U.S. August CPI - Core at a four month high led by shelter and air fares

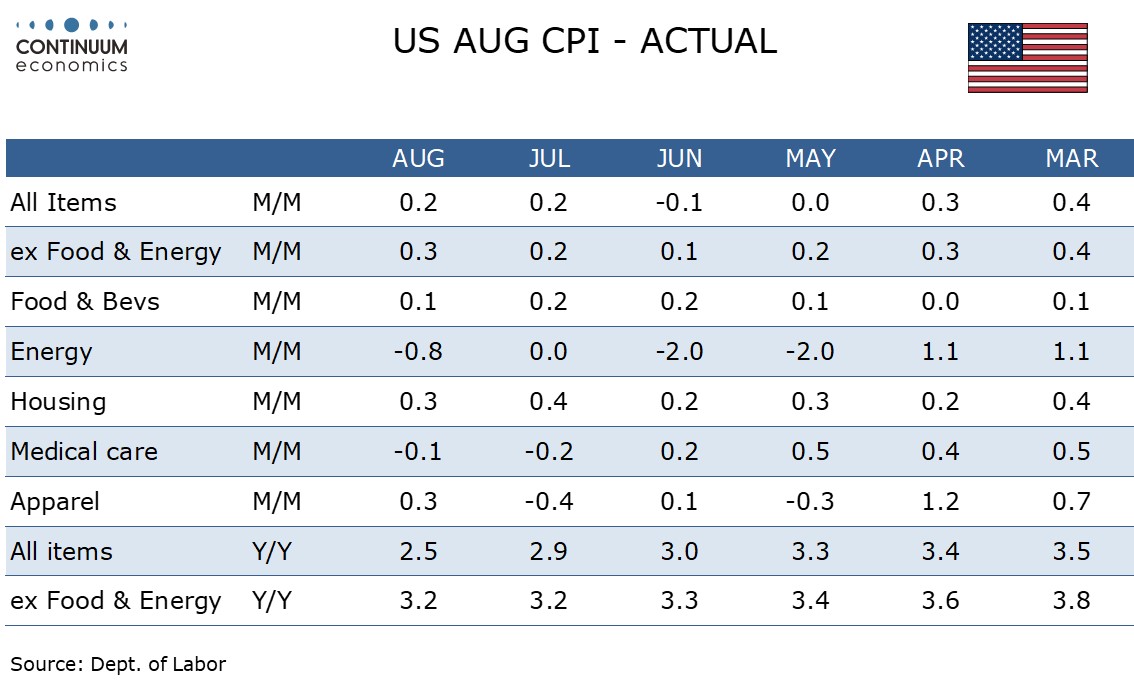

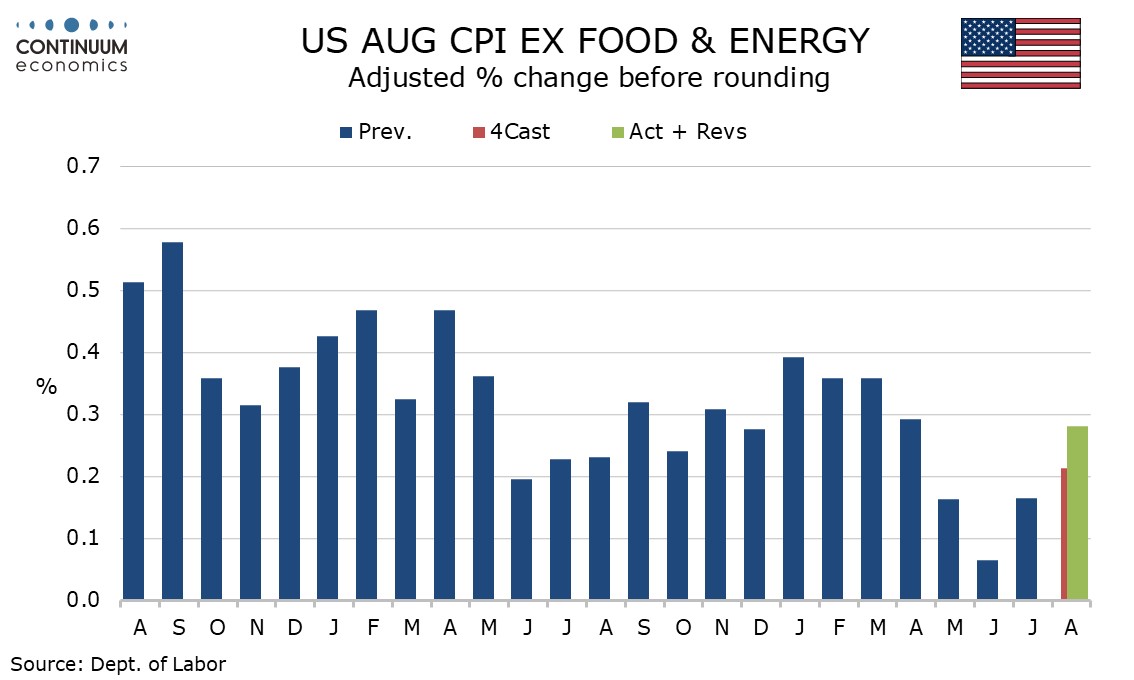

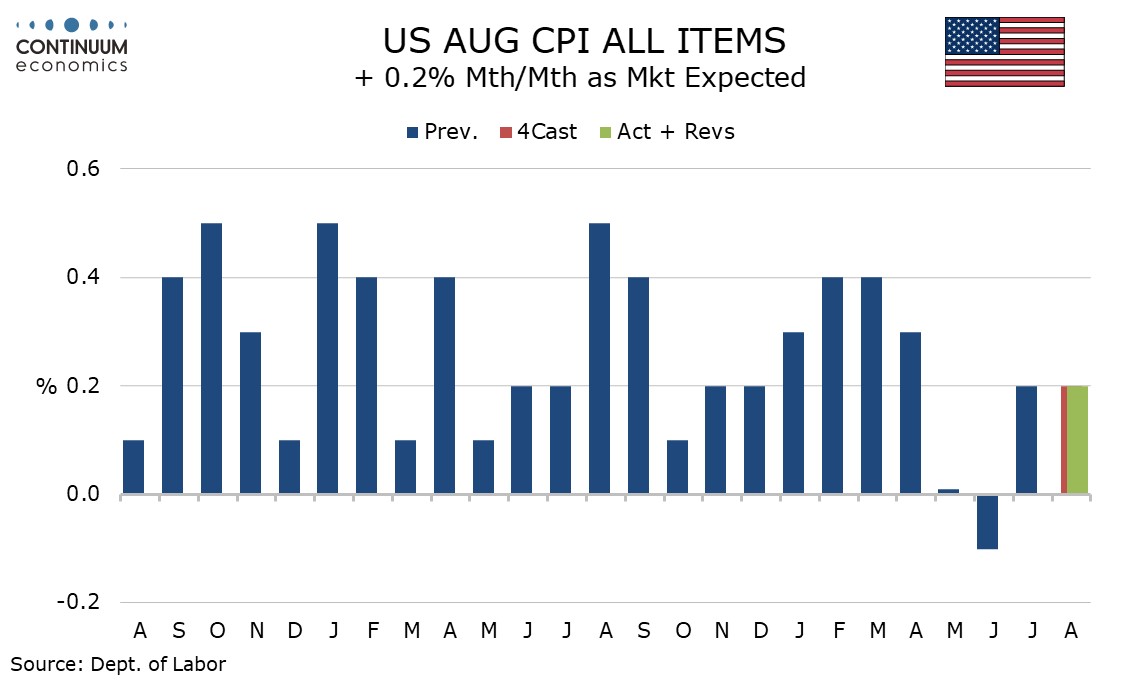

August core CPI has disappointed to the upside with a 0.3% rise ex food and energy with the rise being 0.28% before rounding, a four month high. Overall CPI rose by 0.2% as expected, and by 0.19% before rounding. The data is likely to ensure that the FOMC eases by only 25bps in September. Shelter and air fares were the most obvious contributors to the upside surprise in the core rate.

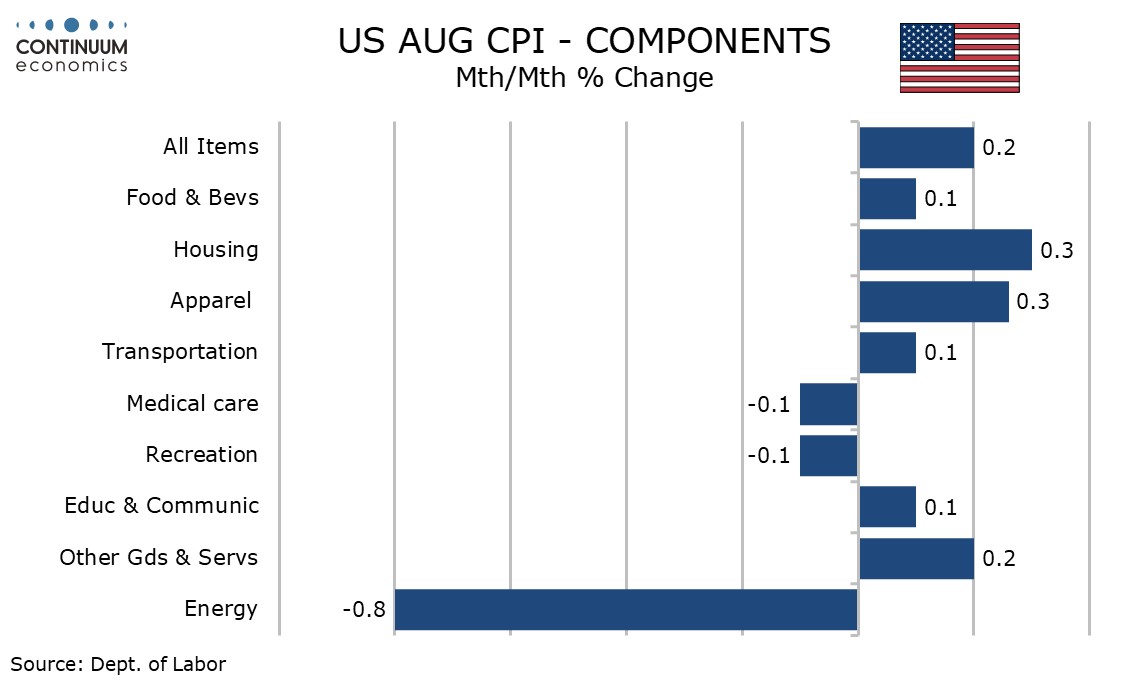

Commodities less food and energy remained soft with a 0.2% decline with used autos still soft at -1.0% if less weak than in July. Apparel corrected a 0.4% July decline with a 0.3% increase. Food rose by a modest 0.1% while gasoline fell by a modest 0.6%, while overall energy fell by 0.8%.

Services less energy services accelerated to a 0.4% increase with shelter up by 0.5%, as was owners’ equivalent rent, the strongest rise in the sector since January and a clear disappointment. Lodging away from home, a volatile subcomponent of shelter, was also firm with a 1.8% increase. Overall housing was restrained to a 0.3% increase by weakness in energy services.

Air fares with a 3.9% increase were another area of strength but this looks corrective from three straight declines. On the downside, medical care services fell by 0.1%, a second straight decline.

Year ago strength in energy saw headline CPI fall significantly to 2.5% from 2.9%, reaching its slowest since March 2021. The ex food and energy rate is however unchanged at 3.2% yr/yr, and shows that the Fed cannot claim victory on inflation yet. A September easing has been clearly signaled, but this data suggests that 25bps is the appropriate amount.