China Consumer Volatility

China consumption patterns are divergent; slowing and becoming more volatile at a sub sector level. Less certainty over new employment and wage growth, plus wealth worries over housing are some of the causes. We forecast GDP to slow in H2 and be 4.0% in 2025.

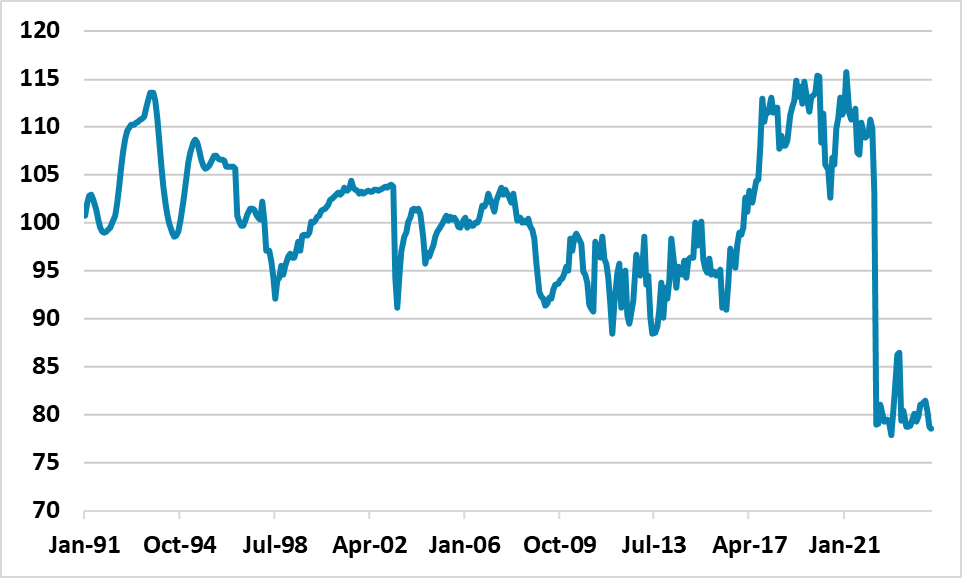

Figure 1: NBS China Consumer Confidence (1991 = 100)

Source Datastream/Continuum Economics

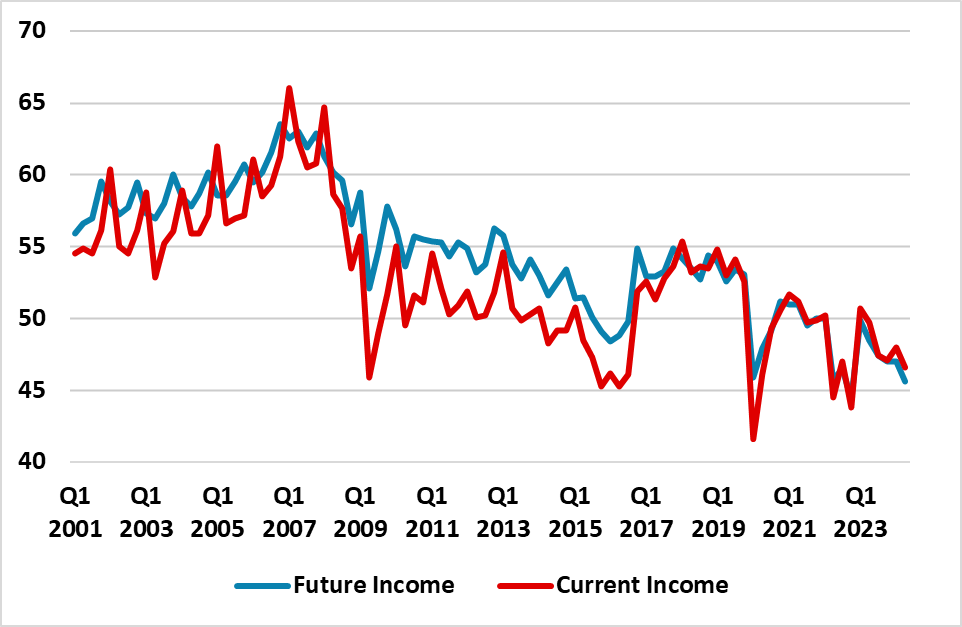

China’s consumption is vital to growth when production is transitioning from old economy dependency on residential investment, steel, cement and other industries. The problem is that China consumer are in a volatile mood. The breakdown of the retail sales numbers suggest that post COVID pent up demand is still providing a boost helped by restaurant services and tourism. However, furniture and household appliance sales are weak, auto sales soft and the luxury industry not seeing the same buying demand from China’s consumers. PDD a major e commerce provider has just reported weak revenue and profits (here), despite targeting budget focused consumers. Finally, consumer confidence is weak (Figure 1). One issue is income for China consumers, where consumers views have deteriorated (Figure 2). This is a combination of private sector companies slowing hiring; some construction related wages stalling or falling plus unevenness in rural to urban migration (that traditionally boosts income and consumption for a sub sector).

Figure 2 Consumers Views on Current and Future Income (diffusion index)

Source Datastream/Continuum Economics

The 2nd issue is decreasing housing wealth. China households assets are biased towards property, which helped wealth perceptions with the relentless rise in house prices from 1990-2019 (here). The moderate fall in house prices, plus the more acute problems in the housing market, do appear to be making China consumer more volatile. Overall, these influences mean that China consumer has faced a more volatile 2020’s compared to the smooth progress seen in the 1990-2019 period. The multiple shocks from COVID and associated lockdowns could also be an influence in producing a more volatile consumer. We will watch incoming retail sales data closely over the coming months, but we remain worried about a slowdown in consumption. This will produce a soft feel to China economy in H2 2024 and also leave us forecast 4% for 2025 GDP growth.