US Equities: Soft v Harder Landing More Than Politics

The U.S. equity market sees positives and negatives behind the volatility of U.S. presidential expectations, partially as Donald Trump is seen to be in favour of lower corporate tax rates. We see the soft versus harder landing for the U.S. economy as being more important, as a harder landing could hurt profit expectations in the wider market and tech sector and cause a proper correction.

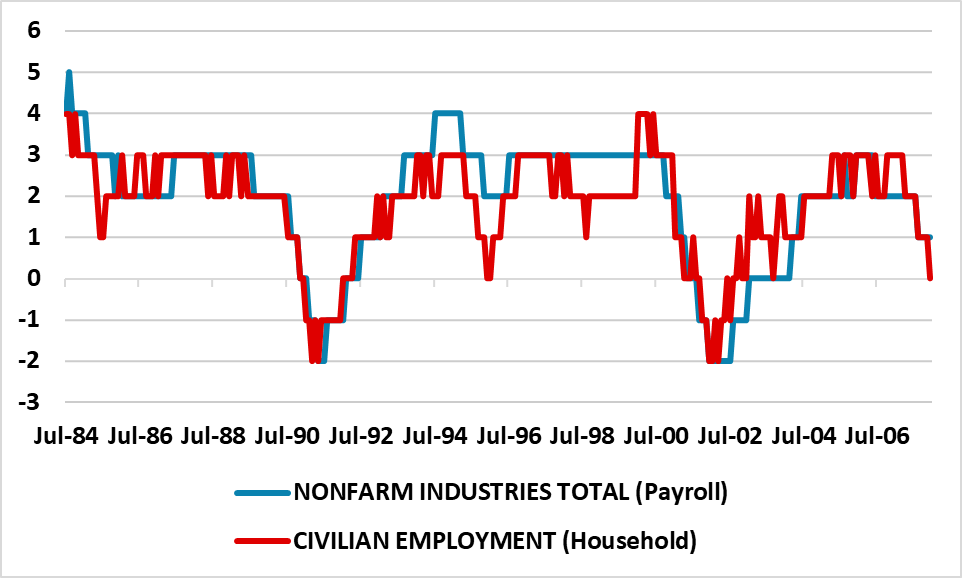

Figure 1: U.S. Employment Payroll and Household Data (Mlns change)

Source: Datastream/Continuum Economics

Though the U.S. government bond market has started to lean towards a steep yield curve of ideas that a President Trump could be more inflationary, the U.S. equity market has not been impacted by the post presidential debate political volatility. The initial view is that a President Trump would likely help reduce corporate taxes and could be good for financials and energy stocks, while U.S. economic growth would be only slightly net impact by selective increased trade tariffs (import substitutions versus higher price of goods) – given the view that the full trade proposals are unlikely to be introduced. Financial markets are also watchful on President Biden eventual decision on still standing ahead of the key August Democratic convention, with yesterday pushback by the White House over other potential candidates seen to be less important than what the opinion polls say before the end of July (here). However, even if the Democrats choice a different candidate for president, it is unlikely to change the proposed policy agenda and may not provide lasting direction for the overall U.S. equity market.

We feel the question of a softer versus hard landing is the key for the U.S. equity market. The equity market has been shifting from a higher for longer narrative towards a soft landing (growth slowing to below trend and inflation converging towards target). This is being viewed positively as earnings downgrades are likely to be modest and could be counterbalanced be more Fed rate cuts than the higher for longer scenario. We see this as the baseline view that we highlighted in our June U.S. outlook (here), though we do feel it can prompt intermittent modest (5%) U.S. equity corrections given the current overvaluation (here).

A harder landing for the U.S. economy would be more challenging for the U.S. equity market. A quick slowdown in the U.S. economy towards stagnation would raise fears that lagged monetary policy tightening and rundown of pandemic savings had been underestimated. This could significantly hurt corporate earnings expectations, including the tech sector and produce a wave of profit-taking on overweight tech and U.S. equity passive funds. We would see the Fed cutting more aggressively over the next 12 months if this occurred, but the profit uncertainty would likely come first. Some are looking at the current large divergence between poor U.S. household data employment changes versus the reasonable slowing in the NFP and initial claims data. The question that is being asked is whether the household data employment leads NFP? This is possible, but household data weakness has also provided false dawns in the past (Figure 1), with a sharp slowing in 2013 that did not feed into NFP. Our overall assessment is that we are see a soft landing, but we will watch incoming data to check this narrative.