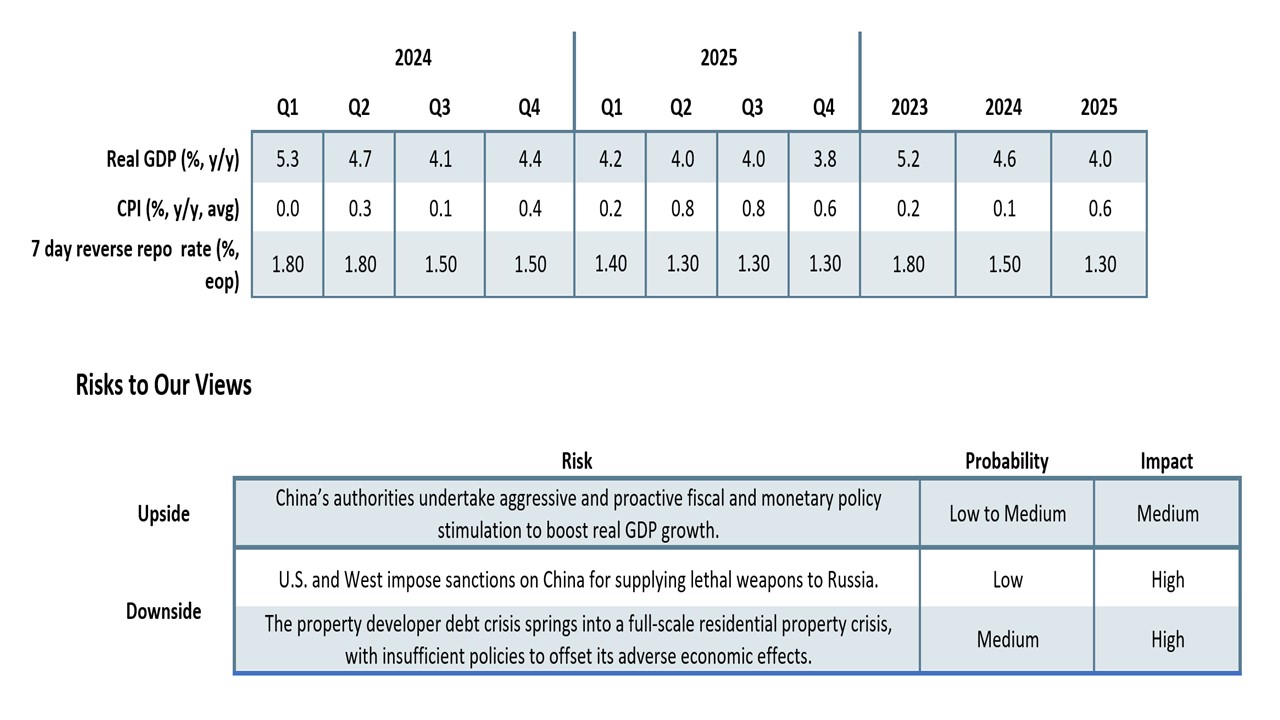

Figure 1: NBS China Consumer Confidence (1991 = 100)

Source: Datastream/Continuum Economics

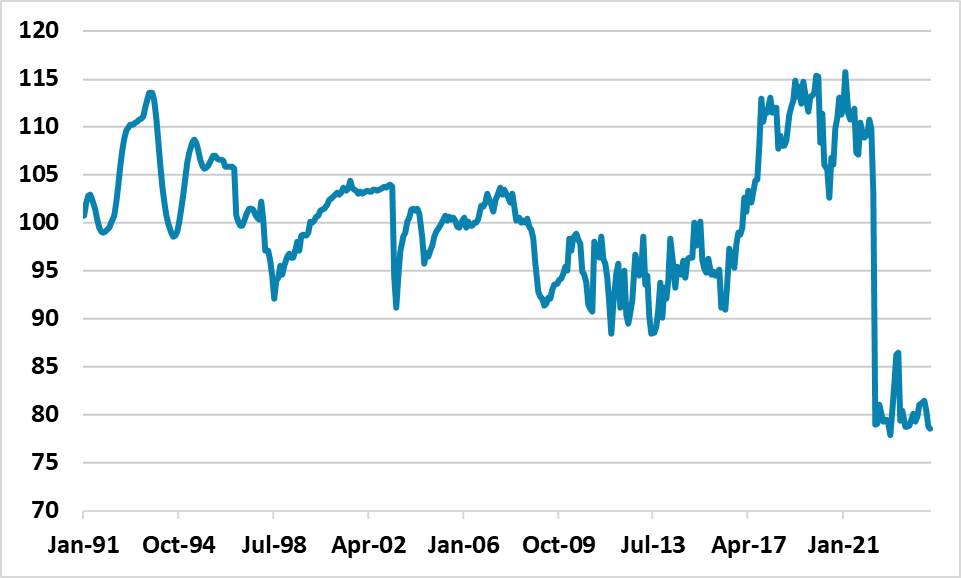

Residential investment is still making a negative contribution to GDP growth, as the housing construction bust continues to be a major drag. Government support in terms of financing to complete homes; buy finished homes/apartments for affordable housing; relaxation of deposits and lower new mortgage rates are providing some support. The government is considering allowing early remortgages to tap into the now lower interest rate structure. The scale of the problem is huge however, with most private developers weak or in distress; multi-year overhang of finished homes/apartments; secular slowing in demand due to population aging and a massive build-up of uncompleted homes (here). In construction terms, it is as bad as the U.S. slump from the 2006 peak (Figure 2). New house prices have only fallen modestly, whereas the overhang of supply and high house price/income ratio would argue for a circa 30% decline in real house prices. The authorities are reluctant to let this kind of adjustment to occur too quickly, which is lengthening the adverse impact. With ultra-low inflation, this is mainly nominal house price falls to help the market reach a bottom. We feel that residential investment will continue to remain a drag of 1-1.5% on GDP in 2025 and probably 1% 2026-28. However, the risks are that this could be worse. 35 years of watching housing busts in DM and EM show that vicious feedback loops can worsen the situation and produce more adverse effects for the economy.

Figure 2: U.S. Housing Construction Peak 2006/China 2021

Source: Datastream/Continuum Economics

Overall, we stick with the 4.6% GDP growth forecast for 2024 and 4.0% for 2025. The main risks are skewed to the downside, with a 30% probability of close to 3% growth in 2025 and 2026 (here). The weakness of demand, plus the excess of production, also reinforces aggressive disinflation forces. Our 2024 CPI inflation forecast of 0.1% reflects these forces as well as soft food prices due to the drag from pork prices. However, we have cut the 2025 inflation forecast to 0.6% from 0.9%. If we end up with persistent negative inflation, then this could delay consumption and investment and be a further negative feedback loop on GDP growth.

Policy

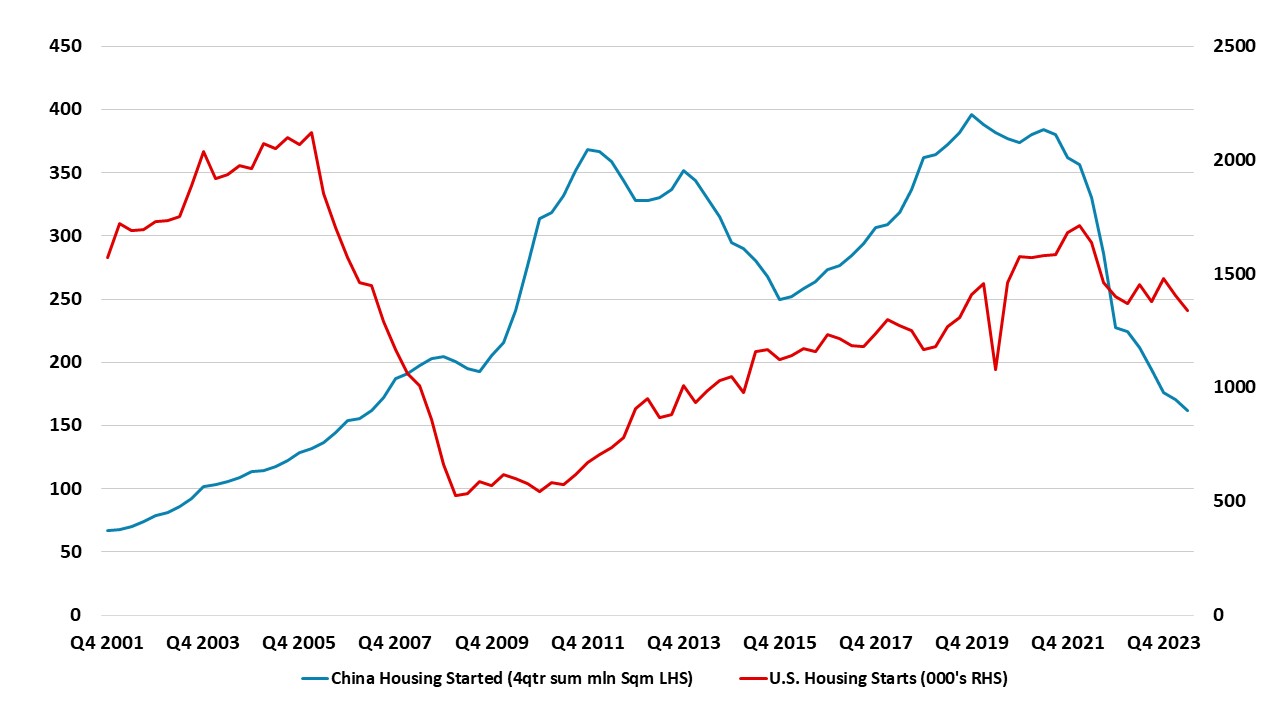

The 20bps cut in the 7 day reverse repo rate September 24 is helpful (here), but the package is not a game changer as monetary policy in less effective with households and private businesses structurally low credit demand. we pencil in two to three 25bps cuts in the RRR rate in H1 2025 and a further two 10bps in the 7 day reverse repo rate (the new key policy rate) to 1.4%. However, lower interest rate costs are not boosting lending and M2 growth (Figure 3), with households keen to pay down debt rather than borrow. The lack of responsiveness in itself is a restraint to the option of aggressive rate cuts, which may not boost lending but could increase Yuan volatility. The authorities could however further encourage loan supply into 2025, which could stop the situation getting worse. The authorities also do not want too low interest rates, as this could hurt bank net interest margins. Meanwhile, we still feel that China will be biased towards a gradual decline in the Yuan to protect exports and this adjustment being made easier by the Fed’s easing cycle – the authorities could soon start intervening to cap the recent softness of the USD.

Figure 3: China M1/M2 Growth (Yr/Yr %)

Source: Datastream/Continuum Economics

This leaves fiscal policy to support the economy. So far, the authorities have been targeted, largely as GDP growth has been close to official targets in 2023 and 2024 and only need fine tuning changes to policy. However, the authorities are also concerned that government/corporate and household debt/GDP has surged significantly since 2008 and in total now exceeds the U.S. and EZ. This means active or aggressive fiscal policy needs to be held back for a future major crisis. In the latest article IV report, China authorities forecast medium-term growth at 5-6%, which is above other forecasts views and our own – based on housing overhang plus population aging and slowing productivity. For now, we look for only further targeted fiscal policy measures in the next 6 months, but the setting of the 2025 GDP target in March 2025 could lead to a more active phase of fiscal policy easing based on our GDP outlook if a 5% plus target is set.

Re the PBOC recent banking stress tests (here) the good news is that China 19 major domestically systemically important banks (D-SIB’s and 72% of loans) hold up well under most solvency and liquidity tests, though some capital shortfalls start to appear with a moderate or severe NPL sensitivity shock scenario. The safety net would likely be capital injections including from central government as occurred with the largest 4 banks in 1997-04 or takeover and mergers. However, small and mid-sized banks shortfall of capital in the more severe sensitivity would test China authorities crisis management and response capacity that could mean a lower tier bank crisis is not quick to be resolved. In the most severe test, 2605 out of 3966 non D-SIB’s banks, would fall below 12% capital ratios.